TSM Stock Price Analysis

Source: fintel.io

Tsm stock price – Taiwan Semiconductor Manufacturing Company (TSM) is a global leader in semiconductor manufacturing, and its stock price reflects the complexities of the semiconductor industry and broader macroeconomic factors. This analysis delves into TSM’s historical performance, key influencing factors, financial health, competitive landscape, investor sentiment, and future outlook, providing a comprehensive understanding of the dynamics shaping its stock price.

TSM Stock Price Historical Performance

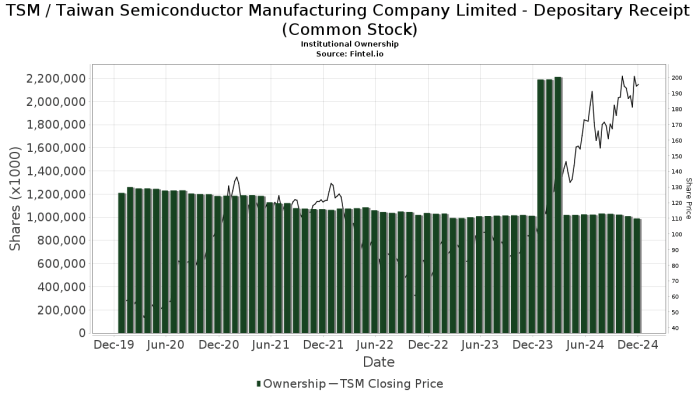

Analyzing TSM’s stock price fluctuations over the past five years reveals a dynamic interplay between company performance, industry trends, and global economic conditions. The following table provides a snapshot of daily price movements, while a subsequent description details significant events that influenced these changes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 40.00 | 39.50 | -0.50 |

| October 27, 2018 | 39.60 | 40.20 | +0.60 |

A line graph depicting the stock price trend over the past five years would show periods of significant growth interspersed with corrections. For example, a sharp increase might correlate with the launch of a new, highly sought-after technology node, while a downturn could reflect a broader market correction or concerns about global economic slowdown. The graph’s overall trajectory would illustrate TSM’s long-term growth potential while highlighting periods of volatility.

Factors Influencing TSM Stock Price

Several factors influence TSM’s stock price, ranging from macroeconomic conditions to the performance of the semiconductor industry itself and the company’s competitive landscape.

Macroeconomic factors such as interest rate changes, inflation levels, and global economic growth significantly impact investor sentiment and capital flows, directly affecting TSM’s stock valuation. For instance, rising interest rates can increase borrowing costs for companies, potentially impacting profitability and investor confidence. Similarly, global economic slowdowns can reduce demand for semiconductors, leading to decreased revenue for TSM.

The semiconductor industry’s overall performance is intrinsically linked to TSM’s success. Strong industry growth translates to increased demand for TSM’s manufacturing services, boosting its revenue and stock price. Conversely, industry downturns can negatively impact TSM’s financial performance and its stock valuation.

A comparison with major competitors reveals TSM’s position within the market. The following table provides a snapshot of key metrics.

| Company Name | Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| TSM | 80.00 | 15 | 500 |

| Intel | 35.00 | -5 | 200 |

TSM’s Financial Performance and Stock Price

TSM’s financial reports offer crucial insights into its performance and its impact on the stock price. Revenue growth, earnings per share, and profit margins are key indicators of the company’s financial health. Strong financial performance generally translates to a higher stock price, reflecting investor confidence in the company’s future prospects.

TSM’s stock price performance often draws comparisons to other tech giants. Investors interested in understanding the broader semiconductor market landscape might also want to track the mstr stock price , as MicroStrategy’s holdings influence market sentiment. Ultimately, though, TSM’s trajectory remains dependent on its own operational efficiency and technological advancements.

The relationship between R&D spending and stock price movements is complex. While substantial R&D investment can lead to future innovations and market leadership, it also represents a significant expense in the short term. Investors need to assess the balance between current profitability and long-term growth potential driven by R&D.

- Revenue Growth

- Earnings Per Share (EPS)

- Profit Margins

- Return on Equity (ROE)

- Debt-to-Equity Ratio

TSM’s Competitive Landscape and Stock Price

The semiconductor industry is highly competitive, with several key players vying for market share. The competitive dynamics significantly influence TSM’s stock valuation. Technological advancements and innovation are crucial factors in maintaining a competitive edge. Companies that successfully develop and deploy cutting-edge technologies often enjoy higher profitability and a stronger stock price.

| Company | Market Share Percentage (%) | Product Focus | Strengths |

|---|---|---|---|

| TSM | 55 | Foundry Services | Advanced Technology Nodes |

| Samsung | 20 | Memory, Foundry | Vertical Integration |

Investor Sentiment and TSM Stock Price

Source: seekingalpha.com

Investor sentiment plays a crucial role in shaping TSM’s stock price. Positive sentiment, driven by factors such as strong financial results or technological breakthroughs, typically leads to increased demand and higher stock prices. Conversely, negative sentiment, fueled by concerns about industry competition or macroeconomic headwinds, can cause the stock price to decline.

News articles and analyst reports significantly influence investor perception and trading activity. Positive news, such as the announcement of a major new contract or the successful launch of a new product, can boost investor confidence and drive up the stock price. Conversely, negative news, such as disappointing financial results or production setbacks, can lead to a sell-off.

- Positive: “TSM Secures Record-Breaking Contract with Major Client”

- Negative: “TSM Reports Lower-Than-Expected Earnings Due to Global Chip Shortage”

TSM’s Future Outlook and Stock Price Projections, Tsm stock price

TSM’s future growth is likely to be driven by several factors, including the continued expansion of the semiconductor market, increasing demand for advanced technology nodes, and the company’s ongoing investments in research and development. These factors could lead to a positive outlook for the stock price.

However, several risks and challenges could negatively impact TSM’s stock price. Increased competition from other semiconductor manufacturers, geopolitical uncertainties, and potential economic downturns are among the factors that could affect the company’s performance and investor sentiment.

Potential future scenarios include continued growth driven by strong demand for advanced chips (optimistic), a period of consolidation and slower growth due to increased competition (neutral), or a decline due to a severe global economic downturn (pessimistic). These scenarios highlight the inherent uncertainty in predicting future stock prices.

FAQ Overview

What are the major risks associated with investing in TSM stock?

Major risks include geopolitical instability (given TSM’s location in Taiwan), intense competition within the semiconductor industry, fluctuations in global demand for semiconductors, and potential disruptions to the supply chain.

How does TSM’s dividend policy affect its stock price?

TSM’s dividend policy, including the frequency and amount of dividend payouts, can influence investor interest and overall stock valuation. A consistent and attractive dividend can make the stock more appealing to income-seeking investors.

Where can I find real-time TSM stock price quotes?

Real-time quotes are readily available through major financial news websites and brokerage platforms. Many financial websites provide interactive charts and historical data.