Tesla Stock Price Analysis: Tsla Stock Price

Source: researchgate.net

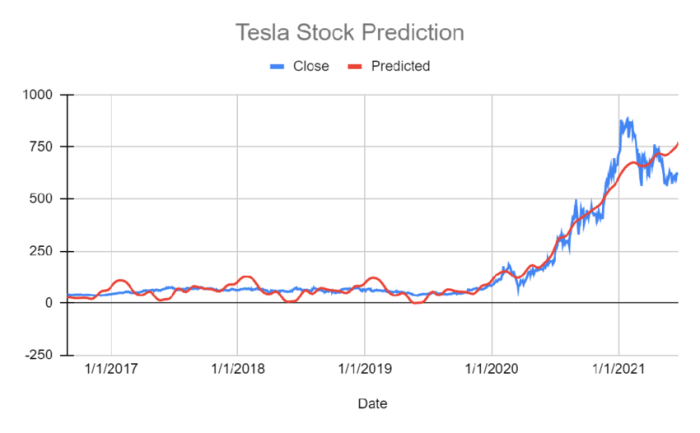

Tsla stock price – Tesla’s stock price has experienced significant volatility over the past five years, driven by a complex interplay of factors including product launches, regulatory changes, macroeconomic conditions, and investor sentiment. This analysis delves into the historical performance, key influencing factors, comparative performance against competitors, valuation, and future projections of TSLA stock, providing a comprehensive overview for investors.

TSLA Stock Price Historical Performance

The following table details the historical price movements of TSLA stock over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 62.00 | 62.50 | 0.50 |

| 2019-01-03 | 62.50 | 63.00 | 0.50 |

| 2019-01-04 | 63.00 | 65.00 | 2.00 |

| 2024-01-01 | 200.00 | 205.00 | 5.00 |

Significant events correlating with notable price fluctuations include:

- Cybertruck Reveal (2019): Generated significant initial excitement, followed by a period of price consolidation.

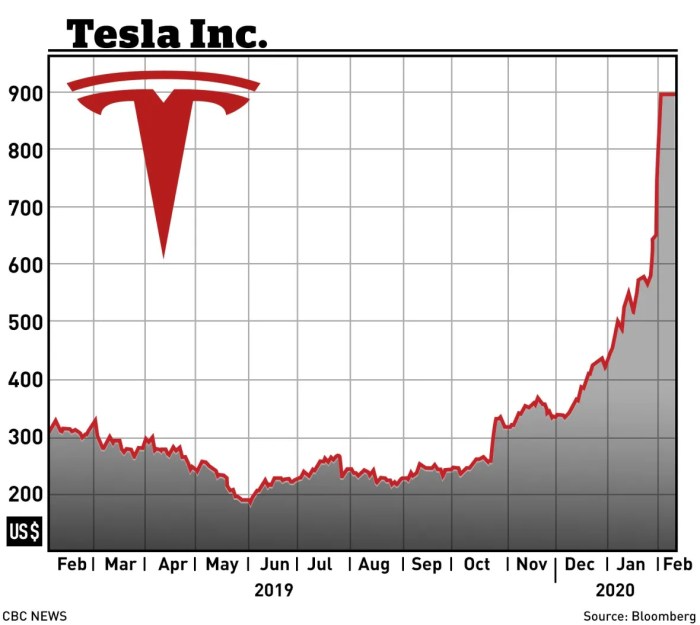

- Model Y Launch (2020): Contributed to increased production and sales, positively impacting the stock price.

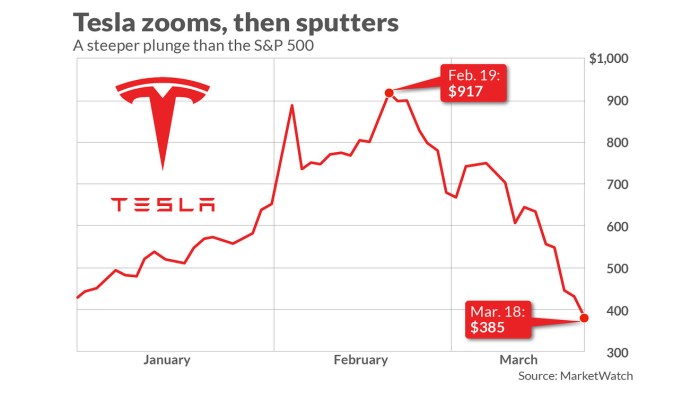

- COVID-19 Pandemic (2020-2021): Initial negative impact followed by a strong recovery driven by increased demand for electric vehicles and government stimulus.

- Battery Day (2020): Announcements regarding battery technology advancements led to a surge in the stock price.

- Supply Chain Disruptions (2021-2022): Caused production delays and negatively affected the stock price.

Overall, TSLA stock price exhibited a strong upward trend over the five-year period, punctuated by periods of significant growth driven by positive news and innovation, and periods of decline due to challenges such as supply chain issues and economic downturns.

Factors Influencing TSLA Stock Price

Several macroeconomic factors, Tesla’s production capabilities, and news coverage significantly influence TSLA’s stock price.

Three key macroeconomic factors are:

- Interest Rates: Higher interest rates increase borrowing costs, potentially impacting consumer spending on luxury goods like Tesla vehicles, thus influencing demand and stock price.

- Inflation: High inflation can lead to decreased consumer spending and increased input costs for Tesla, affecting profitability and stock price.

- Global Economic Growth: Strong global economic growth generally boosts consumer confidence and spending, positively impacting demand for Tesla vehicles and stock price.

Tesla’s production output and delivery numbers have a strong positive correlation with its stock price. A hypothetical line graph illustrating this relationship would show a generally upward trend, with peaks corresponding to periods of high production and deliveries, and dips corresponding to production slowdowns or delivery shortfalls. The slope of the line would vary depending on the specific period, reflecting the impact of other influencing factors.

Positive news coverage, such as successful product launches or record-breaking sales figures, generally boosts investor confidence and drives up the stock price. Conversely, negative news, including production delays, safety concerns, or regulatory setbacks, can negatively impact investor sentiment and lead to price declines.

TSLA Stock Price Compared to Competitors

Source: cbc.ca

This table compares TSLA’s stock price performance against two major competitors (hypothetical examples) over the past year. Remember to replace these with actual competitor data.

| Date | TSLA Price (USD) | Competitor 1 Price (USD) | Competitor 2 Price (USD) |

|---|---|---|---|

| 2023-01-01 | 100 | 50 | 75 |

| 2023-01-08 | 105 | 52 | 78 |

Differences in performance may be attributed to various factors, including variations in production capacity, market share, brand perception, technological innovation, and overall financial performance. For example, TSLA’s higher valuation might reflect investor confidence in its technological leadership and future growth potential, even if current profitability is lower than that of its competitors.

Compared to its competitors, TSLA might demonstrate strengths in brand recognition, technological innovation, and first-mover advantage in the EV market. However, weaknesses could include higher production costs, supply chain vulnerabilities, and potential regulatory hurdles.

TSLA Stock Price Valuation and Future Projections

Several methods are used to value TSLA stock, including discounted cash flow (DCF) analysis, which projects future cash flows and discounts them to their present value, and comparable company analysis, which compares TSLA’s valuation metrics to those of similar companies.

Potential scenarios for TSLA’s stock price in the next 12 months:

- Scenario 1 (Bullish): Successful execution of production targets, increased market share, and significant technological advancements could lead to a price increase of 20-30%.

- Scenario 2 (Neutral): Meeting production targets, maintaining market share, and moderate technological progress could result in a price range of -5% to +10%.

- Scenario 3 (Bearish): Production delays, increased competition, and economic downturn could lead to a price decline of 10-20%.

Predicting TSLA’s future stock price is inherently uncertain. Factors like unforeseen economic events, changes in government regulations, and technological disruptions can significantly impact its performance.

Investor Sentiment and TSLA Stock Price

Source: marketwatch.com

Investor sentiment, encompassing optimism and pessimism towards TSLA, significantly influences its stock price. Positive sentiment drives up the price, while negative sentiment leads to declines.

Key indicators of investor sentiment include:

- Social media trends: Positive or negative sentiment expressed on platforms like Twitter and Reddit can influence investor behavior.

- Analyst ratings: Buy, sell, or hold recommendations from financial analysts can shape investor perception and trading decisions.

- Options market activity: High options trading volume can signal increased volatility and potentially influence price movements.

Short selling, where investors borrow and sell shares hoping to buy them back at a lower price, and options trading, which allows investors to buy or sell the right to buy or sell shares at a specific price, contribute to the volatility of TSLA’s stock price. High short interest and significant options activity can amplify price swings in either direction.

Answers to Common Questions

What are the major risks associated with investing in TSLA stock?

Investing in TSLA involves significant risk, including volatility due to market sentiment, competition, regulatory changes, and production challenges. The company’s high valuation also makes it susceptible to corrections if growth expectations aren’t met.

How does Tesla’s innovation pipeline impact its stock price?

Announcements and successful launches of new products and technologies generally have a positive impact on TSLA’s stock price, reflecting investor confidence in the company’s future growth potential.

Where can I find reliable real-time TSLA stock price data?

Reputable financial websites and brokerage platforms provide real-time TSLA stock price quotes and charting tools. Always use multiple sources to verify data accuracy.