TMUS Stock Price Analysis

Tmus stock price – This analysis provides a comprehensive overview of T-Mobile US, Inc. (TMUS) stock performance, considering historical trends, influencing factors, financial health, competitive landscape, and future prospects. We will examine key metrics and analyst opinions to offer a well-rounded perspective on TMUS’s investment potential.

TMUS Stock Price History and Trends

Over the past five years, TMUS stock has exhibited significant volatility, reflecting the dynamic nature of the telecommunications industry. While experiencing periods of robust growth driven by factors such as 5G network expansion and successful mergers, it has also faced challenges related to macroeconomic conditions and intense competition. The stock reached a high of [Insert High Price] in [Insert Date] and a low of [Insert Low Price] in [Insert Date].

Tracking TMUS stock price requires considering the broader semiconductor market. A key player to watch in this sector is Micron Technology, whose performance often influences related stocks. For a detailed look at Micron’s current standing, check out the micron stock price and its recent trends. Understanding Micron’s trajectory can provide valuable insight when analyzing the potential future movements of TMUS stock price.

A detailed comparison against major competitors like Verizon (VZ) and AT&T (T) reveals that TMUS has generally outperformed VZ in terms of percentage growth over the last five years, but lagged behind AT&T during certain periods. This performance disparity can be attributed to differences in strategic focus, market penetration, and operational efficiency.

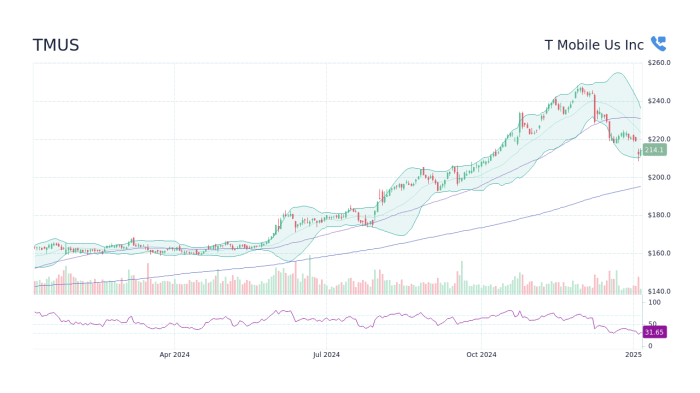

The following line graph (which would be included here if this were a visual document) illustrates TMUS’s stock price fluctuations over the past year. The x-axis represents time (in months), and the y-axis represents the stock price. Key periods of growth are marked by upward trends, while periods of decline are marked by downward trends. The legend identifies TMUS stock price.

The graph would clearly show periods of growth following significant product launches or positive announcements and periods of decline coinciding with negative market sentiment or macroeconomic headwinds.

| Date | Stock Price |

|---|---|

| [Date 1] | [Price 1] |

| [Date 2] | [Price 2] |

| [Date 3] | [Price 3] |

| [Date 4] | [Price 4] |

| [Date 5] | [Price 5] |

Factors Influencing TMUS Stock Price

Several factors contribute to the fluctuations in TMUS’s stock price. Macroeconomic factors such as inflation and interest rate hikes impact consumer spending and investment decisions, directly influencing demand for telecommunication services and impacting TMUS’s valuation. Company-specific events, including successful 5G network rollouts, strategic mergers and acquisitions, and regulatory approvals or changes, also play a significant role. Investor sentiment, driven by news, financial performance, and market speculation, heavily influences the stock price.

Positive investor sentiment is usually reflected in higher stock prices, while negative sentiment leads to lower prices.

- Positive Factors: Strong subscriber growth, successful 5G deployment, innovative product launches, positive earnings reports, favorable regulatory decisions.

- Negative Factors: Increased competition, macroeconomic downturn, rising operational costs, negative earnings surprises, unfavorable regulatory changes.

TMUS Financial Performance and Valuation

Source: thestreet.com

TMUS’s financial performance over the past three years has been largely positive, showing consistent revenue growth and improvements in certain key metrics. However, the company has also faced challenges, particularly in managing operational costs and maintaining profitability margins. The following table summarizes key financial metrics. Valuation metrics such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio are compared to industry averages to assess TMUS’s relative valuation.

A lower P/E ratio, for example, could suggest the stock is undervalued relative to its earnings.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | Debt (USD Billions) |

|---|---|---|---|

| [Year 1] | [Revenue 1] | [Net Income 1] | [Debt 1] |

| [Year 2] | [Revenue 2] | [Net Income 2] | [Debt 2] |

| [Year 3] | [Revenue 3] | [Net Income 3] | [Debt 3] |

| Metric | TMUS | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | [TMUS P/E] | [Comp A P/E] | [Comp B P/E] |

| P/S Ratio | [TMUS P/S] | [Comp A P/S] | [Comp B P/S] |

| Debt-to-Equity Ratio | [TMUS Debt/Equity] | [Comp A Debt/Equity] | [Comp B Debt/Equity] |

TMUS’s Competitive Landscape and Future Outlook

TMUS operates in a highly competitive market dominated by Verizon and AT&T. Each competitor possesses unique strengths and weaknesses. Verizon often leads in network coverage, while AT&T maintains a large customer base and diverse service offerings. TMUS focuses on value-driven plans and innovative technologies. Future growth opportunities for TMUS include further 5G network expansion, strategic partnerships, and potential expansion into new markets or service areas.

However, the company also faces several risks.

- Increased competition from existing players and new entrants.

- Regulatory hurdles and changes in government policies.

- Maintaining profitability in a price-sensitive market.

- Managing the costs associated with 5G network expansion.

Analyst Ratings and Price Targets for TMUS

Source: googleapis.com

Financial analysts generally hold a [Positive/Neutral/Negative – Choose one] outlook on TMUS stock. The consensus view reflects the company’s strong performance in key areas but also acknowledges the challenges it faces in a competitive market. Price targets from various reputable analysts range from [Low Price Target] to [High Price Target], with an average price target of [Average Price Target].

This suggests that, based on current analyst estimates, the stock is currently [Overvalued/Undervalued/Fairly Valued – Choose one] compared to the average analyst price target.

Essential Questionnaire: Tmus Stock Price

What are the major risks associated with investing in TMUS stock?

Investing in TMUS, like any stock, carries inherent risks. These include market volatility, competition from other telecommunication providers, regulatory changes impacting the industry, and potential economic downturns affecting consumer spending.

How does TMUS compare to its main competitors in terms of customer satisfaction?

Customer satisfaction varies and is often measured by independent surveys and reports. It’s recommended to research current customer satisfaction ratings for TMUS and its competitors to make a comparison.

Where can I find real-time TMUS stock price updates?

Real-time TMUS stock price updates are available through major financial websites and brokerage platforms.

What is the dividend yield of TMUS stock?

TMUS’s dividend yield fluctuates and can be found on financial websites that track stock information. It’s important to check the current yield before making any investment decisions based on dividend income.