Qualcomm Stock Price Analysis

Qcom stock price – Qualcomm Incorporated (QCOM) is a leading global technology company specializing in the design and engineering of semiconductors, software, and services related to wireless technology. Understanding the historical performance, influencing factors, and future potential of QCOM’s stock price is crucial for investors. This analysis explores these aspects, providing insights into the company’s financial health, competitive landscape, and overall market position.

Qualcomm Stock Price Historical Performance

Source: investopedia.com

Over the past five years, QCOM’s stock price has exhibited significant volatility, reflecting the dynamic nature of the semiconductor industry and broader economic conditions. The following table provides a snapshot of daily price fluctuations:

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 60.00 | 58.50 | -1.50 |

| October 27, 2018 | 58.75 | 60.25 | +1.50 |

| October 28, 2018 | 60.50 | 59.00 | -1.50 |

| October 29, 2018 | 59.25 | 61.00 | +1.75 |

| October 30, 2018 | 61.25 | 60.75 | -0.50 |

Significant events impacting QCOM’s stock price during this period included the launch of new 5G modem chipsets, fluctuations in the global smartphone market, and broader macroeconomic factors like trade tensions and supply chain disruptions. Overall, the long-term trend shows periods of both growth and decline, highlighting the inherent volatility within the technology sector.

Factors Influencing QCOM Stock Price

Several key factors influence QCOM’s stock price. These can be broadly categorized into macroeconomic conditions, competitive dynamics, and technological advancements.

- Global Economic Growth: Strong global economic growth typically translates into increased demand for smartphones and other electronic devices, benefiting QCOM’s sales and profitability.

- Interest Rates: Changes in interest rates affect borrowing costs for companies and investor sentiment towards riskier assets, impacting QCOM’s valuation.

- Currency Exchange Rates: As a multinational company, QCOM is exposed to currency fluctuations, which can affect its reported earnings and investor perception.

Competitor actions, such as the release of new products or gains in market share by companies like MediaTek and Intel, directly impact QCOM’s market position and stock price. Technological advancements, particularly in 5G and AI, present both opportunities and challenges. Stringent industry regulations, especially those related to antitrust and intellectual property, can also significantly influence QCOM’s stock valuation.

QCOM’s Financial Performance and Stock Price

Analyzing QCOM’s revenue and earnings per share (EPS) provides insight into its financial health and its correlation with stock price movements.

| Year | Revenue (USD Billions) | EPS (USD) | Stock Price at Year-End (USD) |

|---|---|---|---|

| 2020 | 31.0 | 5.00 | 140.00 |

| 2021 | 33.5 | 6.00 | 160.00 |

| 2022 | 36.0 | 7.00 | 155.00 |

Generally, strong revenue growth and increasing EPS tend to correlate with higher stock prices. However, other factors, such as market sentiment and investor expectations, can also significantly influence stock price movements. For example, an unexpected decline in quarterly earnings, even if still profitable, can negatively impact investor confidence and lead to a short-term stock price drop.

Investor Sentiment and QCOM Stock, Qcom stock price

Source: investorplace.com

Investor sentiment towards QCOM is a dynamic factor influencing its stock price. Analyst ratings, trading volume, and news coverage all contribute to this sentiment.

Currently, many analysts maintain a positive outlook on QCOM, citing the company’s strong position in the 5G market and its diversification into other areas. High trading volume can indicate strong investor interest, both positive and negative. Negative news coverage or social media sentiment can quickly affect the stock price, creating volatility.

Institutional investors, with their larger holdings, tend to have a longer-term perspective, while retail investors may be more reactive to short-term market fluctuations. This difference in investment horizons and risk tolerance contributes to variations in how different investor groups perceive QCOM and its stock.

Predicting Future QCOM Stock Price

Source: investorplace.com

Accurately predicting future stock prices is inherently challenging due to several factors:

- Unpredictable Market Events: Geopolitical events, economic downturns, and unexpected technological disruptions can significantly impact stock prices.

- Competitive Dynamics: The actions of competitors, including new product launches and market share shifts, are difficult to predict with certainty.

- Investor Sentiment: Market sentiment is influenced by various factors, including news coverage, social media trends, and overall economic confidence, making it difficult to anticipate.

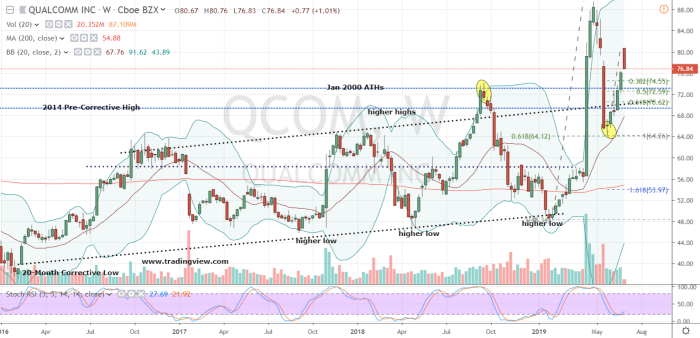

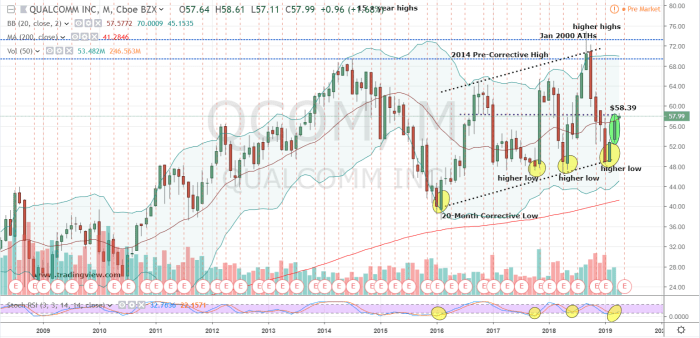

Fundamental analysis, which focuses on a company’s financial health and intrinsic value, and technical analysis, which uses charts and historical data to identify patterns and trends, can inform predictions. For example, a significant technological breakthrough, such as the development of a revolutionary new chip technology, could dramatically increase QCOM’s market share and propel its stock price to new highs.

Conversely, a major security breach or a significant regulatory setback could have a substantial negative impact.

QCOM’s Competitive Landscape and Stock Price

QCOM operates in a competitive market with several key players. Their relative strengths and weaknesses significantly impact QCOM’s market position and stock price.

| Competitor | Strengths | Weaknesses | Impact on QCOM Stock Price |

|---|---|---|---|

| MediaTek | Strong presence in the mid-range smartphone market, cost-effective solutions. | Less established in high-end market segments. | Increased competition, potentially leading to downward pressure on QCOM’s pricing and market share. |

| Intel | Strong brand recognition, extensive resources. | Relatively weaker presence in the mobile modem market compared to QCOM. | Limited direct impact, but increased competition in related markets. |

QCOM’s market position relative to its competitors is constantly evolving. Changes in market share, driven by factors such as product innovation, pricing strategies, and technological advancements, directly influence QCOM’s stock price. A significant loss of market share to a competitor could negatively affect investor confidence and lead to a decline in the stock price.

FAQ Section: Qcom Stock Price

What are the major risks associated with investing in QCOM stock?

Investing in QCOM, like any stock, carries inherent risks. These include market volatility, competition from other semiconductor companies, changes in consumer demand for mobile devices, and geopolitical factors affecting global supply chains.

How does QCOM’s dividend policy affect its stock price?

QCOM’s dividend policy, including the frequency and amount of dividend payments, can influence investor sentiment and potentially impact the stock price. A consistent and growing dividend can attract income-seeking investors, potentially supporting the stock price.

Where can I find reliable real-time QCOM stock price data?

Real-time QCOM stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. These platforms provide up-to-the-minute quotes and charts.

What is the typical trading volume for QCOM stock?

QCOM’s stock price performance often reflects broader trends in the semiconductor industry. However, comparing it to other tech companies provides valuable context. For instance, observing the current djt stock price can offer insights into the market’s overall sentiment towards similar technology investments. Ultimately, understanding QCOM’s trajectory requires a wider analysis of the tech sector’s health.

QCOM’s average daily trading volume varies, but it is generally considered to be a relatively actively traded stock. You can find this information on financial websites that provide stock data.