Plug Power Stock Price Analysis

Plug power stock price – Plug Power, a leading player in the green hydrogen technology sector, has experienced significant stock price volatility in recent years. Understanding the factors driving this volatility is crucial for investors considering adding Plug Power to their portfolios. This analysis delves into the historical performance of Plug Power’s stock price, key influencing factors, financial health, future outlook, and prevailing investor sentiment.

Plug Power Stock Price Historical Performance

Source: investingcube.com

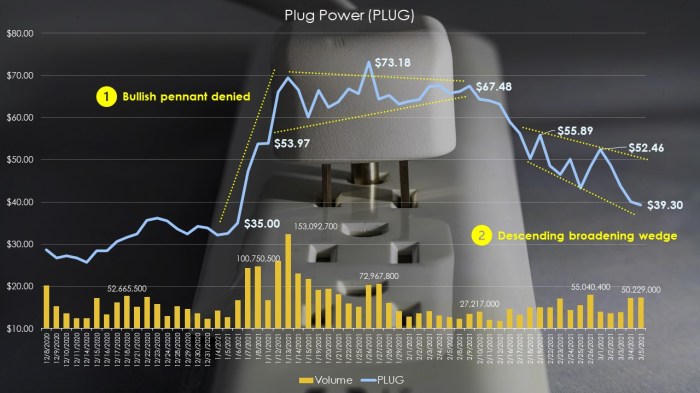

Over the past five years, Plug Power’s stock price has exhibited a rollercoaster ride, reflecting the inherent risks and rewards associated with investing in a growth-oriented company in the renewable energy sector. The stock experienced periods of substantial growth fueled by positive investor sentiment and technological advancements, interspersed with corrections driven by market downturns and concerns about profitability. For instance, the stock saw a significant surge in early 2021, driven by increasing investor interest in green hydrogen solutions, reaching a high of approximately $75 per share.

However, subsequent corrections brought the price down significantly. While precise figures require referencing financial data sources, a general trend of initial growth followed by consolidation and further growth phases can be observed. Significant highs and lows would need to be extracted from reliable financial databases for precise reporting.

| Date Range | Plug Power | S&P 500 | Nasdaq |

|---|---|---|---|

| Last Year (Specific Dates) | (Percentage Change) | (Percentage Change) | (Percentage Change) |

Note: The table above requires specific data from reliable financial sources to populate the percentage changes accurately. The data would reflect the performance of Plug Power’s stock price against the S&P 500 and Nasdaq indices over the specified period.

Major events impacting Plug Power’s stock price during this period included key partnerships, significant contract wins, and quarterly earnings reports. Positive earnings surprises, strategic collaborations with major corporations, and regulatory developments favorable to hydrogen technology have generally resulted in upward price movements. Conversely, missed earnings expectations, supply chain disruptions, and macroeconomic headwinds have often led to price declines. Specific examples would need to be sourced from financial news and company announcements.

Factors Influencing Plug Power’s Stock Price, Plug power stock price

Three key factors consistently influence Plug Power’s stock valuation: technological advancements in hydrogen fuel cell technology, investor sentiment, and macroeconomic conditions. These factors often interact, creating a complex interplay that determines the stock’s price trajectory.

Advancements in hydrogen fuel cell technology directly impact Plug Power’s stock price. Successful development of more efficient, cost-effective, and durable fuel cells enhances the company’s competitive advantage and future growth prospects, leading to positive investor sentiment and higher valuations. Conversely, setbacks in R&D or competition from other players could negatively impact the stock.

Investor sentiment plays a significant role, often amplified by news coverage and analyst ratings. Periods of strong positive sentiment can drive the stock price higher, while negative sentiment, fueled by concerns about profitability or competition, can lead to significant sell-offs. Market trends, particularly in the broader renewable energy sector, also significantly influence Plug Power’s stock price. Positive momentum in the green energy sector generally benefits Plug Power, while negative sentiment in this sector often drags the stock down.

Macroeconomic factors, such as interest rates and inflation, indirectly affect Plug Power’s stock performance. Higher interest rates can increase the cost of capital, making it more expensive for Plug Power to finance its growth initiatives, potentially impacting investor confidence. Inflationary pressures can increase the cost of raw materials and manufacturing, impacting profitability. For example, a period of high inflation could lead to reduced profit margins and potentially lower investor confidence.

Plug Power’s Financial Health and Stock Valuation

Plug Power’s revenue streams primarily come from the sale of hydrogen fuel cell systems and related services to various industries, including material handling, transportation, and energy generation. The contribution of each segment to the overall financial health varies depending on market demand and the company’s strategic focus. Analyzing these revenue streams over time is crucial for assessing the company’s financial stability and growth potential.

Plug Power’s stock price has seen considerable fluctuation recently, largely influenced by broader market trends and the company’s progress in the hydrogen fuel cell sector. It’s interesting to compare its performance to that of other tech giants; for instance, the current trajectory of the qualcomm stock price offers a contrasting perspective on investor sentiment in the tech industry.

Ultimately, understanding the factors impacting Plug Power requires a holistic view of the renewable energy sector and its intersection with broader economic conditions.

| Year | Revenue (USD Millions) | Net Income/Loss (USD Millions) | Total Debt (USD Millions) |

|---|---|---|---|

| Year 1 | (Data Required) | (Data Required) | (Data Required) |

| Year 2 | (Data Required) | (Data Required) | (Data Required) |

| Year 3 | (Data Required) | (Data Required) | (Data Required) |

Note: The table above requires specific financial data from Plug Power’s financial statements to accurately populate the values. This data would provide insights into the company’s financial performance over the three-year period.

A comparative analysis of Plug Power’s valuation metrics (P/E ratio, P/S ratio) against its competitors in the green energy sector requires gathering data on comparable companies and their respective financial performance. This analysis would provide a benchmark for assessing whether Plug Power is overvalued or undervalued relative to its peers.

Future Outlook and Predictions for Plug Power Stock

Plug Power’s current strategic initiatives focus on expanding its market presence in various sectors, enhancing its technological capabilities, and improving its operational efficiency. The success of these initiatives will significantly influence future stock performance. For example, securing large-scale contracts in new markets could drive substantial growth and boost investor confidence.

Potential risks and challenges that could negatively affect Plug Power’s stock price in the next 12 months include intensifying competition, delays in technological advancements, macroeconomic headwinds, and challenges in scaling production to meet growing demand. These risks could lead to decreased profitability or missed growth targets.

Current market conditions, particularly investor sentiment towards the renewable energy sector and overall economic growth, will significantly impact future price predictions. Possible scenarios include:

- Scenario 1 (Bullish): Continued strong growth in the green hydrogen market, successful execution of Plug Power’s strategic initiatives, and positive investor sentiment could lead to significant stock price appreciation.

- Scenario 2 (Bearish): Slowdown in the renewable energy sector, increased competition, and macroeconomic challenges could lead to a decline in Plug Power’s stock price.

- Scenario 3 (Neutral): Moderate growth in the green hydrogen market, steady progress on Plug Power’s initiatives, and relatively stable investor sentiment could result in a sideways price movement.

Investor Sentiment and Analyst Opinions

Source: investorplace.com

The prevailing investor sentiment regarding Plug Power’s stock is generally characterized by a mix of optimism and caution. While the long-term potential of the green hydrogen market is widely recognized, concerns about profitability and the company’s ability to compete effectively remain.

Financial analysts have set a range of price targets for Plug Power’s stock in the next year. These targets reflect varying degrees of optimism and pessimism regarding the company’s future prospects.

- Analyst 1: Price Target (Example: $X)

- Analyst 2: Price Target (Example: $Y)

- Analyst 3: Price Target (Example: $Z)

Note: The above price targets are examples and would need to be replaced with actual data from reputable financial analysts’ reports.

News coverage and media portrayals significantly influence investor perceptions of Plug Power. Positive news coverage, highlighting technological breakthroughs or successful partnerships, can boost investor confidence and drive up the stock price. Conversely, negative news, focusing on financial challenges or setbacks, can trigger sell-offs.

Question Bank: Plug Power Stock Price

What are the major competitors of Plug Power?

Plug Power faces competition from other companies involved in hydrogen fuel cell technology and renewable energy solutions. Specific competitors vary depending on the market segment, but some key players include Ballard Power Systems, Bloom Energy, and FuelCell Energy.

How does Plug Power’s stock price compare to the overall market?

The correlation between Plug Power’s stock price and broader market indices like the S&P 500 and Nasdaq can vary significantly. While general market trends can influence Plug Power’s stock, its performance is often more closely tied to sector-specific factors and company-specific news.

Is Plug Power currently profitable?

Plug Power’s profitability has fluctuated over time. It’s crucial to review their financial statements and earnings reports for the most up-to-date information on their revenue, expenses, and overall profitability.

Where can I find reliable information about Plug Power’s stock price?

Reliable information on Plug Power’s stock price can be found on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg, as well as through the company’s investor relations section.