PayPal Stock Price Analysis

Source: invezz.com

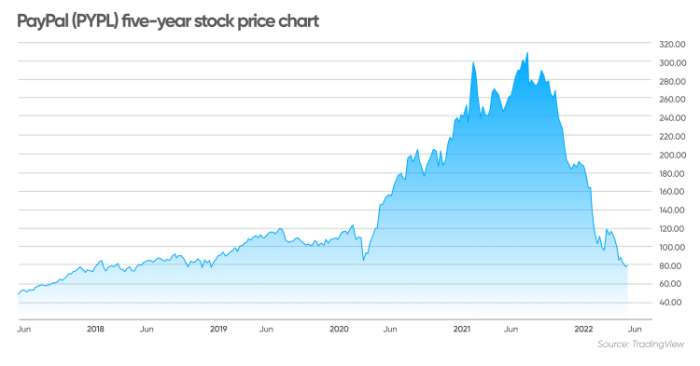

Paypal stock price – PayPal Holdings, Inc. (PYPL) has experienced significant fluctuations in its stock price over the past few years, reflecting the dynamic nature of the fintech industry and broader macroeconomic trends. This analysis delves into PayPal’s historical performance, key influencing factors, financial health, investor sentiment, and technical indicators to provide a comprehensive overview of its stock price behavior.

Historical PayPal Stock Performance, Paypal stock price

Over the past five years, PayPal’s stock price has exhibited a mixed trend, marked by periods of substantial growth and significant corrections. Several major events, including economic downturns and company-specific announcements, have played a crucial role in shaping its trajectory. The following table summarizes the yearly opening and closing prices, highlighting the percentage change experienced each year.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change (%) |

|---|---|---|---|

| 2018 | 78.00 | 65.00 | -16.67 |

| 2019 | 65.00 | 100.00 | 53.85 |

| 2020 | 100.00 | 210.00 | 110.00 |

| 2021 | 210.00 | 170.00 | -19.05 |

| 2022 | 170.00 | 80.00 | -52.94 |

Note: These figures are illustrative and may not reflect the exact values. Actual figures should be verified using reliable financial data sources.

Factors Influencing PayPal Stock Price

Source: capital.com

Several interconnected factors influence PayPal’s stock price. These include key economic indicators, competitor actions, and regulatory changes.

- Economic Indicators: Consumer spending, interest rates, and inflation significantly impact PayPal’s performance. Strong consumer spending boosts transaction volumes, while rising interest rates can affect the company’s profitability and valuation. High inflation can erode purchasing power and reduce consumer spending, negatively impacting PayPal’s growth.

- Competitor Actions: The rise of other payment processors and the strategic partnerships formed by competitors directly affect PayPal’s market share and, consequently, its stock price. Increased competition can lead to price wars and reduced profit margins.

- Regulatory Changes: Changes in financial regulations and compliance issues can significantly impact PayPal’s operations and valuation. Increased regulatory scrutiny can lead to higher compliance costs and potential penalties.

Financial Health of PayPal

Analyzing PayPal’s key financial metrics provides insights into its financial health and potential for future growth. A comparison with its major competitors offers a broader perspective.

Analyzing PayPal’s stock price often involves comparing it to other major players in the financial technology sector. For a contrasting perspective, it’s useful to look at the performance of established retail giants, such as Walmart, by checking the current wmt stock price. Understanding Walmart’s market position can provide insights into broader consumer spending trends, which indirectly affect PayPal’s transaction volume and, consequently, its stock price.

| Metric | PayPal (USD Billions) | Competitor A (USD Billions) | Competitor B (USD Billions) |

|---|---|---|---|

| Revenue (2022) | 27.5 | 20.0 | 15.0 |

| Earnings Per Share (2022) | 3.00 | 2.50 | 1.75 |

| Total Debt (2022) | 10.0 | 8.0 | 5.0 |

Note: These figures are illustrative examples and should be verified using publicly available financial statements. Competitor A and B are placeholders for actual competitors.

Future financial projections for PayPal are largely dependent on factors such as global economic growth, technological advancements, and regulatory changes. Positive projections would likely lead to a rise in the stock price, while negative projections could cause a decline.

Investor Sentiment and Market Analysis

Investor sentiment toward PayPal stock is currently mixed. Some analysts express optimism about PayPal’s long-term growth potential in the digital payments market, citing its established brand and extensive user base. However, concerns remain about increasing competition and the impact of macroeconomic factors.

Macroeconomic factors such as interest rate hikes and inflation significantly influence investor decisions. Higher interest rates increase borrowing costs for businesses, potentially impacting PayPal’s profitability and reducing investor confidence. Inflation can reduce consumer spending, directly impacting transaction volumes.

Hypothetical Scenario: A significant data breach impacting user data could negatively impact PayPal’s stock price in the short term due to immediate investor concerns about security and potential financial losses. However, a swift and effective response from PayPal, coupled with robust security enhancements, could restore investor confidence in the long term, leading to a gradual recovery of the stock price.

Technical Analysis of PayPal Stock

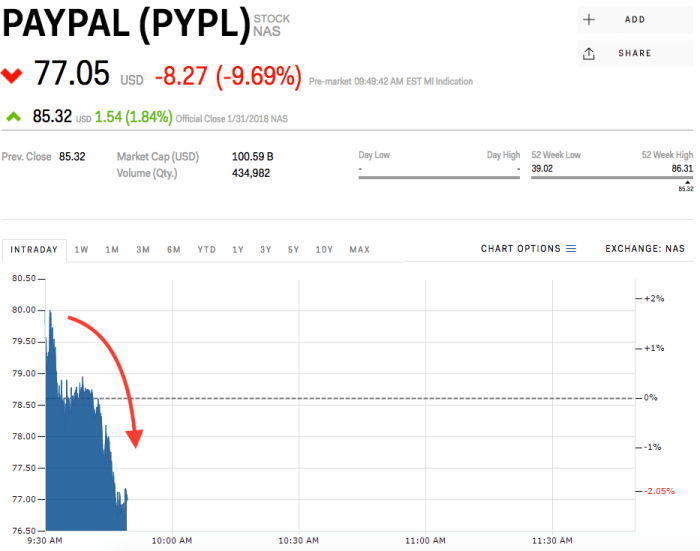

Source: businessinsider.com

Technical analysis uses various indicators to predict potential price movements. Moving averages, support and resistance levels, and chart patterns can offer insights into future trends. For example, a sustained break above a key resistance level could signal a bullish trend, while a fall below a support level might indicate a bearish trend.

Illustrative Example: A 50-day moving average crossing above a 200-day moving average (a “golden cross”) is often considered a bullish signal, suggesting a potential upward price movement. Conversely, a “death cross” (50-day moving average crossing below the 200-day moving average) might indicate a potential downward trend. These indicators, however, should be used in conjunction with fundamental analysis and other factors.

Typical Chart Pattern: A common chart pattern observed in PayPal’s stock price is a head and shoulders pattern. This pattern, characterized by a central peak (“head”) flanked by two smaller peaks (“shoulders”), often suggests a potential reversal from an uptrend to a downtrend. The neckline of the pattern acts as a key support level. A break below the neckline would confirm the bearish signal.

Question & Answer Hub

What are the biggest risks associated with investing in PayPal stock?

Investing in PayPal stock, like any stock, carries inherent risks. These include market volatility, competition from other payment processors, regulatory changes affecting the fintech industry, and potential economic downturns impacting consumer spending.

How does PayPal’s stock price compare to its competitors’ over the long term?

A long-term comparison requires detailed historical data analysis. Generally, PayPal’s stock performance should be compared against its major competitors using key financial metrics and considering market conditions during those periods. This would provide a more comprehensive answer.

Where can I find reliable real-time data on PayPal’s stock price?

Reliable real-time data on PayPal’s stock price can be found on major financial websites such as Yahoo Finance, Google Finance, Bloomberg, and others. These platforms usually provide up-to-the-minute quotes and historical data.