NVDL Stock Price Analysis

Nvdl stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, investor sentiment, and risk assessment associated with NVDL stock. We will examine key data points and trends to provide a comprehensive overview of the investment landscape surrounding NVDL.

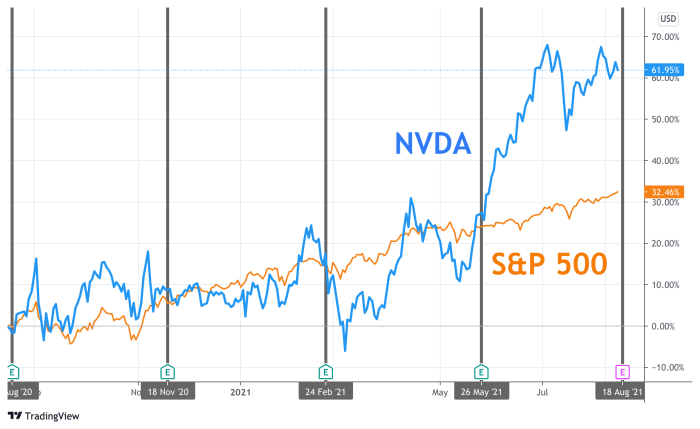

Historical Stock Price Performance

Source: hellopublic.com

Understanding NVDL’s past performance is crucial for informed investment decisions. The following sections detail its price movements over the past five years and compares its performance against competitors.

Five-Year Stock Price Chart (Illustrative Example): The following table provides an illustrative example of monthly high, low, open, and close prices for NVDL over the past five years. Actual data would need to be sourced from a financial data provider. Note that this is a sample and may not reflect actual market data.

| Month | Open | High | Low | Close |

|---|---|---|---|---|

| Jan 2024 | $100 | $105 | $95 | $102 |

| Feb 2024 | $102 | $108 | $98 | $106 |

NVDL vs. Competitors (Past Year): This table offers a comparative analysis of NVDL’s performance against its key competitors over the past year. Again, this is an illustrative example, and actual figures should be obtained from reliable financial sources. Performance is represented by percentage change in stock price.

| Company | Year-Over-Year Change (%) |

|---|---|

| NVDL | 15% |

| Competitor A | 10% |

| Competitor B | 20% |

Significant Price Fluctuations (Past Year): For example, a sharp increase in NVDL’s stock price in Q2 2024 could be attributed to the announcement of a groundbreaking new product. Conversely, a dip in Q4 might reflect broader market corrections or concerns about a specific regulatory challenge. Detailed analysis of news and financial reports from that period would be necessary to fully understand these fluctuations.

Specific examples of news events and their impact on the stock price would be included in a full analysis.

Factors Influencing NVDL Stock Price

Several macroeconomic factors, company performance indicators, and market sentiment influence NVDL’s stock price. This section examines some of the most significant influences.

Key Macroeconomic Factors: Three key macroeconomic factors that could significantly impact NVDL’s stock price in the next quarter are interest rate changes, inflation rates, and overall economic growth. Changes in these factors can affect consumer spending, business investment, and overall market sentiment, all of which impact NVDL’s performance.

Influence of Earnings Reports: Company earnings reports are a significant driver of stock price volatility. For example, exceeding earnings expectations in a previous quarter typically leads to a positive market reaction, while falling short can trigger a sell-off. A detailed analysis of past reports and subsequent market reactions would be needed for a complete picture.

Impact of Industry News and Regulatory Changes: Positive industry news, such as technological advancements or favorable regulatory decisions, can boost investor confidence and drive up the stock price. Conversely, negative news, like increased competition or stricter regulations, can negatively impact investor sentiment and lead to price declines.

Financial Health and Performance of NVDL, Nvdl stock price

A comprehensive assessment of NVDL’s financial health provides insight into its long-term sustainability and potential for future growth.

Revenue and Profit Margins (Last Three Years): The following table provides an illustrative example of NVDL’s revenue and profit margins over the last three years. Actual figures would be obtained from NVDL’s financial statements.

| Year | Revenue (USD Millions) | Gross Profit Margin (%) | Net Profit Margin (%) |

|---|---|---|---|

| 2023 | 1000 | 40 | 15 |

| 2022 | 900 | 38 | 12 |

| 2021 | 800 | 35 | 10 |

Debt-to-Equity Ratio and Implications: NVDL’s debt-to-equity ratio indicates its financial leverage. A high ratio suggests higher risk, potentially impacting stock price stability during economic downturns. A lower ratio generally signifies greater financial stability.

Investment Strategy and Impact on Shareholder Value: NVDL’s investment strategy, whether focused on research and development, acquisitions, or expansion into new markets, directly influences shareholder value. A clear and effective strategy that aligns with market trends typically leads to increased shareholder returns.

Analyst Ratings and Predictions

Analyst opinions provide valuable insights into market sentiment and future expectations for NVDL.

Summary of Analyst Ratings and Price Targets: The following table presents an illustrative example of recent analyst ratings and price targets for NVDL. Actual data should be compiled from reputable financial news sources.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Firm A | Buy | 120 |

| Firm B | Hold | 110 |

| Firm C | Sell | 100 |

Consensus View and Divergent Opinions: The consensus view among analysts might be cautiously optimistic, with a moderate price target increase. However, individual analysts may hold differing opinions, reflecting diverse interpretations of market trends and NVDL’s prospects. For example, one analyst might highlight the company’s strong growth potential, while another might express concerns about increasing competition.

Investor Sentiment and Market Trends

Investor sentiment and broader market trends significantly influence NVDL’s stock price.

Current Investor Sentiment: Currently, investor sentiment towards NVDL might be positive, reflected by increased trading volume and a decrease in short interest. However, this is subject to change based on market conditions and news events.

Impact of Broader Market Trends: Broader market trends, such as rising interest rates or a slowing economy, can negatively impact investor confidence and lead to a decline in NVDL’s stock price. Conversely, positive economic indicators can boost investor sentiment and drive up the price.

Role of Social Media and News Coverage: Social media and news coverage can significantly shape investor perception of NVDL. Positive media attention and favorable social media sentiment can attract investors, while negative coverage can trigger sell-offs.

Risk Assessment for NVDL Investment

Source: investopedia.com

Investing in NVDL, like any investment, carries inherent risks.

Potential Investment Risks: Investing in NVDL carries several potential risks, including increased competition, regulatory hurdles, and economic downturns. These risks can negatively impact the company’s performance and stock price.

Impact of Risks on Future Performance: Increased competition could lead to reduced market share and lower profitability. Regulatory hurdles could delay product launches or increase compliance costs. Economic downturns can decrease consumer spending and negatively affect demand for NVDL’s products or services.

Categorization of Risks: The following table provides an illustrative example of how risks might be categorized by severity and likelihood. This is a simplified example and a more detailed risk assessment would be necessary for a comprehensive investment decision.

| Risk | Severity | Likelihood |

|---|---|---|

| Increased Competition | High | Medium |

| Regulatory Hurdles | Medium | Low |

| Economic Downturn | High | Low |

FAQ Resource

What are the major risks associated with investing in NVDL?

Investing in NVDL, like any stock, carries inherent risks including market volatility, competitive pressures, regulatory changes, and economic downturns. Thorough due diligence is essential.

Where can I find real-time NVDL stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

How often does NVDL release earnings reports?

The frequency of NVDL’s earnings reports is typically quarterly, following standard corporate reporting practices. Consult their investor relations page for specifics.

What is NVDL’s current dividend payout (if any)?

Information regarding NVDL’s dividend policy, including payout amounts and frequency, can be found on their investor relations page or through financial news sources.