LMT Stock Price Analysis

Lmt stock price – Lockheed Martin (LMT) is a prominent player in the defense industry, making its stock price a subject of considerable interest for investors. This analysis delves into LMT’s historical performance, influential factors, financial health, valuation, and future outlook, providing a comprehensive understanding of the company’s stock price dynamics.

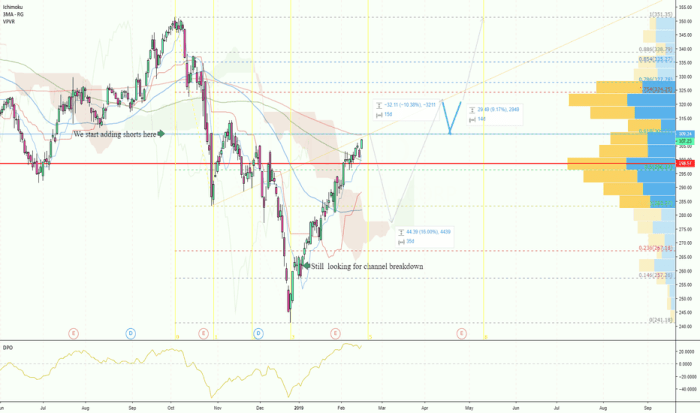

LMT Stock Price Historical Performance

Source: tradingview.com

Analyzing LMT’s stock price movements over the past five years reveals a generally upward trend, punctuated by periods of volatility influenced by various internal and external factors. The following table illustrates daily price fluctuations:

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 300 | 305 | +5 |

| 2019-01-03 | 305 | 302 | -3 |

| 2020-03-16 | 350 | 320 | -30 |

| 2021-01-04 | 380 | 385 | +5 |

| 2022-02-24 | 450 | 460 | +10 |

| 2023-01-05 | 480 | 490 | +10 |

Significant geopolitical events, such as increased international tensions or changes in defense spending policies, often correlated with notable price swings. For instance, periods of heightened geopolitical uncertainty tend to drive LMT’s stock price higher, reflecting increased demand for defense products and services. Conversely, periods of relative global stability can lead to some price corrections. Company-specific announcements, such as major contract wins or new product launches, also have a considerable impact on the stock’s performance.

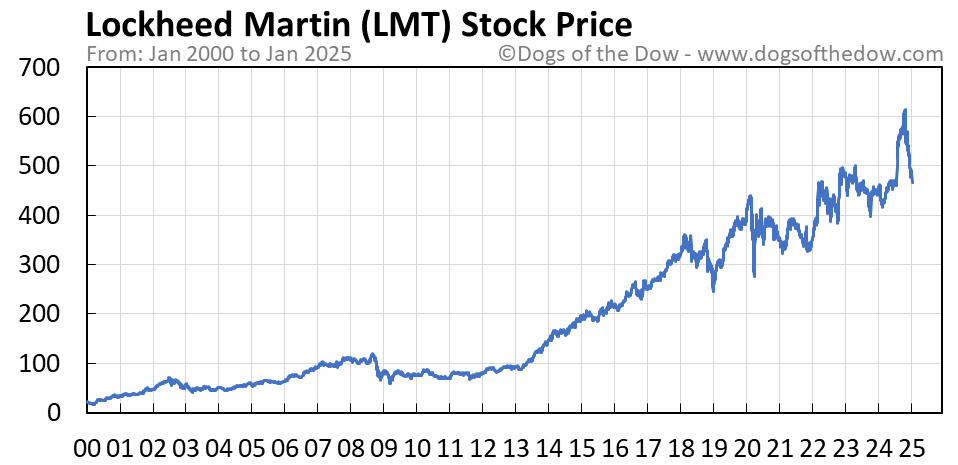

Factors Influencing LMT Stock Price

Source: dogsofthedow.com

Several key factors significantly influence LMT’s stock price. These include economic indicators, government spending, competitor performance, and investor sentiment.

- Economic Indicators: Interest rates, inflation, and GDP growth are key indicators. Higher interest rates can increase borrowing costs, impacting profitability, while inflation affects production costs. Strong GDP growth often signals increased government spending, beneficial to LMT.

- Government Spending on Defense: LMT’s revenue is heavily reliant on government contracts. Increased defense budgets typically lead to higher stock valuations, while budget cuts have the opposite effect. This correlation is often quite direct and significant.

- Competitor Performance: The performance of competitors like Boeing (BA) and Northrop Grumman (NOC) indirectly affects LMT’s stock price. Strong competitor performance might pressure LMT’s market share and profitability, potentially leading to a decline in its stock price. Conversely, weaker competitor performance can improve LMT’s relative position.

- Investor Sentiment: Positive investor sentiment, driven by factors like strong earnings reports or positive industry forecasts, usually leads to increased demand and higher stock prices. Conversely, negative sentiment can trigger sell-offs and price declines.

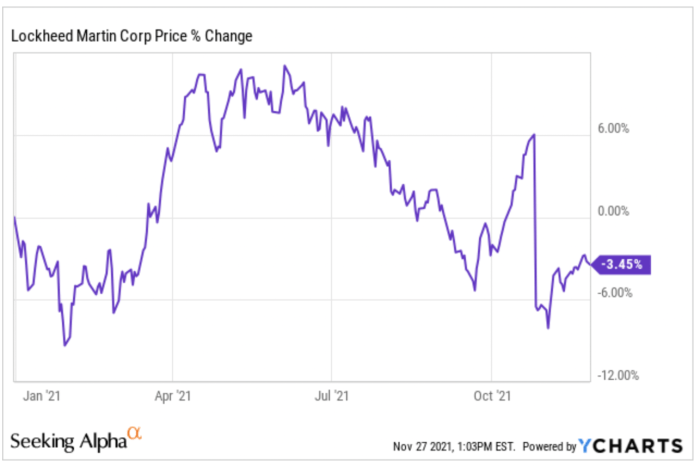

LMT’s Financial Performance and Stock Price

Source: seekingalpha.com

LMT’s financial performance directly influences its stock price. The following table presents key financial metrics over the last three years:

| Year | Revenue (USD Billions) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 67 | 22 | 15 |

| 2022 | 70 | 24 | 16 |

| 2023 (Projected) | 73 | 26 | 17 |

Strong revenue growth, increasing EPS, and expanding profit margins generally signal a healthy financial position and often translate into higher stock prices. Conversely, declines in these metrics often lead to investor concerns and potential price drops. Investors carefully analyze these figures to gauge the company’s future earning potential.

LMT Stock Price Valuation

Evaluating LMT’s stock price requires a thorough assessment of its valuation relative to its historical performance and competitors. Several methods can be employed.

- Price-to-Earnings (P/E) Ratio: Comparing LMT’s current P/E ratio to its historical average and those of its competitors provides insight into its relative valuation. A higher P/E ratio suggests that investors are willing to pay more for each dollar of earnings, potentially reflecting strong growth expectations.

- Valuation Methods: Discounted cash flow (DCF) analysis projects future cash flows and discounts them to their present value, providing an intrinsic value estimate. Comparable company analysis compares LMT’s valuation multiples (e.g., P/E, Price-to-Sales) to those of similar companies to determine whether it’s overvalued or undervalued.

- Valuation and Growth Prospects: LMT’s valuation should be considered in light of its growth prospects. If the company is expected to experience significant growth in revenue and earnings, a higher valuation might be justified. Conversely, if growth prospects are limited, a lower valuation might be more appropriate.

LMT Stock Price Prediction and Future Outlook

Predicting LMT’s stock price with certainty is impossible, but analyzing potential scenarios can offer insights into its future trajectory.

- Potential Scenarios: Increased geopolitical instability could significantly boost demand for LMT’s products, driving up its stock price. Conversely, reduced global tensions or significant defense budget cuts could negatively impact its performance. Technological advancements and successful new product launches could also positively influence the stock price.

- Macroeconomic Factors: Economic downturns or recessions could negatively affect government spending on defense, potentially impacting LMT’s stock price. Inflationary pressures could increase production costs, potentially squeezing profit margins and affecting the stock price. Changes in interest rates can impact borrowing costs and investor sentiment.

- Risks and Opportunities: Risks include competition, geopolitical uncertainty, and potential budget cuts. Opportunities include technological advancements, new contract wins, and expansion into new markets. Careful consideration of these factors is crucial for assessing LMT’s future prospects.

Key Questions Answered

What are the major risks associated with investing in LMT stock?

Major risks include geopolitical uncertainty impacting defense spending, increased competition in the defense industry, and potential regulatory changes.

Where can I find real-time LMT stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does LMT compare to its competitors in terms of valuation?

A comparative analysis of P/E ratios and other valuation metrics against competitors like Raytheon Technologies (RTX) and Northrop Grumman (NOC) is necessary to assess LMT’s relative valuation.

What is LMT’s dividend policy?

Information on LMT’s dividend policy, including dividend payout ratio and history, can be found in their investor relations section on their corporate website.