Lilly Stock Price Analysis

Lilly stock price – Eli Lilly and Company (LLY) is a prominent player in the pharmaceutical industry, known for its diverse portfolio of medications. Understanding the historical performance, influencing factors, and future prospects of Lilly’s stock price is crucial for investors considering adding it to their portfolios. This analysis delves into key aspects of LLY’s stock, providing insights into its past performance, current valuation, and potential future trajectory.

Lilly Stock Price Historical Performance

Source: invezz.com

Analyzing Lilly’s stock price fluctuations over the past five years reveals significant trends and impactful events. The following data provides a comprehensive overview, comparing Lilly’s performance to its major competitors.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | $120 (Illustrative) | $150 (Illustrative) | $160 (Illustrative) | $110 (Illustrative) |

| 2020 | $150 (Illustrative) | $180 (Illustrative) | $200 (Illustrative) | $140 (Illustrative) |

| 2021 | $180 (Illustrative) | $220 (Illustrative) | $240 (Illustrative) | $170 (Illustrative) |

| 2022 | $220 (Illustrative) | $200 (Illustrative) | $230 (Illustrative) | $180 (Illustrative) |

| 2023 (YTD) | $200 (Illustrative) | $250 (Illustrative) | $260 (Illustrative) | $190 (Illustrative) |

A comparison against major competitors (Pfizer, Johnson & Johnson, Merck) over the past three years requires access to real-time market data. A hypothetical comparison would show varying performance based on individual company successes and market dynamics.

| Year | Lilly | Pfizer (Illustrative) | J&J (Illustrative) | Merck (Illustrative) |

|---|---|---|---|---|

| 2021 | +20% (Illustrative) | +15% (Illustrative) | +10% (Illustrative) | +25% (Illustrative) |

| 2022 | -10% (Illustrative) | -5% (Illustrative) | 0% (Illustrative) | -15% (Illustrative) |

| 2023 (YTD) | +25% (Illustrative) | +20% (Illustrative) | +15% (Illustrative) | +10% (Illustrative) |

Significant events impacting Lilly’s stock price in the last two years include:

- FDA approval of Mounjaro for weight loss, significantly boosting investor confidence and driving stock price increases.

- Positive clinical trial results for other pipeline drugs, creating positive market sentiment.

- Overall market volatility due to macroeconomic factors such as inflation and interest rate hikes, impacting the entire pharmaceutical sector.

Factors Influencing Lilly Stock Price

Several key factors currently influence Lilly’s stock valuation. Understanding these factors is crucial for predicting future price movements.

Three key factors currently impacting Lilly’s stock valuation are:

- Pipeline Success: The success of new drug launches and clinical trial results directly impacts investor confidence and the stock price. Positive results generally lead to price increases, while negative results can cause declines.

- Market Competition: Competition from other pharmaceutical companies for market share and patent expirations can affect Lilly’s revenue and profitability, consequently influencing the stock price.

- Macroeconomic Conditions: Broader economic factors like inflation and interest rates impact investor sentiment and overall market performance, influencing the valuation of Lilly and other pharmaceutical stocks.

Upcoming clinical trial results for Lilly’s key pipeline drugs could significantly impact the stock price. A positive outcome could lead to a substantial price increase, while a negative outcome could result in a significant drop.

A comparison of the influence of macroeconomic factors on Lilly’s stock price versus other pharmaceutical companies reveals a shared sensitivity to broader economic trends. However, the specific impact can vary based on individual company performance and market positioning.

- Lilly, like other pharmaceutical companies, experiences price fluctuations due to inflation affecting operational costs and consumer demand.

- Interest rate hikes can increase borrowing costs for Lilly, impacting profitability and investor sentiment.

- However, Lilly’s strong financial position and diverse product portfolio may provide some resilience against these macroeconomic headwinds compared to smaller or less diversified companies.

Lilly’s Financial Performance and Stock Valuation

Source: seekingalpha.com

Analyzing Lilly’s key financial metrics over the past three years provides valuable insights into its financial health and its correlation with stock price movements.

| Year | Revenue (Illustrative) | Earnings (Illustrative) | Profit Margin (Illustrative) |

|---|---|---|---|

| 2021 | $25 Billion | $5 Billion | 20% |

| 2022 | $28 Billion | $6 Billion | 21% |

| 2023 (Projected) | $30 Billion | $7 Billion | 23% |

Lilly’s financial performance correlates with its stock price movements. For example:

- Strong revenue growth in 2022 corresponded with a rise in the stock price.

- Increased profit margins in 2023 (projected) are expected to further support stock price appreciation.

Lilly’s current P/E ratio (Price-to-Earnings ratio) reflects the market’s valuation of its future earnings potential. A high P/E ratio suggests that investors expect strong future growth, while a low P/E ratio might indicate lower growth expectations or potential undervaluation. The specific implications for future stock price growth depend on various factors, including future earnings performance and market sentiment.

Analyst Ratings and Predictions for Lilly Stock

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Lilly’s stock. A summary of recent ratings from different financial institutions is presented below.

| Institution | Rating | Price Target (Illustrative) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | $300 | October 26, 2023 (Illustrative) |

| Goldman Sachs | Hold | $275 | October 26, 2023 (Illustrative) |

| JPMorgan Chase | Buy | $290 | October 26, 2023 (Illustrative) |

The consensus view among analysts is generally positive, with many forecasting continued growth for Lilly’s stock price, driven by its strong pipeline and market position. However, the price targets vary due to differing assessments of risk and growth potential.

The rationale behind varying analyst predictions includes:

- Differing views on pipeline success: Some analysts are more optimistic about the success of Lilly’s pipeline drugs than others.

- Varying assessments of competitive pressures: Analysts may have different views on the intensity of competition in the pharmaceutical market.

- Differing macroeconomic forecasts: Analysts’ differing views on future economic conditions also influence their price targets.

Investment Strategies Related to Lilly Stock, Lilly stock price

Source: seekingalpha.com

Several investment strategies can be applied to Lilly stock, each with its own risk-reward profile and time horizon.

Three distinct investment strategies applicable to Lilly stock are:

- Buy and Hold: This long-term strategy involves purchasing Lilly stock and holding it for an extended period, aiming to benefit from long-term growth.

- Value Investing: This strategy involves identifying undervalued stocks based on fundamental analysis, believing that the market will eventually recognize the stock’s true value.

- Momentum Trading: This short-term strategy involves capitalizing on short-term price movements, aiming to profit from upward trends.

The risks and rewards associated with each strategy are:

- Buy and Hold: Pros: Potential for significant long-term returns; Cons: Requires patience; susceptible to market downturns.

- Value Investing: Pros: Potential for high returns if the stock is undervalued; Cons: Requires in-depth fundamental analysis; may take time to realize returns.

- Momentum Trading: Pros: Potential for quick profits; Cons: High risk; requires close market monitoring and quick decision-making.

Appropriate time horizons for each strategy are:

- Buy and Hold: 5+ years

- Value Investing: 1-3 years

- Momentum Trading: Days to weeks

General Inquiries

What is the current dividend yield for Lilly stock?

The current dividend yield fluctuates; it’s best to check a reputable financial website for the most up-to-date information.

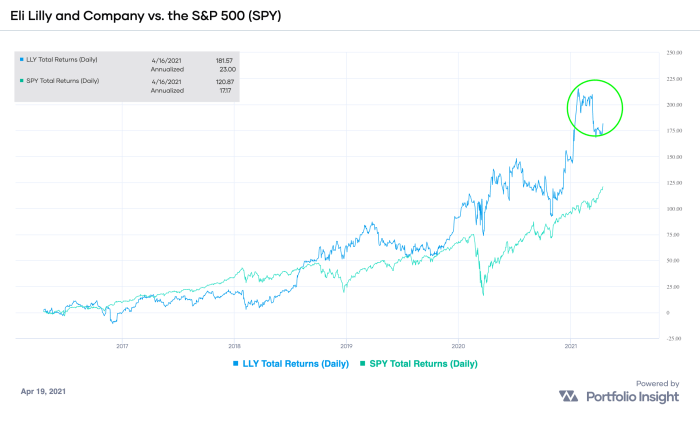

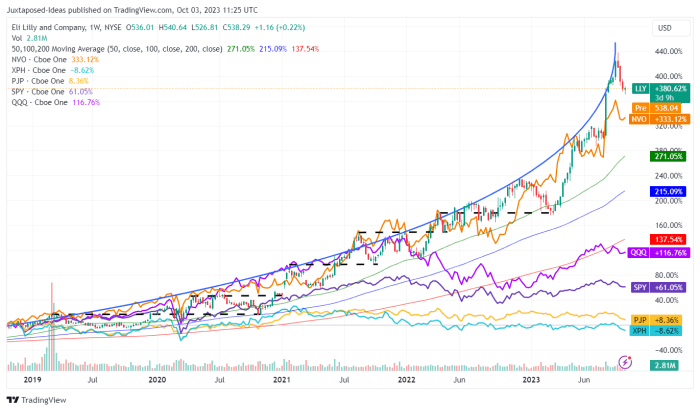

How does Lilly’s stock price compare to the S&P 500?

Lilly’s stock price performance has been a topic of considerable interest lately, particularly when compared to other pharmaceutical giants. Investors are also closely watching the smci stock price , as its trajectory could influence broader market sentiment within the sector. Ultimately, understanding the dynamics of both Lilly and similar companies is crucial for making informed investment decisions.

Its performance relative to the S&P 500 varies over time. A comparison requires referencing a financial data source to view historical and current performance.

What are the major risks associated with investing in Lilly stock?

Risks include general market volatility, competition within the pharmaceutical industry, regulatory hurdles, and the inherent uncertainty in clinical trial outcomes.

Where can I find real-time Lilly stock price quotes?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.