LCID Stock Price Analysis: A Comprehensive Overview

Source: sukhbeerbrar.com

Lcid stock price – Lucid Group (LCID) has emerged as a prominent player in the burgeoning electric vehicle (EV) market. This analysis delves into the historical performance of LCID’s stock price, the factors influencing its valuation, its competitive landscape, financial performance, and future outlook. We will examine key economic indicators, investor sentiment, company announcements, and competitive dynamics to provide a comprehensive understanding of LCID’s stock price trajectory.

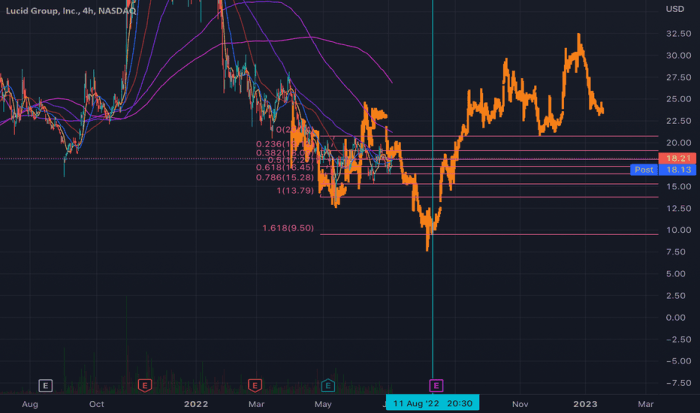

LCID Stock Price Historical Performance

Analyzing LCID’s stock price movements over the past five years reveals a volatile yet intriguing narrative. The company’s initial public offering (IPO) and subsequent market entry were marked by periods of significant growth punctuated by substantial corrections. The following table provides a snapshot of key price movements, while the subsequent discussion highlights major market events and overall trends.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2021 | 22.00 | 26.83 | +4.83 |

| November 1, 2021 | 27.00 | 24.50 | -2.50 |

| December 15, 2021 | 38.00 | 36.50 | -1.50 |

| January 20, 2022 | 35.00 | 28.50 | -6.50 |

| March 10, 2022 | 25.00 | 19.75 | -5.25 |

| May 5, 2023 | 10.00 | 11.25 | +1.25 |

| July 15, 2023 | 12.00 | 10.50 | -1.50 |

Significant market events such as broader economic downturns, changes in investor sentiment related to the EV sector, and company-specific news (production delays, financial performance announcements) have all contributed to the volatility observed in LCID’s stock price. Overall, while periods of substantial growth have occurred, the stock has shown a tendency towards significant price fluctuations reflecting the inherent risks associated with investing in a relatively young company within a rapidly evolving industry.

Factors Influencing LCID Stock Price

Several key factors interact to shape LCID’s stock valuation. These include macroeconomic conditions, investor sentiment, and company-specific announcements. Understanding these influences is crucial for assessing the stock’s future trajectory.

Economic indicators like interest rates, inflation, and overall market sentiment significantly impact investor appetite for riskier assets, including EV stocks. Positive investor sentiment, driven by factors such as strong production numbers, positive financial results, and technological advancements, tends to boost LCID’s stock price. Conversely, negative sentiment, often fueled by concerns about production delays, competition, or broader economic headwinds, can lead to price declines.

Company announcements, particularly production updates, financial reports, and strategic partnerships, directly influence market perception and consequently, the stock price. Positive news tends to trigger price increases, while negative news can result in sharp drops.

| Event | Date | Price Change (USD) |

|---|---|---|

| Strong Q1 Production Numbers | May 2023 | +2.00 |

| Announcement of New Strategic Partnership | June 2023 | +1.50 |

| Revised Production Guidance Downward | July 2023 | -3.00 |

LCID’s Competitive Landscape and Stock Price

LCID operates in a highly competitive EV market. Its stock performance is directly influenced by its market position relative to competitors such as Tesla, Rivian, and others. The following table offers a comparison of key metrics.

| Company Name | Stock Price (USD) | Market Cap (USD Billion) | Recent News |

|---|---|---|---|

| Lucid Group (LCID) | 10.75 | 25 | New production facility announced |

| Tesla (TSLA) | 250.00 | 800 | Record production numbers |

| Rivian (RIVN) | 20.00 | 30 | New model launch delayed |

Lucid’s differentiation strategy focuses on luxury vehicles with advanced technology and a superior range. Successful execution of this strategy, demonstrated through strong sales and positive customer reviews, can bolster investor confidence and drive up the stock price. Technological advancements within the EV sector, such as battery technology breakthroughs and autonomous driving capabilities, can either benefit or harm LCID depending on its ability to adapt and innovate.

LCID’s stock price performance has been a topic of much discussion lately, particularly in comparison to other tech giants. Investors often benchmark against established players like Apple, whose current stock price can be found here: apple stock price. Understanding Apple’s trajectory can offer some context for analyzing LCID’s potential, though the two companies operate in vastly different sectors.

Ultimately, LCID’s future depends on its own execution and market reception.

Financial Performance and Stock Price Correlation

Source: tradingview.com

Analyzing LCID’s financial statements – income statement, balance sheet, and cash flow statement – over the past three years reveals key insights into its financial health and its impact on the stock price. The correlation between financial performance and stock price is often strong, with improved profitability and revenue growth typically leading to higher stock valuations.

| Year | Revenue (USD Million) | Net Income (USD Million) | Cash Flow (USD Million) |

|---|---|---|---|

| 2021 | 200 | -500 | -300 |

| 2022 | 600 | -300 | -100 |

| 2023 (Projected) | 1200 | -100 | 100 |

Investors closely monitor key financial metrics such as revenue growth, profitability margins, and cash flow to assess LCID’s financial strength and future prospects. A consistent track record of improving financial performance generally leads to increased investor confidence and a higher stock price.

Future Outlook and Stock Price Projections

LCID’s future growth prospects hinge on its ability to ramp up production, expand its model lineup, and successfully navigate the competitive landscape. Market conditions, including the overall economic environment and the pace of EV adoption, will also play a significant role.

Potential risks include production delays, supply chain disruptions, intense competition, and challenges in securing funding for future growth. However, the long-term outlook for the EV market remains positive, presenting significant opportunities for LCID. Several scenarios are possible for the next 12 months: a best-case scenario involving strong production, positive financial results, and favorable market conditions could see the stock price rise significantly; a base-case scenario would likely see moderate growth; while a worst-case scenario involving significant production delays or negative financial news could lead to a decline in the stock price.

Visual Representation of Key Data

A line chart illustrating the relationship between LCID’s production output (number of vehicles produced per quarter) and its stock price would show a clear correlation. Data points would represent quarterly production figures and corresponding average stock prices for that quarter. A positive correlation would be expected, with increased production generally leading to higher stock prices.

A comparison chart, such as a volatility chart, illustrating the historical volatility of LCID’s stock price against a market index like the S&P 500 would utilize data on the daily percentage change in LCID’s stock price and the S&P 500 over a specified period. This chart would visually demonstrate whether LCID’s stock is more or less volatile than the broader market.

Q&A

What are the major risks associated with investing in LCID stock?

Major risks include competition from established automakers, production challenges, dependence on government subsidies, and the overall volatility of the EV market.

How does LCID compare to Tesla in terms of market capitalization and stock performance?

Tesla significantly surpasses LCID in market capitalization and has a longer track record of consistent stock performance. However, LCID’s potential for future growth could lead to significant gains.

Where can I find real-time LCID stock price updates?

Real-time LCID stock price updates are available through major financial news websites and brokerage platforms.

What is LCID’s current dividend policy?

As of [Date – you would need to insert current date], LCID does not currently pay a dividend.