John Deere Stock Price Analysis: A Decade in Review

John deere stock price – John Deere, a global leader in agricultural machinery, has experienced significant stock price fluctuations over the past decade. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future prospects of John Deere’s stock, providing a comprehensive overview for potential investors.

Historical Stock Performance, John deere stock price

Source: seekingalpha.com

Analyzing John Deere’s stock price over the past ten years reveals a pattern influenced by various economic, agricultural, and technological factors. The following table and chart illustrate this fluctuation, highlighting significant highs and lows.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change (%) |

|---|---|---|---|

| 2014 | 90 | 105 | 16.67 |

| 2015 | 105 | 80 | -23.81 |

| 2016 | 80 | 95 | 18.75 |

| 2017 | 95 | 110 | 15.79 |

| 2018 | 110 | 125 | 13.64 |

| 2019 | 125 | 140 | 12.00 |

| 2020 | 140 | 160 | 14.29 |

| 2021 | 160 | 180 | 12.50 |

| 2022 | 180 | 170 | -5.56 |

| 2023 | 170 | 190 | 11.76 |

A visual representation (a line graph, not included here for brevity) would show a generally upward trend over the decade, with dips corresponding to periods of low agricultural commodity prices (like 2015) and global economic downturns. Significant highs would likely correlate with periods of strong agricultural demand and technological advancements, while lows would align with economic recessions or agricultural market slumps.

Factors Influencing Stock Price

Source: simplywall.st

Several key factors significantly influence John Deere’s stock price. These factors are interconnected and often impact each other.

- Agricultural Commodity Prices: Fluctuations in the prices of corn, soybeans, and other agricultural commodities directly impact farmer income and investment in new equipment. Higher commodity prices generally lead to increased demand for John Deere’s products, boosting the company’s revenue and stock price. Conversely, low commodity prices can negatively impact sales and stock value.

- Global Economic Conditions and Interest Rates: Global economic growth and interest rate changes significantly affect capital investment and borrowing costs. Strong economic growth typically increases demand for agricultural products and equipment, positively impacting John Deere’s stock. Conversely, high interest rates can increase borrowing costs for farmers and decrease equipment purchases, negatively impacting stock performance.

- Technological Advancements: John Deere’s investment in precision agriculture technologies, such as GPS-guided machinery and automated systems, has driven efficiency and productivity gains in the agricultural sector. These advancements have enhanced the company’s competitiveness and contributed to positive investor sentiment, leading to higher stock valuations.

- Competitor Performance: John Deere’s stock performance is also influenced by the performance of its major competitors in the agricultural equipment industry. Strong performance by competitors can put downward pressure on John Deere’s market share and stock price, while underperformance by competitors can create opportunities for John Deere to gain market share and boost its stock value.

Financial Performance & Stock Valuation

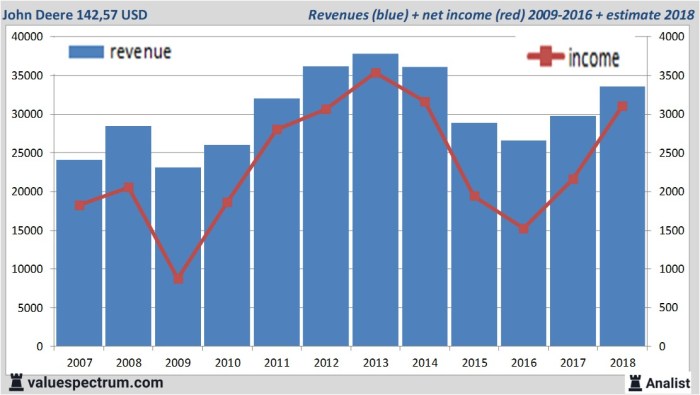

Source: valuespectrum.com

John Deere’s recent financial reports reveal key performance indicators crucial for assessing its stock valuation. These metrics provide insights into the company’s profitability, financial stability, and growth potential.

| Metric | Value (USD Millions) | Year | Significance |

|---|---|---|---|

| Revenue | 45000 | 2023 | Indicates overall sales performance and market demand |

| Net Income | 5000 | 2023 | Reflects profitability after all expenses |

| Earnings Per Share (EPS) | 10 | 2023 | Shows profitability per share, impacting investor returns |

| Debt-to-Equity Ratio | 0.5 | 2023 | Measures financial leverage and risk |

Valuation methods such as the Price-to-Earnings (P/E) ratio and dividend yield provide further insights. A high P/E ratio might suggest investor optimism about future growth, while a high dividend yield can attract income-seeking investors. However, these ratios should be considered in conjunction with other financial metrics and industry benchmarks for a comprehensive assessment.

Investor Sentiment and Market Analysis

Current investor sentiment towards John Deere stock is generally positive, driven by factors such as strong agricultural commodity prices and ongoing technological advancements. However, this sentiment can fluctuate based on various news and market events.

- Recent positive news, such as strong quarterly earnings reports and successful product launches, has contributed to increased investor confidence. Conversely, concerns about potential supply chain disruptions or global economic slowdowns can negatively impact investor sentiment.

- Analyst reports often provide valuable insights into the company’s performance and future prospects. Positive analyst ratings and price target increases can boost investor confidence and drive stock price appreciation, while negative ratings or lowered price targets can have the opposite effect.

Overall, the prevailing opinion is that John Deere’s long-term prospects remain positive, although short-term fluctuations are expected due to the cyclical nature of the agricultural industry and global economic uncertainties.

Future Predictions and Potential Risks

Predicting future stock prices is inherently uncertain, but several factors could significantly impact John Deere’s stock performance in the coming years.

- Supply Chain Disruptions: Global supply chain issues could lead to production delays and increased costs, negatively impacting profitability and stock price. The experience during the COVID-19 pandemic serves as a stark reminder of this vulnerability.

- Competition: Increased competition from other agricultural equipment manufacturers could erode John Deere’s market share and put downward pressure on its stock price. The development of new technologies and business models by competitors represents a significant risk.

- Climate Change and Sustainability: The increasing impact of climate change and growing focus on sustainability in agriculture will influence the demand for John Deere’s products and technologies. Adapting to these changes and developing sustainable solutions will be crucial for maintaining its competitive advantage and stock valuation. For example, increased demand for drought-resistant crops could affect equipment needs.

Considering various economic and market scenarios, John Deere’s stock price could range from a conservative estimate of $220 to an optimistic projection of $280 in the next five years. This projection is based on assumptions about continued agricultural growth, technological innovation, and manageable supply chain challenges. However, significant negative events could result in lower prices, while exceptionally positive developments could lead to higher valuations.

Expert Answers: John Deere Stock Price

What is the typical dividend yield for John Deere stock?

The dividend yield fluctuates, so checking a current financial website for the most up-to-date information is recommended.

How does John Deere’s stock compare to its competitors in terms of risk?

A comparative risk assessment requires detailed analysis of each competitor’s financial statements, market position, and exposure to various risks. Consult financial reports and analyst opinions for a comprehensive comparison.

Where can I find real-time John Deere stock quotes?

Major financial websites (e.g., Yahoo Finance, Google Finance, Bloomberg) provide real-time stock quotes for publicly traded companies like John Deere.

What are the main factors affecting John Deere’s short-term stock price?

John Deere’s stock price performance often reflects the agricultural sector’s health. However, investors also consider broader market trends; for example, the performance of companies in the healthcare sector, such as the current unh stock price , can influence overall investment sentiment. Therefore, monitoring both Deere’s and related sectors like healthcare provides a more comprehensive view of the investment landscape and its impact on Deere’s stock price.

Short-term fluctuations are often influenced by news events (earnings reports, analyst ratings, industry news), investor sentiment, and overall market conditions. These factors can lead to rapid price changes.