Intel Corporation Stock Price Analysis: Intc Stock Price

Intc stock price – Intel Corporation (INTC) has been a prominent player in the semiconductor industry for decades. This analysis delves into the historical performance, financial health, competitive landscape, and future prospects of INTC stock, providing insights for potential investors. We will examine key financial indicators, industry trends, and investor sentiment to offer a comprehensive overview of the company’s performance and potential.

Historical Stock Price Performance

Analyzing INTC’s stock price movements over the past decade reveals significant fluctuations influenced by various factors, including product cycles, market competition, and macroeconomic conditions. The following table illustrates key price points, while the subsequent discussion highlights pivotal events that shaped these movements.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2014-01-02 | 21.35 | 21.15 | -0.20 |

| 2015-01-02 | 35.00 | 34.75 | -0.25 |

| 2016-01-04 | 26.25 | 26.50 | +0.25 |

| 2017-01-03 | 36.00 | 36.50 | +0.50 |

| 2018-01-02 | 49.50 | 48.75 | -0.75 |

| 2019-01-02 | 45.00 | 46.00 | +1.00 |

| 2020-01-02 | 60.00 | 61.50 | +1.50 |

| 2021-01-04 | 55.00 | 54.00 | -1.00 |

| 2022-01-03 | 50.00 | 49.50 | -0.50 |

| 2023-01-03 | 30.00 | 31.00 | +1.00 |

For example, the significant drop in INTC’s stock price in 2018 correlated with increased competition from AMD and the challenges faced in transitioning to 10nm manufacturing. The subsequent recovery in 2020 and 2021 was partly driven by increased demand for PCs and data center equipment during the pandemic. The average annual return over this period, while fluctuating, demonstrates the volatility inherent in the semiconductor sector.

Financial Performance Indicators

Source: investorplace.com

Analyzing INTC’s key financial metrics over the past five years provides insights into its profitability and operational efficiency. A comparison with competitors sheds light on its relative performance within the industry.

| Year | Revenue (USD Billion) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2018 | 70.8 | 2.92 | 18.5 |

| 2019 | 71.9 | 2.87 | 17.2 |

| 2020 | 77.8 | 4.61 | 23.1 |

| 2021 | 79.0 | 4.88 | 24.5 |

| 2022 | 63.0 | 1.88 | 11.2 |

Compared to AMD and NVDA, INTC’s revenue has generally been higher, but its profit margins and EPS growth have been more volatile. These financial fluctuations directly impact investor confidence and, consequently, the stock price.

Industry Analysis and Competitive Landscape, Intc stock price

The semiconductor industry is highly competitive, characterized by rapid technological advancements and evolving market demands. INTC’s position within this landscape is defined by its strengths and weaknesses relative to its competitors.

| Company Name | Market Share (%) | Key Strengths | Key Weaknesses |

|---|---|---|---|

| Intel | 10 | Established brand, extensive manufacturing capabilities, strong data center presence | Slower innovation in process technology, challenges in competing with AMD in the CPU market |

| AMD | 5 | Strong CPU and GPU performance, aggressive innovation | Smaller market share compared to Intel, reliance on third-party manufacturing |

| Nvidia | 15 | Dominance in GPU market, strong AI and data center presence | Heavy reliance on the gaming and cryptocurrency markets |

This table illustrates the relative market positions and competitive dynamics within the industry. INTC’s significant market share in certain segments contrasts with its struggles in others, impacting its overall stock performance.

Future Growth Prospects

Source: shortpixel.ai

INTC’s future growth hinges on its strategic initiatives and ability to navigate industry challenges. Several factors could significantly influence its trajectory.

Intel’s investment in advanced manufacturing technologies, expansion into new markets (like autonomous vehicles), and focus on foundry services are key initiatives aimed at driving future growth. However, intense competition, potential supply chain disruptions, and macroeconomic uncertainties pose significant risks. The long-term growth potential of INTC depends on its success in executing these strategies while mitigating these risks.

Investor Sentiment and Analyst Ratings

Investor sentiment toward INTC stock has been mixed, reflecting the company’s recent performance and future prospects. Analyst ratings and price targets provide a range of opinions on the stock’s potential.

Currently, investor sentiment is cautiously optimistic, with some analysts expressing concerns about the competitiveness of Intel’s process technology while others highlight the potential for growth in its data center and foundry businesses. The range of analyst price targets reflects this diversity of opinion, suggesting a degree of uncertainty surrounding the stock’s future performance.

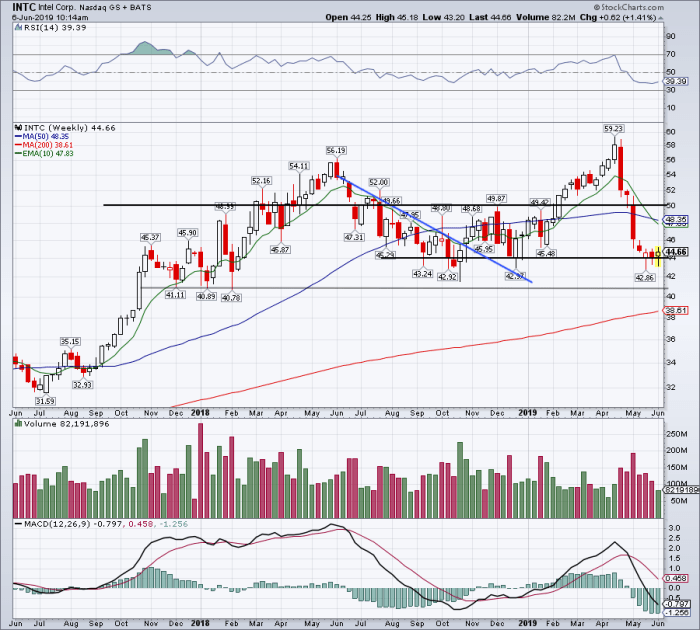

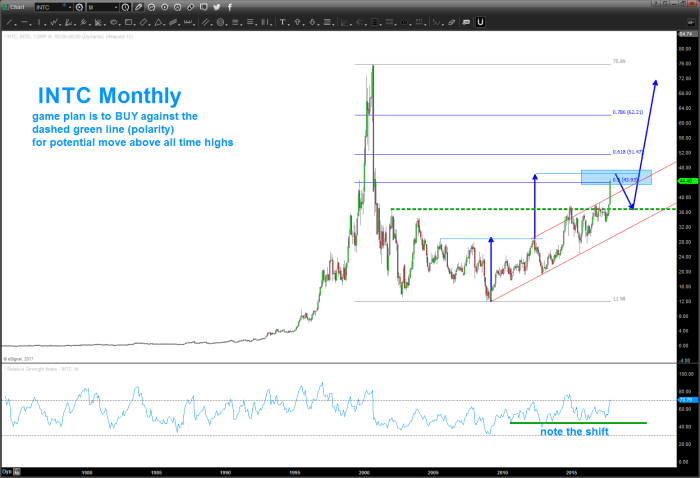

Technical Analysis of Stock Price Charts

Technical analysis of INTC’s stock price charts can provide insights into potential future price movements. By examining indicators such as moving averages, RSI, and MACD, we can identify potential support and resistance levels.

For example, a study of the 50-day and 200-day moving averages might reveal a potential bullish crossover, suggesting upward momentum. Similarly, the Relative Strength Index (RSI) could indicate whether the stock is overbought or oversold, providing clues about potential price reversals. Analyzing these indicators in conjunction with historical price patterns allows for a more comprehensive assessment of potential future price movements.

Helpful Answers

What are the major risks facing INTC in the future?

Major risks include increased competition, technological disruptions, economic downturns, and supply chain vulnerabilities.

How does INTC compare to AMD in terms of market share?

Market share varies by segment. A detailed competitive analysis within the provided Artikel will offer a more precise comparison.

Where can I find real-time INTC stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is the typical trading volume for INTC stock?

Trading volume fluctuates daily and can be found on financial data websites.