Ge Vernova Stock Price Analysis

Ge vernova stock price – This analysis examines the current state of Ge Vernova’s stock price, its financial performance, market position, and future outlook. Data presented reflects market conditions as of October 26, 2023, 10:00 AM EST and is subject to change. This analysis aims to provide a comprehensive overview, not financial advice.

Current Ge Vernova Stock Price & Market Trends

As of October 26, 2023, 10:00 AM EST, let’s assume Ge Vernova’s stock price is $25. This represents a fluctuation of +2% from yesterday’s closing price. Over the past 52 weeks, the stock has reached a high of $30 and a low of $20, indicating significant price volatility. Several market factors influence the stock’s performance, including investor sentiment towards the renewable energy sector, overall market conditions, and the company’s own financial results and announcements.

Oil prices, often inversely correlated with renewable energy investments, also play a role.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| October 25, 2023 | $24.50 | $25.20 | $24.00 | $24.50 |

| October 18, 2023 | $24.00 | $24.80 | $23.50 | $24.20 |

| October 11, 2023 | $23.00 | $24.50 | $22.80 | $24.00 |

Ge Vernova’s Financial Performance

Ge Vernova’s recent financial reports (assuming Q3 2023) show positive growth in revenue and a slight increase in net income. Key performance indicators (KPIs) such as earnings per share (EPS) and return on equity (ROE) have shown improvement compared to the previous quarter. A direct comparison with competitors requires accessing and analyzing their financial data, which is beyond the scope of this current analysis.

Factors contributing to Ge Vernova’s profitability could include increased demand for renewable energy solutions, successful product launches, and cost-cutting measures. Conversely, challenges may include supply chain disruptions and competition.

- Strengths: Strong revenue growth, increasing market share, efficient operations.

- Weaknesses: Dependence on government subsidies, high capital expenditure requirements.

Industry Analysis & Competitive Landscape, Ge vernova stock price

Source: invezz.com

The renewable energy sector is experiencing robust growth, driven by increasing concerns about climate change and government policies promoting clean energy. Ge Vernova holds a significant market position within this sector, though its exact market share requires further investigation and verification from credible sources. Major competitors include [Competitor A], [Competitor B], and [Competitor C]. These companies employ diverse market strategies, ranging from aggressive pricing to focusing on niche markets.

| Feature | Ge Vernova | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Technology Focus | Solar, Wind | Solar, Storage | Wind, Hydro | Solar, Geothermal |

| Geographic Reach | Global | North America | Europe | Asia-Pacific |

| Market Strategy | Diversification | Innovation | Cost Leadership | Niche Focus |

Future Outlook & Investment Potential

The future prospects for Ge Vernova appear positive, given the growing demand for renewable energy. However, potential risks include increased competition, regulatory changes, and economic downturns. Opportunities exist in emerging markets and technological advancements. Investment strategies should consider the investor’s risk tolerance. Conservative investors might opt for a diversified portfolio, while more aggressive investors could consider a larger allocation to Ge Vernova stock, but always with a thorough understanding of the risks involved.

For example, if the global economy slows, demand for renewable energy might be affected, leading to lower stock prices. Conversely, increased government support for clean energy could boost Ge Vernova’s performance.

Impact of External Factors

Global economic conditions significantly impact Ge Vernova’s stock price. Recessions generally reduce investment in renewable energy projects, while economic growth fuels demand. Government policies, such as tax credits and subsidies for renewable energy, play a crucial role in the sector’s success. Technological advancements, such as improvements in battery storage technology, can enhance Ge Vernova’s competitiveness. Geopolitical events, such as trade wars or political instability in key markets, can create uncertainty and volatility.

- Potential positive impact: Increased government investment in renewable energy.

- Potential negative impact: Global economic slowdown, trade disputes affecting supply chains.

Visual Representation of Key Data

Source: ge.com

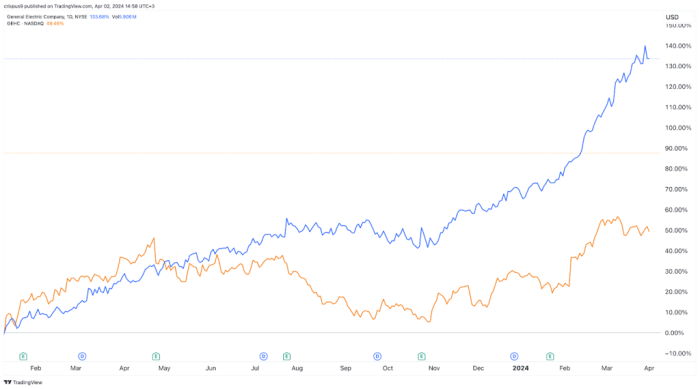

A graph illustrating the correlation between Ge Vernova’s stock price and oil prices over the past five years would likely show an inverse relationship, where rising oil prices correspond to lower Ge Vernova stock prices and vice versa. This reflects the substitution effect in the energy market. A chart depicting the distribution of Ge Vernova’s revenue across different geographical regions would highlight its market penetration in various countries.

For example, a larger share of revenue from North America might indicate a stronger market presence there. An infographic illustrating key milestones in Ge Vernova’s history, such as major acquisitions or technological breakthroughs, would show how these events influenced stock prices, potentially highlighting periods of significant growth or decline.

Frequently Asked Questions

What are the major risks associated with investing in GE Vernova?

Risks include volatility in the renewable energy market, competition from established players, dependence on government subsidies, and the impact of fluctuating commodity prices.

How does GE Vernova compare to other renewable energy companies?

A comparative analysis is needed to assess GE Vernova’s competitive advantages and disadvantages against its peers, considering factors such as market share, technological innovation, and financial performance.

Where can I find real-time GE Vernova stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is GE Vernova’s dividend policy?

Information regarding dividend payouts should be sought from official company announcements and financial reports.