GameStop Stock Price: A Deep Dive

The GameStop stock price has experienced extraordinary volatility, captivating investors and sparking widespread debate about market dynamics, the power of social media, and the role of institutional investors. This analysis delves into the key factors driving these fluctuations, from its initial public offering to the present day.

Historical Price Fluctuations

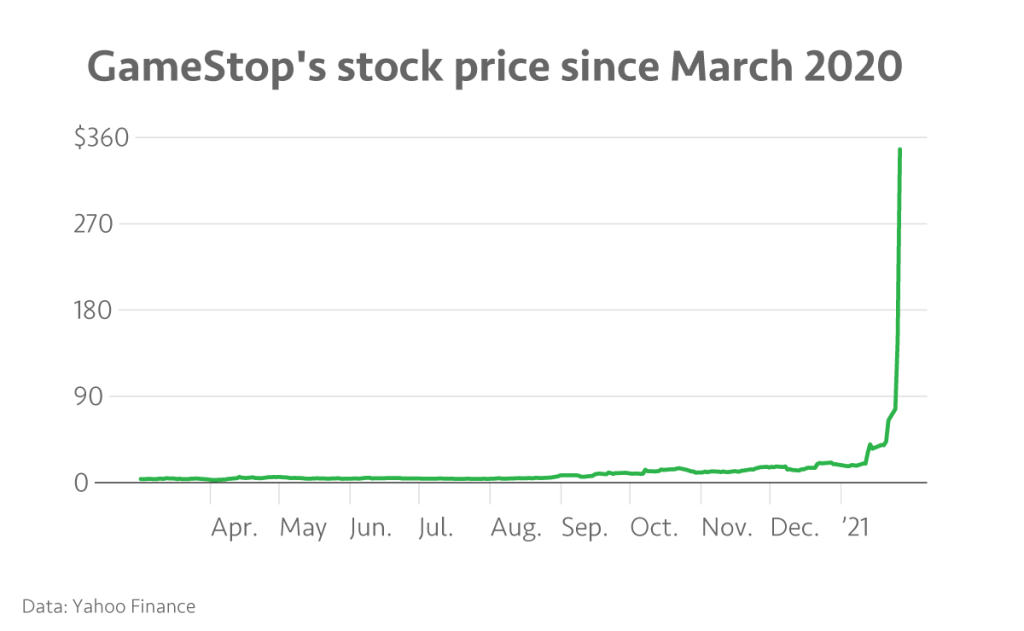

GameStop’s stock price journey has been marked by periods of both significant growth and dramatic decline. Understanding this historical context is crucial to grasping the recent events surrounding the stock.

| Date Range | Opening Price (Approximate) | Closing Price (Approximate) | Significant Events |

|---|---|---|---|

| 2002-2019 | $1 – $20 | $1 – $20 | Initial Public Offering (IPO); Gradual decline due to competition from digital game distribution; Several attempts at business model transformation. |

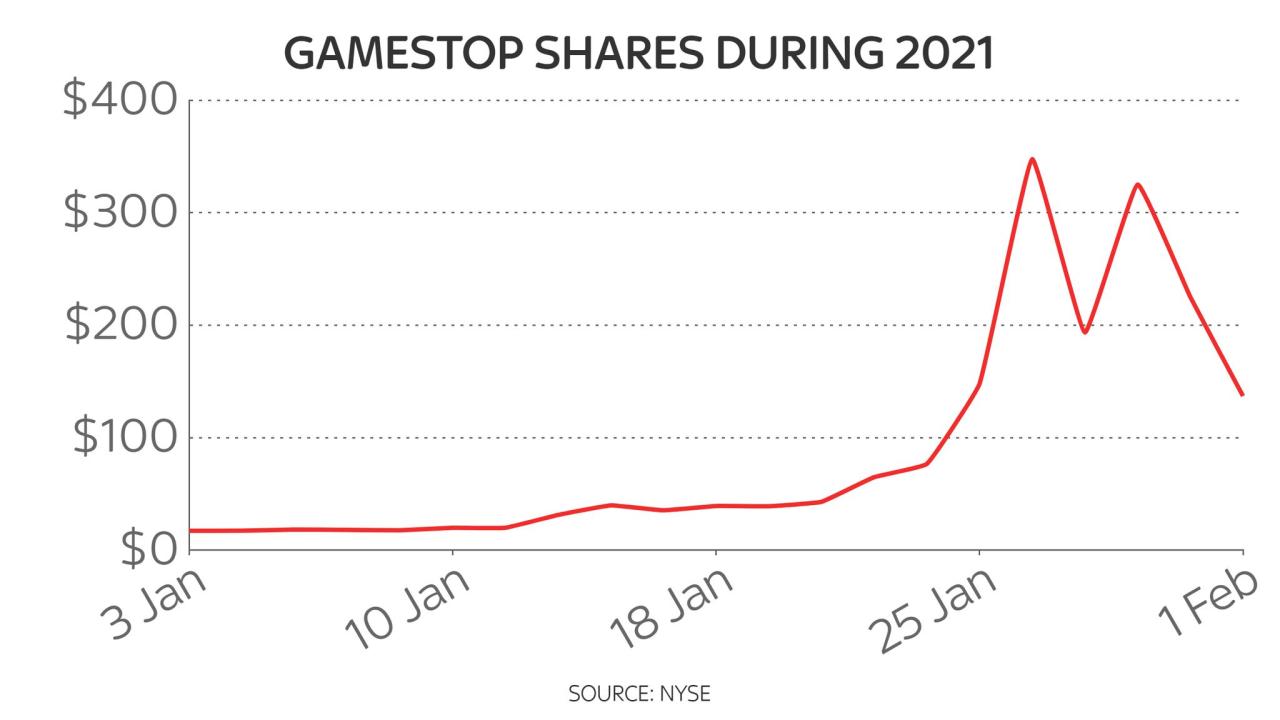

| January 2021 | $17 | $347 | Significant increase driven by Reddit’s WallStreetBets community; Short squeeze. |

| February 2021 – Present | $30 – $200 | $10 – $30 | Price consolidation; increased regulatory scrutiny; continued volatility. |

Market sentiment shifted dramatically throughout this period. Early years were characterized by cautious optimism, transitioning to pessimism as the company struggled to adapt to the changing retail landscape. The Reddit-fueled surge brought extreme bullishness, followed by a period of increased uncertainty and regulatory concern.

Impact of Social Media and Reddit

Source: marketplace.org

The role of social media, particularly Reddit’s WallStreetBets subreddit, in influencing GameStop’s stock price is undeniable. This section examines the pre- and post-Reddit eras to highlight the impact on trading volume and volatility.

Before the Reddit influence, GameStop’s trading volume was relatively low, reflecting its status as a struggling retailer. Price movements were generally gradual. Following the WallStreetBets campaign, trading volume exploded, resulting in unprecedented price volatility. The stock became a battleground between retail investors and short-sellers.

A visual representation would show a relatively flat line representing GameStop’s price and trading volume before the Reddit influence. Upon the surge in Reddit activity, the line would sharply increase, showing a strong positive correlation between increased Reddit posts and comments about GameStop and the subsequent stock price increase and trading volume. Following the peak, the graph would show increased volatility, with periods of both increases and decreases in price, still influenced by Reddit activity, though less directly than during the initial surge.

Influence of Institutional Investors, Gamestop stock price

Several institutional investors played significant roles in GameStop’s stock price fluctuations. Their trading strategies and motivations had a substantial impact.

- Some institutional investors initially held short positions, betting against the company’s success. These positions were significantly impacted by the short squeeze.

- Other investors, recognizing the potential for a short squeeze or seeing value in the company’s turnaround efforts, bought shares, further fueling the price increase.

- Some institutional investors may have participated in the short squeeze to profit from the rising prices, while others may have exited their positions to limit potential losses.

Motivations for buying GameStop shares included the potential for short squeezes, belief in the company’s turnaround strategy, and the opportunity to profit from increased investor enthusiasm. Motivations for selling included risk aversion, profit-taking, and a lack of confidence in the company’s long-term prospects.

Fundamental Analysis of GameStop

GameStop’s business model centers on the retail sale of video games, consoles, and related merchandise. Revenue streams are primarily derived from sales and related services. The company has faced significant challenges due to the rise of digital game distribution and competition from online retailers.

Strengths include a vast network of physical stores and a loyal customer base. Weaknesses include its reliance on a declining retail model and the need for a successful digital transformation. Compared to competitors like Best Buy and Walmart, GameStop generally has lower revenue and profitability. Its long-term prospects depend on its ability to successfully adapt to the changing market landscape.

Short Selling and its Effect

Source: 365dm.com

Short selling involves borrowing shares, selling them, and hoping to buy them back later at a lower price to profit from the difference. In GameStop’s case, a large number of shares were shorted, creating a significant vulnerability. When the price started rising rapidly, driven by Reddit’s WallStreetBets, short-sellers were forced to buy back shares to limit their losses, creating a short squeeze and further fueling the price increase.

Short squeezes can lead to dramatic price increases, as seen with GameStop. The risk for short-sellers is potentially unlimited losses if the price keeps rising. The reward is the potential for significant profits if the price falls as anticipated. However, the risk of a short squeeze can be substantial.

Regulatory Response and Market Implications

The GameStop stock price volatility prompted regulatory scrutiny of trading practices and market manipulation. Investigations were launched to assess whether any illegal activity occurred. The events highlighted the potential impact of social media on market dynamics and raised questions about the fairness and efficiency of the market.

The GameStop saga had broad implications for investor behavior, increasing awareness of short squeezes and the power of coordinated retail investor action. It also led to discussions about potential changes to trading regulations and increased scrutiny of online trading platforms. Some regulatory changes focused on improving transparency and preventing market manipulation.

FAQ Section

What is a short squeeze?

A short squeeze occurs when a heavily shorted stock experiences a rapid price increase, forcing short sellers to buy back shares to limit their losses, further driving up the price.

What are the long-term prospects for GameStop?

The volatility of the Gamestop stock price has been a fascinating case study in market behavior. Investors often compare such unpredictable stocks to more stable blue-chip options, and a contrasting example is the jnj stock price , which tends to exhibit less dramatic fluctuations. Understanding the differences between these two investment approaches is key to making informed decisions regarding the Gamestop stock price and minimizing risk.

GameStop’s long-term prospects are subject to debate and depend heavily on its ability to adapt to the changing landscape of the video game industry, successfully implement its turnaround strategy, and manage its financial performance.

How did regulatory bodies respond to the GameStop volatility?

Regulatory bodies investigated potential market manipulation and reviewed trading practices. Some changes to trading rules were considered, though the overall response was varied across different jurisdictions.

What are the ethical considerations surrounding the GameStop saga?

The GameStop saga raises ethical questions about market manipulation, the role of social media in influencing investment decisions, and the fairness of the financial system for both retail and institutional investors.