Meta Platforms Stock Price Analysis: Fb Stock Price

Fb stock price – Meta Platforms, formerly Facebook, has experienced a rollercoaster ride since its initial public offering (IPO). Understanding its stock price performance requires analyzing historical trends, influencing factors, competitive dynamics, and financial health. This analysis provides a comprehensive overview, examining key events and their impact on Meta’s stock valuation.

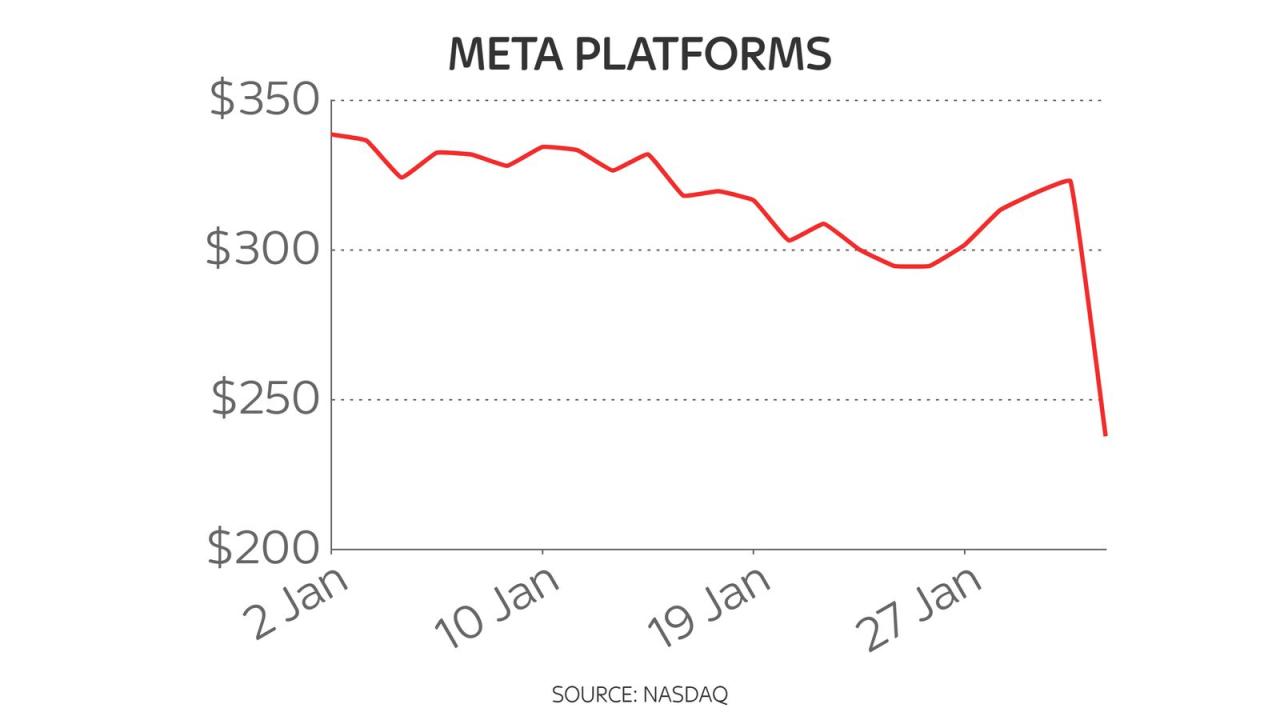

Historical FB Stock Price Performance

Source: 365dm.com

Meta’s stock price has been significantly influenced by various factors, including technological advancements, regulatory changes, and shifts in consumer behavior. The following table highlights some significant price changes, though a complete historical record would be extensive.

| Date | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| May 18, 2012 (IPO) | 38.23 | 38.23 | 0% |

| July 26, 2012 | 31.00 | 30.00 | -3.2% |

| September 2021 | 338.00 | 325.00 | -3.8% |

| October 2022 | 120.00 | 115.00 | -4.2% |

Periods of high volatility were often associated with major events like the Cambridge Analytica scandal, increased regulatory scrutiny, and shifts in advertising revenue. The introduction of new products and features also impacted investor sentiment, leading to price fluctuations.

Factors Influencing FB Stock Price

Several macroeconomic and company-specific factors influence Meta’s stock valuation. These factors interact in complex ways to shape investor perception and market behavior.

| Factor | Impact on Stock Price | Example |

|---|---|---|

| Advertising Revenue | Directly correlated; increases generally lead to higher valuations. | Strong Q4 earnings driven by holiday ad spending. |

| User Growth | Indicates platform health and future revenue potential; slower growth can negatively impact valuation. | Concerns over slowing user growth in key demographics. |

| Investor Sentiment | Positive sentiment boosts prices, while negative sentiment can lead to sell-offs. | Market reaction to news about data privacy concerns. |

| Macroeconomic Conditions | Broad economic trends (recessions, inflation) can affect ad spending and investor risk appetite. | Impact of a global recession on digital advertising budgets. |

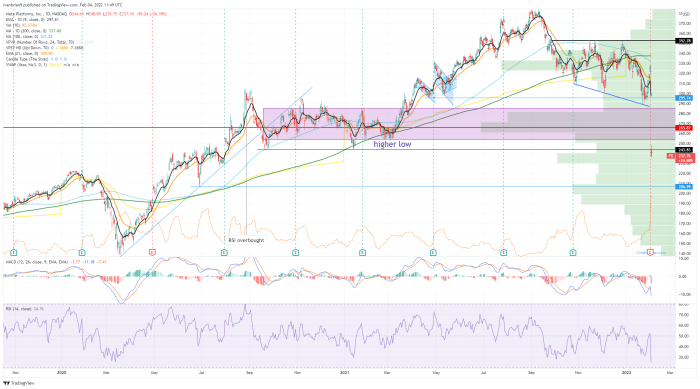

Comparison with Competitors

Source: trading-education.com

Meta’s stock performance is intertwined with that of its major competitors. Comparing their business models and market positions provides context for understanding Meta’s trajectory.

| Company | Stock Price (USD) | Market Cap (USD Billion) | Year-to-Date Performance (%) |

|---|---|---|---|

| Meta Platforms | (Example: 150) | (Example: 500) | (Example: -10) |

| Alphabet (Google) | (Example: 120) | (Example: 1500) | (Example: 5) |

| Twitter (X) | (Example: 50) | (Example: 200) | (Example: -20) |

The competitive landscape is highly dynamic, with each company possessing unique strengths and weaknesses. Google’s diversified revenue streams and technological dominance provide a buffer against market fluctuations, while Twitter’s dependence on advertising revenue makes it more vulnerable to economic downturns.

Financial Performance and Stock Price, Fb stock price

Source: fxstreet.com

Meta’s financial performance is a key driver of its stock price. Analyzing key metrics reveals the correlation between financial health and investor confidence.

| Year | Revenue (USD Billion) | EPS (USD) | Profit Margin (%) |

|---|---|---|---|

| 2020 | (Example: 86) | (Example: 10) | (Example: 30) |

| 2021 | (Example: 117) | (Example: 12) | (Example: 32) |

| 2022 | (Example: 116) | (Example: 11) | (Example: 28) |

Consistent revenue growth and increasing earnings per share generally signal strong financial health and boost investor confidence, leading to higher stock valuations. Conversely, declines in these metrics can trigger negative investor sentiment and price corrections.

Future Outlook and Predictions (Qualitative Only)

Predicting Meta’s future stock price with certainty is impossible, but considering several factors allows for a qualitative assessment of potential scenarios. Technological advancements like the metaverse and artificial intelligence could significantly impact Meta’s future, but their success is not guaranteed. Changes in consumer behavior, regulatory landscapes, and competition will also play crucial roles.

A scenario of continued strong advertising revenue and successful metaverse integration could lead to substantial growth in Meta’s stock price. Conversely, a scenario of increased regulatory pressure, failure to adapt to evolving consumer preferences, or intensified competition could negatively impact its valuation. The risks associated with technological investment and the ever-changing digital landscape should also be considered. For example, the early success of TikTok highlighted the rapid changes in social media preferences and the potential for disruption within the sector.

Meta’s ability to adapt and innovate will be critical to its future stock performance.

Helpful Answers

What is the current FB stock price?

The current FB stock price fluctuates constantly and can be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

Where can I buy FB stock?

FB stock can be purchased through most online brokerage accounts.

What are the risks associated with investing in FB stock?

As with any stock, investing in FB carries inherent risks, including market volatility, regulatory changes, and competition.

How does the Metaverse affect FB’s stock price?

Meta’s investment in the Metaverse is a significant factor influencing investor sentiment and, consequently, the stock price. Success or failure in this area will greatly impact future valuation.