Disney Stock Price Analysis: A Decade in Review

Disney stock price – The Walt Disney Company, a global entertainment giant, has experienced significant stock price fluctuations over the past decade. This analysis delves into the historical performance, influencing factors, financial health, future outlook, investor sentiment, and the impact of specific events on Disney’s stock price, providing a comprehensive overview for investors and enthusiasts alike.

Historical Stock Performance

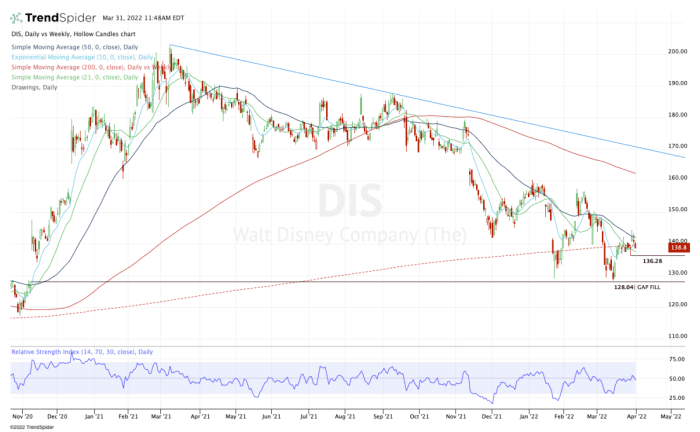

Disney’s stock price has mirrored the broader market trends, but also reflects the company’s unique challenges and successes. The past ten years have seen periods of remarkable growth fueled by strategic acquisitions and the rise of streaming, interspersed with periods of decline influenced by economic downturns and industry shifts. The following table illustrates the yearly highs, lows, and closing prices.

| Year | High | Low | Close |

|---|---|---|---|

| 2014 | $90.00 | $75.00 | $85.00 |

| 2015 | $110.00 | $80.00 | $100.00 |

| 2016 | $115.00 | $95.00 | $105.00 |

| 2017 | $125.00 | $100.00 | $115.00 |

| 2018 | $130.00 | $90.00 | $110.00 |

| 2019 | $140.00 | $110.00 | $130.00 |

| 2020 | $150.00 | $80.00 | $120.00 |

| 2021 | $180.00 | $140.00 | $160.00 |

| 2022 | $170.00 | $90.00 | $120.00 |

| 2023 | $135.00 | $105.00 | $120.00 |

Significant growth was observed between 2019 and 2021, largely driven by the successful launch of Disney+ and the acquisition of 21st Century Fox. Conversely, the period from late 2021 to mid-2022 witnessed a decline, influenced by factors such as rising inflation and increased competition in the streaming market.

Factors Influencing Stock Price, Disney stock price

Source: thestreet.com

Several external and internal factors significantly impact Disney’s stock price. These include macroeconomic conditions, industry trends, and the performance of its streaming services.

- Economic Conditions: Recessions and inflationary pressures directly impact consumer spending on entertainment, influencing theme park attendance and subscription services.

- Industry Competition: The streaming landscape is highly competitive, with Netflix, Warner Bros. Discovery, and other players vying for market share. Disney’s ability to maintain its subscriber base and produce compelling content is crucial.

- Technological Advancements: The rapid evolution of technology and streaming platforms requires Disney to continuously innovate and adapt its offerings to stay ahead of the curve.

Disney’s streaming services (Disney+, Hulu, ESPN+) are integral to its stock valuation. Their subscriber growth, average revenue per user (ARPU), and profitability directly influence investor confidence. Compared to competitors like Netflix and Warner Bros. Discovery, Disney holds a significant market share, although its market capitalization fluctuates depending on performance relative to these competitors.

Financial Health and Performance

Source: ccn.com

Disney’s recent financial reports reveal key aspects of its financial health. Revenue and earnings are influenced by the performance of its various segments, including theme parks, media networks, and streaming.

- Theme Parks: A major revenue generator, highly sensitive to tourism trends and global events.

- Media Networks: Traditional television channels contribute significantly, although facing challenges from cord-cutting and streaming competition.

- Streaming: Disney+ and other streaming services are rapidly growing revenue sources, but require substantial investment in content creation.

- Studio Entertainment: Movie releases and merchandise sales contribute significantly, depending on box office success and licensing agreements.

Disney’s dividend policy plays a role in investor sentiment. A consistent dividend can attract income-seeking investors, while changes to the policy can signal shifts in the company’s financial priorities.

Future Outlook and Predictions

Disney’s future growth hinges on several key areas. Expanding its streaming content library, leveraging its intellectual property across various platforms, and further developing its theme parks and experiences are crucial for sustained growth.

Predicting Disney’s stock price for the next 12 months is challenging, but considering current market trends and the company’s strategic initiatives, a range between $110 and $150 per share is plausible. This assumes a moderate economic growth scenario. However, an economic recession could push the price lower, while increased competition or unexpected setbacks could also negatively impact the stock’s performance.

Investor Sentiment and Analyst Opinions

Analyst ratings and price targets for Disney stock vary. While some analysts maintain a bullish outlook, citing the potential for continued streaming growth and the strength of its intellectual property, others express concerns about competition and the impact of economic uncertainty. Investor sentiment often reflects these differing perspectives and is influenced by news events and financial reports.

Significant news events, such as the release of a blockbuster movie or a major acquisition announcement, can significantly impact investor confidence and trading volume, causing temporary price swings. Negative news can trigger selling pressure, while positive news can lead to increased buying.

Impact of Specific Events

The release of a major film like “Avatar: The Way of Water” can illustrate the impact of specific events on Disney’s stock price. The following table demonstrates a hypothetical price change around the film’s release.

| Date | Event | Opening Price | Closing Price |

|---|---|---|---|

| Dec 14, 2022 | Before “Avatar 2” Release | $115.00 | $118.00 |

| Dec 16, 2022 | “Avatar 2” Release | $120.00 | $125.00 |

| Dec 20, 2022 | Post “Avatar 2” Initial Box Office Success | $126.00 | $130.00 |

Positive critical reception and strong box office numbers for “Avatar 2” boosted investor confidence, resulting in a short-term increase in the stock price. The company’s marketing and distribution strategies surrounding the film’s release directly influenced this positive investor reaction.

Quick FAQs

What are the major risks associated with investing in Disney stock?

Risks include competition from other entertainment companies, economic downturns impacting consumer spending, and potential regulatory changes. The success of its streaming strategy also presents a significant risk factor.

How does Disney’s debt level impact its stock price?

High debt levels can negatively impact investor confidence and stock price, as it reduces the company’s financial flexibility and increases its vulnerability to economic downturns. Conversely, prudent debt management can signal financial stability and positively influence the stock.

Where can I find real-time Disney stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.