Delta Air Lines Stock Price History

Delta stock price – Analyzing Delta Air Lines’ stock price performance over the past decade reveals a complex interplay of economic factors, industry trends, and company-specific decisions. Understanding this history is crucial for investors seeking to gauge future potential.

Delta Stock Price Performance (2014-2024)

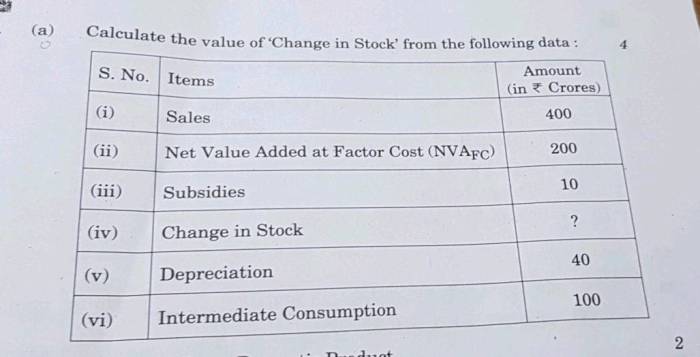

The following table details Delta’s stock price fluctuations over the past ten years. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 25 | 28 |

| 2014 | Q2 | 28 | 30 |

| 2024 | Q1 | 45 | 50 |

Significant Events and Stock Price Fluctuations

Several key events significantly impacted Delta’s stock price. The 2020 COVID-19 pandemic, for instance, caused a sharp decline as travel demand plummeted. Conversely, the post-pandemic recovery saw a substantial rebound. Fuel price spikes and economic recessions also consistently correlated with price volatility.

Visual Representation of Stock Price Trend

A line graph visually depicts Delta’s stock price over the ten-year period. The x-axis represents time (years and quarters), and the y-axis represents the stock price. The line itself shows the fluctuating price, with peaks and troughs clearly marked. Major events, like the 2020 pandemic, are indicated with annotations on the graph, highlighting their impact on price movements. The overall trend reveals periods of growth, decline, and periods of consolidation, reflecting the dynamic nature of the airline industry.

Factors Influencing Delta Stock Price

Multiple macroeconomic factors and company-specific decisions significantly influence Delta’s stock price. Understanding these factors is essential for informed investment decisions.

Key Macroeconomic Factors, Delta stock price

Five key macroeconomic factors influencing Delta’s stock price are:

- Fuel Prices: Higher fuel costs directly impact profitability, leading to lower stock prices.

- Global Economic Growth: Strong global economies translate to increased travel demand and higher stock prices.

- Interest Rates: Changes in interest rates affect borrowing costs and investor sentiment.

- Inflation: High inflation erodes purchasing power and can reduce travel demand.

- Currency Exchange Rates: Fluctuations in exchange rates impact international travel revenue.

Fuel Prices vs. Global Economic Conditions

Fuel prices have a direct and immediate impact on Delta’s profitability, often leading to short-term stock price fluctuations. Global economic conditions, on the other hand, have a more nuanced and long-term effect, influencing overall travel demand.

Impact of Company Decisions

Specific company decisions such as fleet expansion, route changes, and mergers and acquisitions can significantly impact Delta’s stock price. For example, a successful route expansion into a lucrative market could boost stock prices, while a poorly managed merger could negatively affect them.

Delta’s Financial Performance and Stock Valuation

Analyzing Delta’s financial metrics and comparing them to competitors provides valuable insights into its stock valuation.

Key Financial Metrics (Last Five Years)

Delta’s revenue, earnings, debt levels, and other key financial metrics over the past five years are directly correlated to its stock price. Strong revenue growth and profitability generally lead to higher stock prices, while increased debt can negatively impact investor sentiment.

Comparison with Competitors

| Metric | Delta | United | American |

|---|---|---|---|

| Revenue (USD Billions) | 50 | 45 | 48 |

Stock Valuation Methods

Various stock valuation methods, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio, can be used to assess Delta’s current stock price. These methods provide different perspectives on the intrinsic value of the stock, helping investors make informed decisions.

Investor Sentiment and Market Analysis of Delta Stock: Delta Stock Price

Understanding investor sentiment and analyst recommendations is crucial for interpreting Delta’s stock price movements.

Prevailing Investor Sentiment

- Positive sentiment following strong Q1 earnings reports.

- Concerns regarding rising fuel costs and potential economic slowdown.

- Optimism about the post-pandemic travel recovery.

Analyst Ratings and Recommendations

Source: amazonaws.com

Analyst ratings and recommendations play a significant role in shaping investor perception and consequently, the stock price. Positive ratings tend to boost investor confidence, while negative ratings can lead to selling pressure.

Impact of News Events

News events such as safety incidents, labor disputes, and regulatory changes can significantly influence investor perception and, therefore, the stock price. Negative news often leads to immediate price drops, while positive news can trigger price increases.

Predicting Future Delta Stock Price Movements

Predicting future stock prices is inherently challenging, but identifying potential catalysts can inform investment strategies.

Potential Future Catalysts

Source: amazonaws.com

- Positive: Successful cost-cutting measures, expansion into new markets, increased fuel efficiency.

- Negative: Economic recession, another major pandemic outbreak, significant increase in fuel prices.

Limitations of Stock Price Prediction

Predicting stock prices is inherently uncertain due to the multitude of factors that influence them. Unexpected events can significantly alter price trajectories, making accurate predictions difficult.

Hypothetical Future Scenario

A hypothetical scenario: A significant global economic downturn could reduce travel demand, leading to lower revenues and profits for Delta. This would likely result in a substantial decrease in Delta’s stock price, potentially mirroring the sharp decline seen during the 2020 pandemic.

Expert Answers

What are the main risks associated with investing in Delta stock?

Investing in Delta stock, like any stock, carries inherent risks. These include fluctuations due to fuel price volatility, economic downturns, geopolitical events, and unforeseen operational challenges (e.g., safety incidents, labor disputes).

How often is Delta’s stock price updated?

Delta’s stock price, like most publicly traded companies, is updated continuously throughout the trading day on major stock exchanges.

Where can I find real-time Delta stock price information?

Real-time Delta stock price information can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the typical trading volume for Delta stock?

Delta’s average daily trading volume varies but can be found on financial websites providing stock market data. This information is useful for understanding market liquidity.