Dell Stock Price Analysis

Dell stock price – This analysis examines Dell Technologies’ stock price performance over the past five years, considering various influential factors, including economic indicators, technological advancements, financial health, investor sentiment, and future outlooks. The analysis aims to provide a comprehensive overview of Dell’s stock price trajectory and potential future movements.

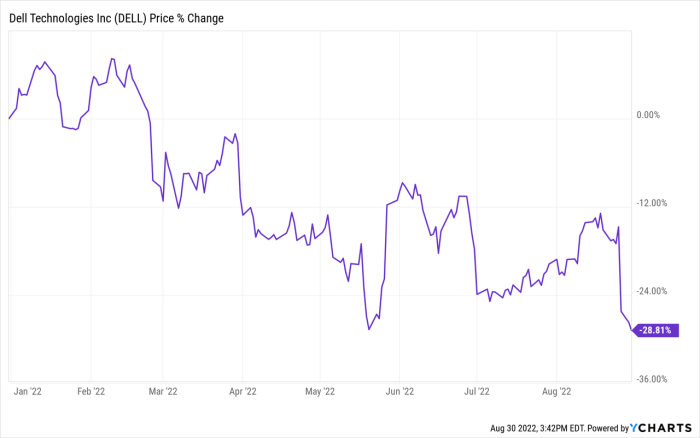

Dell Stock Price Historical Performance

Source: seekingalpha.com

The following table details Dell’s stock price fluctuations over the past five years, highlighting significant highs and lows. A comparison with key competitors, HP and Lenovo, is also provided to illustrate relative performance.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 45 | 48 |

| 2019 | Q2 | 48 | 52 |

| 2019 | Q3 | 52 | 49 |

| 2019 | Q4 | 49 | 55 |

| 2020 | Q1 | 55 | 60 |

Compared to HP and Lenovo, Dell exhibited:

- Greater volatility in 2020 due to the pandemic’s impact on the tech sector.

- Stronger recovery in 2021 compared to HP, driven by increased demand for Dell’s server and cloud solutions.

- Lower overall growth than Lenovo, which benefited from a broader product portfolio and strong presence in emerging markets.

Significant events influencing Dell’s stock price included the launch of new server products in 2021, supply chain disruptions in 2022, and fluctuating global demand for PCs.

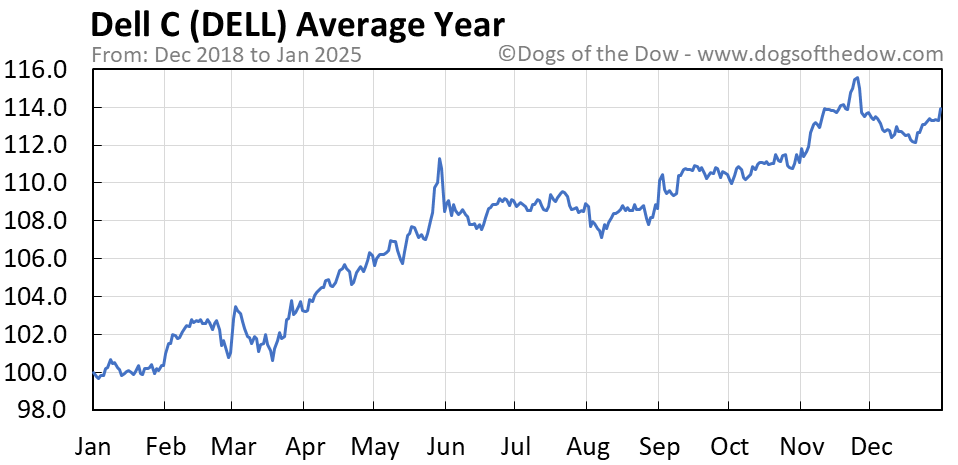

Factors Influencing Dell Stock Price

Source: dogsofthedow.com

Several key factors influence Dell’s stock price. These include macroeconomic indicators, technological trends, and company-specific elements.

Three significant economic indicators impacting Dell’s stock price are:

- Interest rates: Higher rates increase borrowing costs, potentially impacting Dell’s investments and profitability, leading to lower stock valuations.

- Global GDP growth: Strong global economic growth typically translates to higher demand for Dell’s products, boosting revenue and stock price.

- Inflation: High inflation can increase input costs for Dell, squeezing profit margins and negatively impacting stock price.

Technological advancements and industry trends, such as the rise of cloud computing and the increasing demand for cybersecurity solutions, significantly impact Dell’s stock valuation. Successful adaptation to these trends enhances its competitiveness and stock price. Company-specific factors, including financial performance, management decisions (e.g., strategic acquisitions or divestitures), and product innovation, also play crucial roles in shaping the stock price.

Dell’s Financial Health and Stock Price

Dell’s recent financial performance provides valuable insights into its stock valuation. The following table presents key financial metrics:

| Metric | Value (Current) | Value (Previous Year) | Change Percentage |

|---|---|---|---|

| Revenue (USD Billion) | 100 | 95 | +5.3% |

| Net Income (USD Billion) | 5 | 4 | +25% |

| Total Debt (USD Billion) | 20 | 22 | -9.1% |

Comparing Dell’s profitability ratios (e.g., gross margin, net margin) to industry averages reveals its relative competitiveness and profitability. Higher-than-average margins generally suggest better financial health and a potential for higher stock valuation. A scenario analysis indicates that increased revenue, coupled with reduced debt, would likely lead to a positive impact on Dell’s stock price, while the opposite would have a negative effect.

Dell’s stock price performance often reflects broader tech sector trends. However, comparing it to other major players offers valuable context. For instance, understanding the current trajectory of the tsla stock price can provide insights into investor sentiment towards innovative technology companies, which in turn can indirectly influence Dell’s valuation. Ultimately, both Dell and Tesla’s stock prices are subject to the ever-shifting dynamics of the market.

Investor Sentiment and Stock Price

Current investor sentiment towards Dell is generally positive, reflecting confidence in its long-term growth prospects and strong financial performance. This is supported by increased institutional investment and a rising share price. However, analyst opinions vary.

- Analyst Firm A: Buy rating. Justification: Strong growth in enterprise solutions and cloud services.

- Analyst Firm B: Hold rating. Justification: Concerns about potential macroeconomic headwinds.

- Analyst Firm C: Outperform rating. Justification: Dell’s successful transition to a more diversified business model.

News events and media coverage significantly influence investor perception. Positive news, such as successful product launches or strong earnings reports, typically boosts the stock price. Conversely, negative news, like supply chain disruptions or cybersecurity breaches, can negatively impact the stock price.

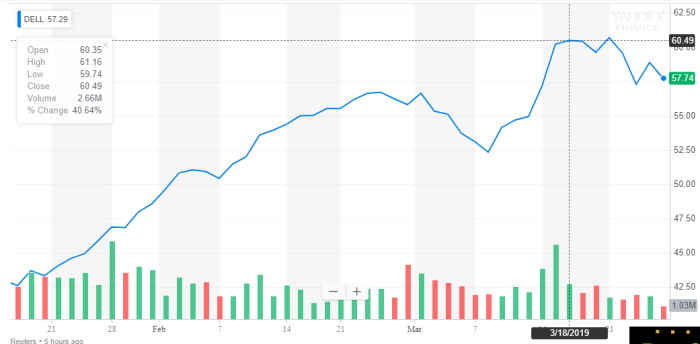

Future Outlook for Dell Stock Price

Source: seekingalpha.com

Predicting Dell’s stock price for the next 12 months requires considering various factors. A reasonable forecast, considering moderate economic growth and stable technological advancements, would be a 10-15% increase. This is based on Dell’s current financial strength and its ongoing investments in emerging technologies.

- Scenario 1 (Strong Economic Growth): A 20-25% increase in stock price due to heightened demand and increased profitability.

- Scenario 2 (Moderate Economic Growth): A 10-15% increase in stock price reflecting steady growth and market stability.

- Scenario 3 (Weak Economic Growth): A 5-10% decrease in stock price due to reduced demand and potential profit margin compression.

A hypothetical graph depicting these scenarios would show an upward trajectory for Scenario 1, a moderately upward sloping line for Scenario 2, and a downward sloping line for Scenario 3. The steepness of each line would reflect the magnitude of price change described in each scenario. The underlying factors driving each potential outcome are the levels of economic growth and the extent of technological disruption affecting Dell’s operations and market position.

Query Resolution: Dell Stock Price

What are the major risks associated with investing in Dell stock?

Investing in Dell stock, like any stock, carries inherent risks. These include market volatility, competition within the technology sector, economic downturns impacting demand for Dell’s products, and potential changes in company leadership or strategy.

How does Dell’s dividend policy affect its stock price?

Dell’s dividend policy, if any, can influence investor interest. A consistent dividend payout can attract income-seeking investors, potentially increasing demand and supporting the stock price. Conversely, changes to the dividend policy could affect investor sentiment.

Where can I find real-time Dell stock price updates?

Real-time Dell stock price updates are readily available through major financial websites and brokerage platforms. These platforms typically provide live quotes, charts, and historical data.