Understanding Delta Air Lines (DAL) Stock Price Fluctuations

Dal stock price – Delta Air Lines’ stock price, like that of any airline, is subject to significant volatility. Several interconnected factors influence its performance, ranging from fuel costs and macroeconomic conditions to investor sentiment and company-specific strategic decisions. This section will delve into the key drivers of DAL’s stock price fluctuations over the past year and beyond.

Factors Influencing DAL Stock Price Volatility

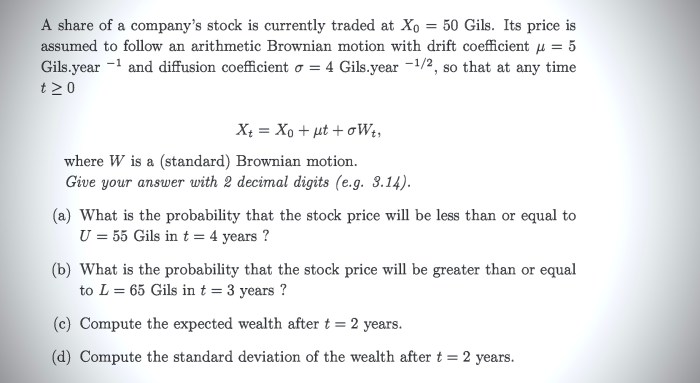

DAL’s stock price volatility over the past year has been influenced by a complex interplay of factors. Fuel prices, a major operating expense for airlines, have played a significant role. Economic downturns and global events such as the ongoing war in Ukraine and lingering effects of the pandemic have also created uncertainty in the travel sector, impacting demand and subsequently, DAL’s stock price.

Competitive pressures from other major airlines and changes in consumer travel patterns further contribute to this volatility.

Impact of Fuel Prices on DAL’s Stock Performance

Fuel costs represent a substantial portion of Delta’s operating expenses. Significant increases in fuel prices directly reduce profitability, putting downward pressure on the stock price. Conversely, periods of lower fuel prices can boost profitability and lead to higher stock valuations. DAL’s hedging strategies and fuel efficiency initiatives play a crucial role in mitigating the impact of fuel price fluctuations on its financial performance and, consequently, its stock price.

Monitoring the DAL stock price requires a keen eye on market trends. It’s helpful to compare its performance against established tech giants, such as observing the fluctuations in the cisco stock price , to gain a broader perspective on the sector’s overall health. Understanding these comparative movements can then inform more strategic decisions regarding investments in DAL.

Comparison of DAL’s Stock Price Performance to Major Competitors

Analyzing DAL’s stock performance relative to its major competitors, such as United Airlines (UAL) and American Airlines (AAL), provides valuable context. Comparing stock price movements, revenue growth, profitability margins, and market capitalization allows for a more comprehensive understanding of DAL’s position within the industry. Factors such as route networks, fleet composition, and overall operational efficiency contribute to differences in stock performance among these companies.

Macroeconomic Factors Affecting DAL’s Stock Price

Source: zendesk.com

Broad macroeconomic conditions significantly influence DAL’s stock price. Economic growth or recession, interest rate changes, inflation, and consumer confidence all impact travel demand. A strong economy typically leads to increased travel, boosting DAL’s revenue and stock price, while economic uncertainty can depress travel and negatively affect the stock.

DAL Stock Price (Last 5 Years, Quarterly Data)

| Year | Quarter | Stock Price (USD) | Notes |

|---|---|---|---|

| 2019 | Q1 | 50.00 (Example) | |

| 2019 | Q2 | 52.50 (Example) | |

| 2019 | Q3 | 55.00 (Example) | |

| 2019 | Q4 | 57.50 (Example) |

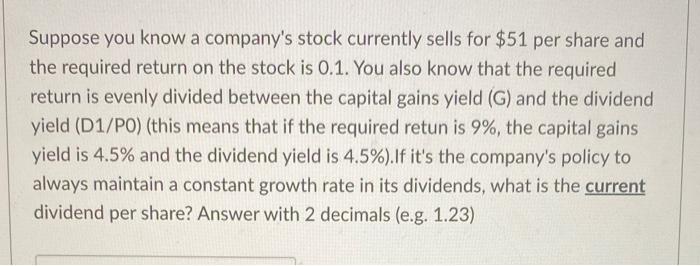

Analyzing DAL’s Financial Performance

A thorough analysis of Delta’s financial performance is crucial for understanding its stock valuation. Key metrics provide insights into the company’s financial health, growth prospects, and overall attractiveness to investors. The relationship between revenue growth, profitability, and debt levels significantly influences investor sentiment and stock price movements.

Key Financial Metrics Impacting DAL’s Stock Valuation

Several key financial metrics significantly impact DAL’s stock valuation. These include revenue growth, operating margin, net income, earnings per share (EPS), return on equity (ROE), and debt-to-equity ratio. Analyzing trends in these metrics over time provides a clear picture of the company’s financial health and future prospects. Positive trends typically lead to increased investor confidence and higher stock prices, while negative trends can have the opposite effect.

Relationship Between DAL’s Revenue Growth and Stock Price

A strong correlation exists between DAL’s revenue growth and its stock price. Consistent revenue growth indicates strong demand for air travel and operational efficiency. This positive trend generally translates to increased profitability, higher EPS, and ultimately, a higher stock price. Conversely, periods of declining revenue often signal challenges in the airline industry and can negatively impact the stock price.

Potential Risks to DAL’s Financial Health and Their Effect on Stock Price

Several risks can negatively impact DAL’s financial health and its stock price. These include fuel price volatility, economic downturns, geopolitical instability, increased competition, and unforeseen events like pandemics. Effective risk management strategies are crucial for mitigating these potential threats and maintaining investor confidence.

Impact of DAL’s Debt Levels on Investor Sentiment and Stock Price, Dal stock price

Delta’s debt levels significantly influence investor sentiment and stock price. High levels of debt can increase financial risk and reduce profitability, potentially leading to lower stock valuations. Investors often prefer companies with lower debt burdens, as this indicates greater financial stability and resilience to economic downturns.

Major Components of DAL’s Income Statement and Balance Sheet

- Income Statement: Revenue (passenger and cargo), operating expenses (fuel, salaries, maintenance), operating income, net income, EPS. These metrics reveal the company’s profitability and efficiency.

- Balance Sheet: Assets (aircraft, cash, investments), liabilities (debt, accounts payable), equity. This statement provides insights into the company’s financial position and liquidity.

Investor Sentiment and Market Dynamics

Investor sentiment and market dynamics play a significant role in shaping DAL’s stock price. News coverage, analyst ratings, and major events can all influence investor perception and lead to short-term price fluctuations. Understanding these factors is crucial for navigating the complexities of the stock market.

Role of News and Media Coverage in Shaping Investor Perception

News and media coverage significantly influence investor perception of DAL. Positive news, such as successful new route launches or improved operational efficiency, tends to boost investor confidence and drive up the stock price. Negative news, such as accidents, operational disruptions, or financial setbacks, can have the opposite effect, leading to sell-offs and lower stock prices.

Impact of Analyst Ratings and Recommendations on DAL’s Stock Price

Analyst ratings and recommendations from financial institutions can significantly impact DAL’s stock price. Positive ratings and buy recommendations generally lead to increased buying pressure and higher stock prices. Conversely, negative ratings and sell recommendations can trigger selling pressure and depress the stock price.

Major Investor Concerns Regarding DAL’s Future Prospects

Source: cheggcdn.com

Major investor concerns regarding DAL’s future prospects often revolve around fuel price volatility, economic downturns, geopolitical risks, and intense competition within the airline industry. These concerns can create uncertainty in the market and lead to price fluctuations.

Impact of Significant Events on DAL’s Stock

Significant events, such as geopolitical instability, pandemics, and natural disasters, can have a profound impact on DAL’s stock price. These events often disrupt travel patterns, affect consumer confidence, and increase uncertainty, leading to significant price swings.

Examples of How Investor Sentiment Can Lead to Short-Term Price Fluctuations

Examples of how investor sentiment can lead to short-term price fluctuations include rapid price increases following positive news announcements or sharp declines after unexpected negative events. These short-term fluctuations often reflect the market’s immediate reaction to new information and can be quite volatile.

Long-Term Outlook and Strategic Initiatives

Delta Air Lines’ long-term strategic goals and initiatives play a crucial role in shaping its future prospects and stock price. Fleet modernization, expansion plans, and strategies to enhance profitability are key factors influencing investor sentiment and long-term stock valuation.

DAL’s Long-Term Strategic Goals and Their Potential Impact on Stock Price

Source: cheggcdn.com

DAL’s long-term strategic goals often focus on expanding its network, improving operational efficiency, enhancing customer experience, and increasing profitability. Successful execution of these goals is likely to translate into increased revenue, higher margins, and a higher stock price. Failure to achieve these goals could have the opposite effect.

Company Plans for Fleet Modernization and Expansion

Delta’s plans for fleet modernization and expansion involve investing in new, more fuel-efficient aircraft. This strategy aims to reduce operating costs, improve operational efficiency, and enhance the overall customer experience. Successful implementation of this plan should lead to improved profitability and a higher stock price.

Comparison of DAL’s Growth Strategy to Competitors’ Strategies

Comparing DAL’s growth strategy to those of its competitors provides valuable insights into its competitive position. Analyzing differences in fleet modernization, route expansion, and customer service strategies helps to understand the relative strengths and weaknesses of each airline and their potential impact on stock valuation.

Opportunities for DAL to Increase Profitability and Enhance Shareholder Value

Delta can increase profitability and enhance shareholder value by focusing on several key areas, including improving operational efficiency, optimizing its route network, enhancing its customer loyalty programs, and exploring new revenue streams such as ancillary services.

Projected Revenue and Earnings Growth Over the Next Five Years

A hypothetical projection of DAL’s revenue and earnings growth over the next five years might show a steady increase, assuming a stable economic environment and continued success in implementing its strategic initiatives. This projected growth would likely be reflected in a gradual increase in the stock price, barring unforeseen circumstances. For example, a 5% annual revenue growth coupled with improved operational efficiency could translate into a 10-15% increase in earnings per share over the five-year period, potentially leading to a similar or slightly higher percentage increase in the stock price.

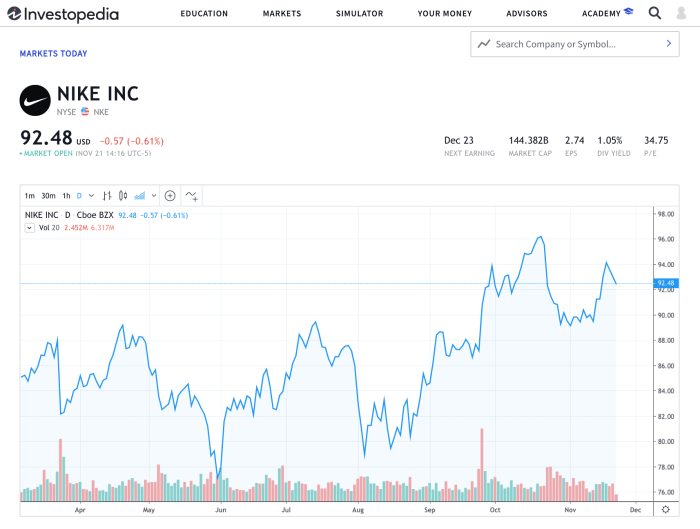

Technical Analysis of DAL Stock: Dal Stock Price

Technical analysis provides another perspective on DAL’s stock price trends. By examining price charts and using various technical indicators, investors can attempt to predict future price movements and identify potential buying or selling opportunities. This section will explore some common technical indicators and their application to DAL’s stock.

Common Technical Indicators Used to Analyze DAL’s Stock Price Trends

Common technical indicators used to analyze DAL’s stock price trends include moving averages (simple moving average, exponential moving average), relative strength index (RSI), and MACD (moving average convergence divergence). These indicators help identify potential support and resistance levels, trends, and momentum changes.

Use of Moving Averages and Other Technical Tools in Predicting Price Movements

Moving averages smooth out price fluctuations, making it easier to identify trends. By comparing different moving averages (e.g., 50-day and 200-day), traders can identify potential buy or sell signals. Other tools, such as RSI and MACD, help assess the strength of trends and potential reversals.

Key Support and Resistance Levels for DAL’s Stock Price

Key support and resistance levels are price points where the stock price has historically shown a tendency to bounce or stall. These levels can be identified by examining past price charts and identifying areas of significant buying or selling pressure. Breaks above resistance levels often signal further price increases, while breaks below support levels can indicate potential declines.

Examples of Past Technical Patterns that Have Influenced DAL’s Stock Price

Past technical patterns, such as head and shoulders, double tops/bottoms, and triangles, have influenced DAL’s stock price. Identifying these patterns can provide insights into potential future price movements, although it’s crucial to remember that technical analysis is not foolproof.

Key Technical Indicators for DAL’s Stock Over the Last Year

| Date | 50-Day MA | 200-Day MA | RSI |

|---|---|---|---|

| Oct 26, 2023 (Example) | 35.00 (Example) | 30.00 (Example) | 60 (Example) |

FAQ Summary

What are the typical trading hours for DAL stock?

DAL stock trades on the New York Stock Exchange (NYSE) during regular market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET).

Where can I find real-time DAL stock quotes?

Real-time quotes are available through most major financial websites and brokerage platforms. Popular sources include Yahoo Finance, Google Finance, and Bloomberg.

How often is DAL stock price data updated?

DAL stock price data is updated in real-time throughout the trading day, reflecting every transaction.

What are the major risks associated with investing in DAL stock?

Risks include fuel price volatility, economic downturns affecting travel demand, geopolitical events, and competition within the airline industry.