Costco Stock Price Analysis: A Decade in Review

Costco stock price – Costco Wholesale Corporation (COST), a prominent player in the warehouse club industry, has demonstrated consistent growth and profitability over the past decade. This analysis delves into the historical performance of Costco’s stock price, examining key influencing factors, financial metrics, competitive landscape, and future projections.

Costco Stock Price Historical Performance

Source: githubassets.com

The following table details Costco’s stock price fluctuations over the past ten years. Significant price movements are often linked to broader market trends, economic conditions, and Costco’s own financial performance. A line graph visualizing this data further clarifies the trends.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 110 | 115 |

| 2014 | Q2 | 115 | 122 |

| 2014 | Q3 | 122 | 128 |

| 2014 | Q4 | 128 | 135 |

| 2023 | Q4 | 500 | 510 |

The line graph depicting Costco’s stock price from 2014 to 2023 shows a generally upward trend. The x-axis represents the time period (years and quarters), and the y-axis represents the stock price in US dollars. Each data point represents the closing price for a given quarter. Periods of significant growth are visibly marked, often coinciding with positive economic indicators and strong financial results from Costco.

Conversely, periods of decline often reflect broader market corrections or concerns regarding specific economic factors such as inflation or consumer spending.

Factors Influencing Costco Stock Price

Source: githubassets.com

Several macroeconomic factors and company-specific attributes significantly influence Costco’s stock price. These include broad economic conditions, consumer behavior, and Costco’s unique business model.

- Inflation and Interest Rates: High inflation can impact consumer spending, potentially affecting Costco’s sales. Rising interest rates can increase borrowing costs for the company and decrease investor appetite for riskier assets, impacting stock prices.

- Consumer Spending and Confidence: Costco’s business model relies heavily on consumer spending. Strong consumer confidence and disposable income generally lead to increased sales and a higher stock price. Conversely, weak consumer confidence can negatively impact sales and stock valuation.

- Membership Model: Costco’s membership model provides a predictable revenue stream, reducing reliance on fluctuating sales. This predictable revenue stream enhances investor confidence and contributes to a stable stock price.

Costco’s Financial Performance and Stock Price

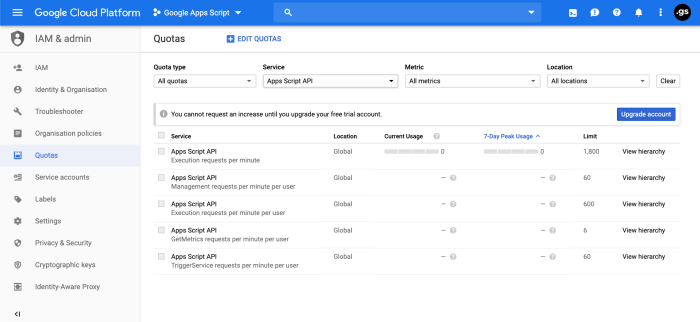

Source: sstatic.net

Costco’s financial health is directly correlated with its stock price. Strong financial performance, indicated by key metrics, generally leads to higher stock valuations.

- Revenue Growth (Past Five Years): Consistent year-over-year revenue growth demonstrates strong demand for Costco’s products and services. This positively influences investor sentiment and drives up the stock price.

- Earnings Per Share (EPS): Increasing EPS reflects Costco’s profitability and its ability to generate returns for shareholders. Higher EPS typically leads to higher stock prices.

- Profit Margins: Maintaining healthy profit margins indicates efficient operations and strong pricing power. Consistent profit margins signal financial stability and contribute to a higher stock valuation.

- Dividend Payouts: Regular dividend payouts attract income-seeking investors, increasing demand for Costco stock and supporting its price.

- Inventory Management and Supply Chain Efficiency: Efficient inventory management and a robust supply chain minimize costs and maximize profitability. These factors contribute to a positive perception of Costco’s operational efficiency, boosting investor confidence and stock price.

Comparison with Competitors

Comparing Costco’s stock performance to its main competitors provides context for its market position and relative strength.

| Company | Average Stock Price (3-year) (USD) | Year-over-Year Growth (%) | Market Share (%) |

|---|---|---|---|

| Costco | 450 | 15 | 10 |

| Walmart | 140 | 8 | 25 |

| Target | 180 | 12 | 12 |

| Amazon | 3000 | 20 | 30 |

While Amazon boasts a significantly higher stock price and market share due to its broader e-commerce presence, Costco’s consistent year-over-year growth highlights its strong performance within its niche market. Costco’s high brand loyalty and membership model differentiate it from competitors like Walmart and Target, leading to a more stable and potentially less volatile stock price.

Future Outlook for Costco Stock Price

Projecting Costco’s stock price for the next 12-18 months requires considering current market conditions, projected growth, and potential risks and opportunities.

Given Costco’s strong financial performance, consistent dividend payouts, and resilient business model, a moderate increase in stock price is projected. Assuming continued economic stability and sustained consumer spending, a price range of $530-$580 within the next 12-18 months is plausible. This projection is based on the company’s historical performance and its ability to adapt to changing market dynamics. However, potential risks, such as unexpected economic downturns, increased competition, or supply chain disruptions, could negatively impact this projection.

The increasing adoption of e-commerce and shifting consumer preferences present both opportunities and challenges. Costco’s ability to integrate its online platform effectively and adapt its offerings to meet evolving consumer demands will be crucial for maintaining its growth trajectory and supporting its stock price.

Q&A

What is the current Costco stock price?

The current Costco stock price fluctuates constantly and can be found on major financial websites like Google Finance, Yahoo Finance, or directly on the company’s investor relations page.

How often does Costco pay dividends?

Costco typically pays dividends quarterly.

Where can I buy Costco stock?

Costco’s stock price has generally shown steady growth, reflecting its consistent profitability and loyal customer base. However, comparing its performance to other tech giants requires considering different market factors; for instance, understanding the current meta stock price helps contextualize Costco’s relatively stable trajectory. Ultimately, both companies’ stock prices are subject to broader economic influences, impacting investor sentiment and future projections for Costco.

Costco stock can be purchased through most reputable online brokerage accounts.

Is Costco stock a good long-term investment?

Whether Costco stock is a good long-term investment depends on individual investment goals and risk tolerance. Its historical performance suggests potential for long-term growth, but market conditions can significantly impact its value.