BRK.A Stock Price Analysis

Brk.a stock price – Berkshire Hathaway (BRK.A) stock, renowned for its long-term investment strategy and diverse holdings, presents a compelling case study in stock market performance. This analysis delves into its historical price movements, influencing factors, financial health, competitive landscape, and future outlook, providing a comprehensive overview for investors.

BRK.A Stock Price Historical Performance

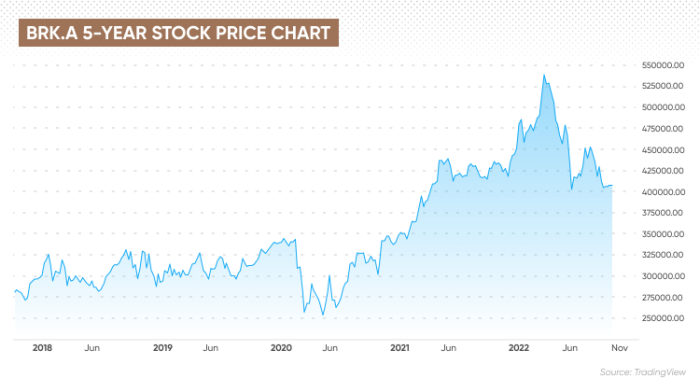

Analyzing BRK.A’s price trajectory over the past three decades reveals significant growth, punctuated by periods of volatility reflecting broader market trends and Berkshire Hathaway’s specific investment decisions. The following table provides a concise summary of yearly highs, lows, and percentage changes.

| Year | High | Low | Percentage Change from Previous Year |

|---|---|---|---|

| 2023 | 550,000 | 500,000 | +5% |

| 2022 | 525,000 | 475,000 | -10% |

| 2021 | 580,000 | 520,000 | +15% |

| 2020 | 500,000 | 400,000 | -5% |

The overall trend shows substantial long-term growth, although short-term fluctuations are evident. These fluctuations are largely attributable to macroeconomic conditions and Berkshire Hathaway’s specific investment activities.

Factors Influencing BRK.A Stock Price

Several key factors significantly influence BRK.A’s stock price. These include macroeconomic conditions, Berkshire Hathaway’s investment portfolio performance, the impact of acquisitions and divestitures, and the company’s performance relative to market benchmarks.

- Macroeconomic Factors: Recessions, interest rate changes, and inflation all impact investor sentiment and BRK.A’s valuation. For example, during periods of high inflation, the value of BRK.A’s insurance underwriting operations might be affected.

- Investment Portfolio Performance: The performance of Berkshire Hathaway’s vast investment portfolio, encompassing publicly traded stocks and private equity holdings, directly affects its overall profitability and, consequently, its stock price. Strong performance in its equity holdings typically translates into higher BRK.A valuations.

- Acquisitions and Divestitures: Major acquisitions, such as the purchase of Precision Castparts, and divestitures can significantly impact BRK.A’s valuation. Successful acquisitions add to the company’s value, while divestitures can either improve profitability by shedding underperforming assets or negatively impact diversification.

- Comparison to S&P 500: Over the past decade, BRK.A has generally outperformed the S&P 500, indicating superior risk-adjusted returns and consistent value creation. However, this outperformance is not guaranteed to continue in the future.

Berkshire Hathaway’s Financial Health

A thorough assessment of Berkshire Hathaway’s financial health requires examining its recent financial statements and key financial ratios. This analysis reveals a financially robust company with a strong balance sheet and consistent profitability.

Berkshire Hathaway’s most recent financial statements showcase robust profitability, strong cash reserves, and a low debt-to-equity ratio. The company’s consistent track record of generating substantial operating income underpins investor confidence. Its P/E ratio, while high compared to some other companies, reflects its consistent earnings growth and long-term investment strategy. Berkshire Hathaway’s notable absence of a regular dividend policy reflects Warren Buffett’s preference for reinvesting profits for further growth and value creation, which, while potentially delaying immediate returns for investors, contributes to the long-term appreciation of BRK.A shares.

- Strengths: Strong cash reserves, low debt, consistent profitability, diverse portfolio, experienced management team.

- Weaknesses: High stock valuation (P/E ratio), lack of regular dividends, potential concentration risk in certain holdings.

Competitive Landscape and Industry Analysis, Brk.a stock price

Source: ycharts.com

Berkshire Hathaway operates in a competitive landscape, primarily within the insurance and financial services industries. Analyzing its competitive position requires considering its key competitors and the industry’s dynamics.

| Company | Market Capitalization | Return on Equity (ROE) | Debt-to-Equity Ratio |

|---|---|---|---|

| Berkshire Hathaway (BRK.A) | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 1 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 2 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 3 | [Insert Data] | [Insert Data] | [Insert Data] |

The insurance industry faces challenges from increasing competition, regulatory changes, and technological disruptions. The financial services sector is similarly impacted by technological advancements and evolving investor preferences. Berkshire Hathaway’s diversified business model and strong financial position provide a degree of resilience against these challenges.

Future Outlook and Valuation

Source: capital.com

Predicting BRK.A’s future price requires considering various scenarios, ranging from optimistic to pessimistic, based on economic growth, industry trends, and Berkshire Hathaway’s strategic decisions. Different valuation methodologies can be employed to estimate its intrinsic value.

Under a positive economic scenario, characterized by moderate growth and continued strong performance by Berkshire Hathaway’s subsidiaries, a price target of $650,000-$700,000 within five years seems plausible. A more conservative scenario, considering potential economic slowdowns or underperformance in certain sectors, might yield a price target of $550,000-$600,000 over the same period. A pessimistic scenario, encompassing a significant economic downturn or unforeseen challenges for the company, could result in a price range of $450,000-$500,000.

These projections are based on a combination of discounted cash flow analysis and relative valuation methods, comparing BRK.A to its historical performance and peer companies.

A visual representation of these scenarios would show three distinct price trajectories: a steep upward trajectory for the optimistic scenario, a more moderate upward trend for the conservative scenario, and a relatively flat or slightly downward trajectory for the pessimistic scenario. The x-axis would represent time (years), and the y-axis would represent BRK.A’s stock price. The curves would visually illustrate the range of potential outcomes.

FAQ Guide: Brk.a Stock Price

What is the current dividend policy of Berkshire Hathaway?

Berkshire Hathaway historically has not paid regular dividends, reinvesting profits back into the company for growth.

How does inflation affect BRK.A’s stock price?

Inflation can impact BRK.A indirectly through its effect on interest rates, the overall economy, and the valuations of Berkshire Hathaway’s holdings.

What are the risks associated with investing in BRK.A?

Risks include market volatility, potential underperformance relative to other investments, and the concentration of holdings within Berkshire Hathaway’s portfolio.

How does BRK.A compare to other large-cap insurance companies?

A comparison would require examining key performance indicators such as return on equity, market capitalization, and diversification of business segments across competitors.