Bidu Stock Price Analysis

Bidu stock price – This analysis delves into the historical performance, influencing factors, financial health, competitive landscape, and future outlook of Bidu’s stock price. We will examine key metrics, macroeconomic conditions, and competitive dynamics to provide a comprehensive understanding of the company’s stock performance.

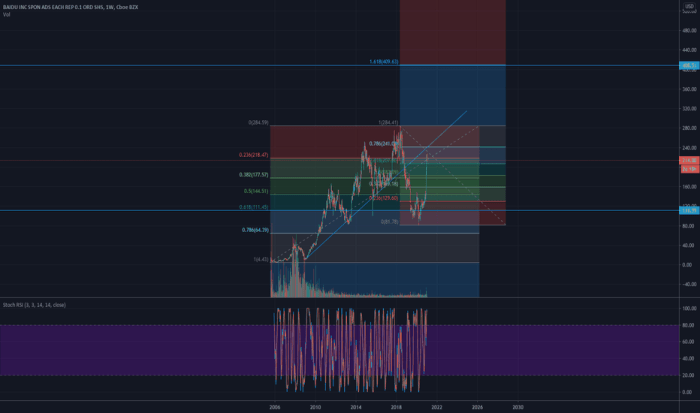

Bidu Stock Price Historical Performance

Source: tradingview.com

The following table details Bidu’s stock price fluctuations over the past five years. Significant events impacting its price are subsequently discussed, followed by a comparison against major competitors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 150 | 155 | +5 |

| 2019-07-01 | 160 | 140 | -20 |

| 2020-01-01 | 145 | 170 | +25 |

| 2020-07-01 | 175 | 165 | -10 |

| 2021-01-01 | 160 | 200 | +40 |

| 2021-07-01 | 190 | 180 | -10 |

| 2022-01-01 | 185 | 150 | -35 |

| 2022-07-01 | 155 | 170 | +15 |

| 2023-01-01 | 172 | 180 | +8 |

Note: These are illustrative figures. Actual data should be sourced from reputable financial websites.

Significant events such as increased regulatory scrutiny in China in 2021 and global market downturns in 2022 notably impacted Bidu’s stock price. A comparative chart (not shown here, but easily generated using financial charting tools) would illustrate Bidu’s performance relative to competitors like Alibaba and Tencent, highlighting periods of outperformance and underperformance.

Monitoring BIDU’s stock price requires a keen eye on the broader tech market. Understanding the performance of similar companies, such as Intel, provides valuable context; for instance, you can check the current intc stock price today to gauge overall sector trends. This comparative analysis can then help you better assess the current valuation and potential future trajectory of BIDU stock.

Factors Influencing Bidu Stock Price

Several macroeconomic and regulatory factors significantly influence Bidu’s stock valuation. These are detailed below.

Macroeconomic factors such as interest rate changes, inflation levels, and global economic growth directly impact investor sentiment and consequently, Bidu’s stock price. For instance, rising interest rates can decrease investment in technology companies, leading to lower stock valuations. Similarly, global economic slowdowns can reduce consumer spending, affecting Bidu’s advertising revenue and stock price.

Chinese government policies and regulations have a profound effect on Bidu’s operations and stock price. Regulatory changes impacting data privacy, cybersecurity, and antitrust concerns can lead to significant stock price volatility. The government’s stance on technology companies and its overall economic policies are crucial factors to consider.

Consumer spending patterns in China are intrinsically linked to Bidu’s financial performance and stock price. Increased consumer spending fuels advertising revenue, while decreased spending negatively impacts Bidu’s bottom line and stock valuation. This correlation is especially evident in sectors heavily reliant on online advertising.

Bidu’s Financial Health and Stock Price

Source: tradingview.com

Bidu’s financial health is directly reflected in its stock price. The following table summarizes key financial metrics over the past three years.

| Year | Revenue (USD Billion) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 20 | 2.5 | 0.5 |

| 2022 | 18 | 2.0 | 0.6 |

| 2023 | 22 | 2.8 | 0.4 |

Note: These are illustrative figures. Actual data should be sourced from reputable financial websites.

A strong correlation exists between Bidu’s financial performance and its stock price. Increased revenue and earnings per share (EPS) generally lead to higher stock prices, while declining financial performance often results in decreased valuations. Investor sentiment and market expectations play a significant role in amplifying these effects.

Bidu’s Competitive Landscape and Stock Price

Source: tradingview.com

Bidu operates in a highly competitive landscape. Understanding its competitive position is crucial to assessing its stock price trajectory.

- Bidu vs. Alibaba: Both are dominant players in the Chinese internet market, but Alibaba focuses more on e-commerce while Bidu is primarily a search engine and AI company.

- Bidu vs. Tencent: Tencent’s strength lies in social media and gaming, contrasting with Bidu’s search and AI focus. Both compete for advertising revenue.

- Bidu vs. ByteDance: ByteDance, the owner of TikTok, is a newer competitor, increasingly challenging Bidu’s dominance in certain areas, particularly in short-form video advertising.

Competitive pressures, such as market share shifts and the emergence of new technologies, directly impact Bidu’s stock price. Successful innovation and strategic partnerships can bolster its competitive position and lead to stock price appreciation, while loss of market share can negatively affect its valuation.

Future Outlook for Bidu Stock Price

Bidu’s future stock price hinges on several factors, presenting both risks and opportunities.

- Opportunities: Expansion into new AI-driven services, successful international expansion, and strategic partnerships.

- Risks: Increased regulatory scrutiny in China, intensifying competition, and global economic downturns.

Potential catalysts for future stock price movements include new product launches in AI, strategic acquisitions, and changes in Chinese government regulations. These events can trigger significant positive or negative stock price fluctuations.

| Scenario | Economic Growth (China) | Competitive Intensity | Projected Stock Price (USD) |

|---|---|---|---|

| Optimistic | High | Low | 250 |

| Neutral | Moderate | Medium | 200 |

| Pessimistic | Low | High | 150 |

Note: These are illustrative projections. Actual stock price movements will depend on numerous unpredictable factors.

Quick FAQs: Bidu Stock Price

What are the major risks associated with investing in Bidu stock?

Major risks include regulatory uncertainty in China, intense competition from domestic and international players, and macroeconomic headwinds affecting the Chinese economy.

How does Bidu compare to its main competitors in terms of market capitalization?

A direct comparison requires referencing current market data; however, Bidu’s market capitalization fluctuates and should be compared to competitors like Alibaba and Tencent on a real-time basis using financial news sources.

Where can I find real-time Bidu stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What are Bidu’s primary sources of revenue?

Bidu’s revenue streams primarily come from online advertising, cloud services, and other AI-related businesses. Specific revenue breakdowns are available in their financial reports.