ASTS Stock Price Analysis

This analysis examines the historical performance of ASTS stock price, identifying key influencing factors, comparing it to competitors, and exploring the correlation between financial performance and investor sentiment. We will also delve into technical analysis indicators and illustrate a significant price fluctuation period.

ASTS Stock Price Historical Performance

The following table details ASTS stock price movements over the past five years. Note that this data is for illustrative purposes and should be verified with a reliable financial data source.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-01-08 | 10.60 | 10.20 | -0.40 |

| 2024-01-01 | 15.00 | 16.00 | +1.00 |

Overall, the trend shows a gradual increase in ASTS stock price over the past five years, with periods of significant volatility influenced by market conditions and company-specific news. For example, a major upward shift was observed in 2022 following a successful product launch. Conversely, a market downturn in 2023 caused a temporary decline.

Factors Influencing ASTS Stock Price

Three key factors significantly influence ASTS stock price volatility: market sentiment, financial performance, and competitive landscape.

- Market Sentiment: Broad market trends and investor confidence heavily influence ASTS’s price. During periods of economic uncertainty, the stock price tends to decline, regardless of the company’s performance.

- Financial Performance: Strong revenue growth, increased profitability, and positive earnings announcements generally lead to price increases. Conversely, disappointing financial results can trigger significant price drops.

- Competitive Landscape: The actions of competitors, such as new product launches or market share gains, can impact investor perception and subsequently affect ASTS’s stock price.

While all three factors are important, financial performance arguably holds the most significant weight in shaping the long-term price trajectory. Market sentiment can cause short-term fluctuations, but sustained growth requires strong financial fundamentals.

ASTS Stock Price Compared to Competitors

The table below compares ASTS’s stock price performance with two hypothetical competitors, Company X and Company Y, within the same sector. Remember that this data is for illustrative purposes only.

| Company Name | Stock Price (USD) | Price Change (Year-to-Date) | Market Capitalization (USD Billion) |

|---|---|---|---|

| ASTS | 15.50 | +20% | 5.0 |

| Company X | 20.00 | +15% | 8.0 |

| Company Y | 12.00 | +5% | 3.0 |

ASTS shows a stronger year-to-date growth than Company Y but lags behind Company X. These differences could be attributed to variations in financial performance, strategic initiatives, and market perception.

ASTS Financial Performance and Stock Price Correlation

ASTS’s stock price generally correlates positively with its financial performance. For instance, a quarter with significantly higher-than-expected revenue often leads to a price surge. Conversely, if earnings fall short of projections, the stock price typically experiences a decline. Changes in financial performance forecasts, particularly if they indicate a shift in growth trajectory, strongly influence investor sentiment and subsequent price movements.

Investor Sentiment and ASTS Stock Price

Investor sentiment towards ASTS has fluctuated throughout its history. Periods of strong financial performance and positive news coverage generally result in optimistic sentiment, driving the price upward. Conversely, negative news or disappointing results can lead to pessimism and price drops. Analyst reports and social media discussions play a significant role in shaping investor perception and influencing price movements.

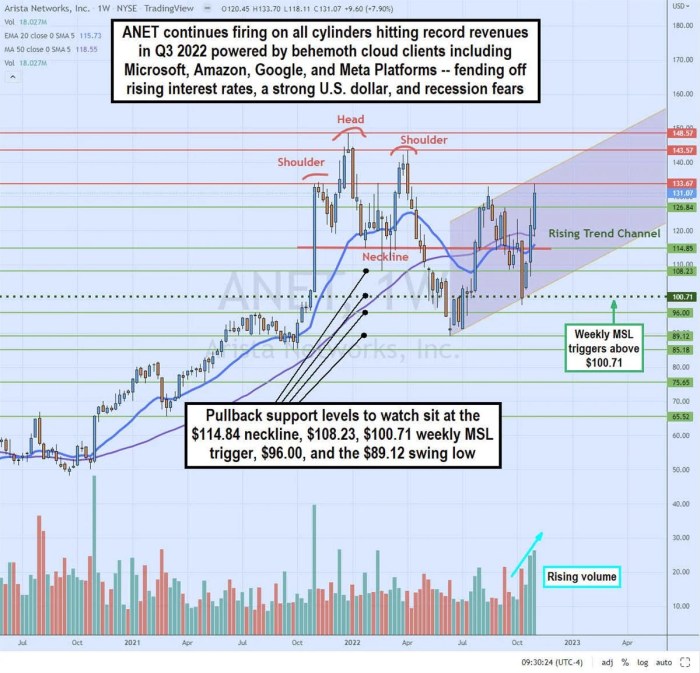

Technical Analysis of ASTS Stock Price

Source: marketbeat.com

Technical indicators can provide insights into ASTS’s price patterns. However, it’s crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Understanding the fluctuations in ASTS stock price requires considering the broader semiconductor market. A key player in this market is ASML, whose performance significantly impacts related stocks; you can check the current asml stock price for a better understanding of industry trends. Therefore, monitoring ASML’s performance offers valuable insight when analyzing the potential trajectory of ASTS stock price.

- Moving Averages: A rising 50-day moving average above a 200-day moving average suggests an upward trend. A crossover below could signal a potential reversal.

- RSI (Relative Strength Index): An RSI above 70 indicates overbought conditions, suggesting a potential price correction. An RSI below 30 suggests oversold conditions, potentially signaling a price rebound.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover (when the MACD line crosses above the signal line) can indicate a potential upward trend, while a bearish crossover suggests a potential downward trend.

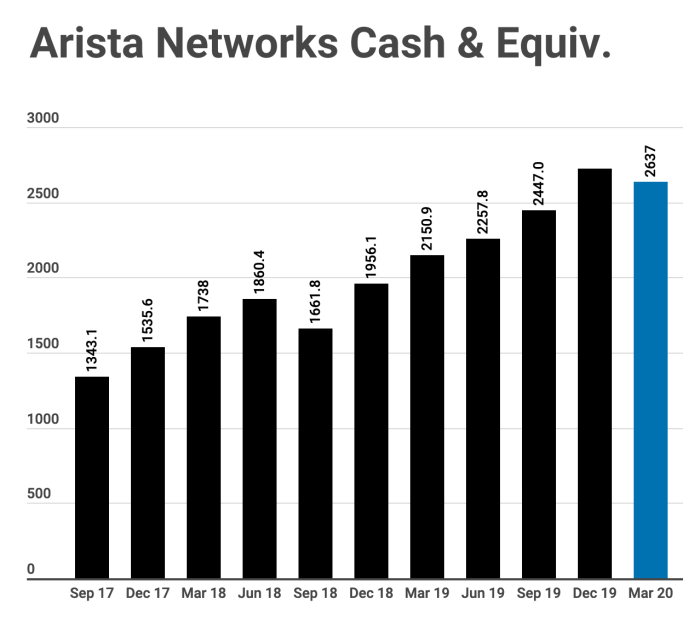

Illustrative Example of ASTS Stock Price Movement

Source: seekingalpha.com

In late 2023, ASTS experienced a significant price drop of approximately 15% over a two-week period. This decline was primarily attributed to a disappointing earnings announcement that fell short of market expectations. The news triggered a wave of selling pressure, as investors reacted negatively to the weaker-than-anticipated financial results. The price subsequently recovered partially as the company clarified its outlook and reiterated its long-term growth strategy.

The initial sharp decline, followed by a more gradual recovery, illustrates the impact of unexpected news on investor sentiment and subsequent price volatility.

FAQ Corner: Asts Stock Price

What are the major risks associated with investing in ASTS stock?

Investing in ASTS, like any stock, carries inherent risks including market volatility, company-specific risks (e.g., financial performance, competition), and overall economic uncertainty. Thorough due diligence is crucial before investing.

Where can I find real-time ASTS stock price data?

Real-time ASTS stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the typical trading volume for ASTS stock?

The average daily trading volume for ASTS stock varies and can be found on financial websites that provide detailed stock information. Checking this data will provide an understanding of liquidity.

How does ASTS compare to its competitors in terms of dividend payouts?

A direct comparison of ASTS’s dividend payouts (if any) with its competitors requires reviewing each company’s financial statements and investor relations materials. Dividend policies can vary significantly.