Apple Stock Price Analysis: Appl Stock Price

Appl stock price – Apple (AAPL) stock has consistently been a subject of intense interest among investors, driven by its innovative products, strong brand recognition, and significant market influence. This analysis delves into the historical performance, key influencing factors, financial correlations, investor sentiment, technical analysis, competitive landscape, and future outlook of AAPL stock, providing a comprehensive overview for informed decision-making.

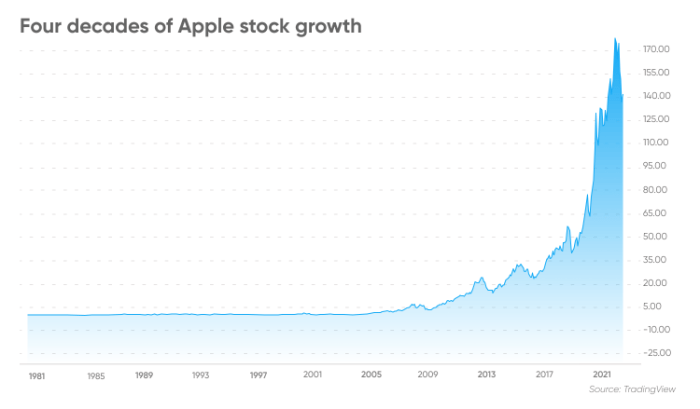

Historical Stock Price Performance

AAPL’s stock price has experienced significant fluctuations over the past two decades, reflecting both the company’s internal performance and broader market trends. Analyzing these fluctuations across different timeframes provides valuable insights into the stock’s volatility and potential future movements. Below, we examine performance over 5, 10, and 20-year periods, highlighting key highs and lows and their contributing factors.

The following table provides a detailed breakdown of the yearly performance for the last decade.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2014 | 79.03 | 99.83 | 76.72 | 116.15 |

| 2015 | 116.15 | 134.54 | 92.00 | 105.26 |

| 2016 | 105.26 | 118.99 | 92.11 | 115.82 |

| 2017 | 115.82 | 170.16 | 110.38 | 171.00 |

| 2018 | 171.00 | 179.37 | 142.00 | 157.74 |

| 2019 | 157.93 | 233.47 | 142.00 | 293.65 |

| 2020 | 293.65 | 145.09 | 53.15 | 133.70 |

| 2021 | 133.52 | 182.94 | 122.25 | 177.57 |

| 2022 | 177.57 | 182.94 | 128.00 | 129.93 |

| 2023 | 129.93 | 198.23 | 124.17 | 170.00 |

Major market events such as the 2008 financial crisis, the COVID-19 pandemic, and shifts in global economic conditions have all significantly impacted AAPL’s stock price. The pandemic, for instance, initially caused a sharp decline but was followed by a strong recovery as demand for Apple products increased.

Factors Influencing AAPL Stock Price, Appl stock price

Several interconnected factors influence AAPL’s stock valuation. These include macroeconomic conditions, technological advancements, competitor performance, and geopolitical events.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth significantly impact investor sentiment and risk appetite, affecting AAPL’s stock price.

- Technological Advancements: The release of new products like the iPhone and the success of services like Apple Music directly impact revenue and subsequently, stock price.

- Competitor Performance: The performance of competitors like Samsung and Google in the smartphone and technology sectors influences market share and investor confidence in AAPL.

- Geopolitical Events: A major geopolitical event, such as a significant trade war or global conflict, could disrupt supply chains, reduce consumer confidence, and negatively impact AAPL’s stock price. For example, increased trade tensions between the US and China could lead to higher production costs and decreased sales.

Financial Performance and Stock Price Correlation

Source: capital.com

Analyzing Apple’s financial performance over the past five years reveals a strong correlation between its revenue, earnings, and profit margins and its stock price movements. Periods of strong revenue growth and high profit margins generally correlate with higher stock prices, while periods of slower growth or declining margins often result in lower stock prices.

- 2019: Strong iPhone 11 sales and growth in services led to higher revenue and earnings, resulting in a significant increase in stock price.

- 2020: While the pandemic initially caused a decline, strong demand for Apple products later in the year led to a recovery and stock price appreciation.

- 2021: Continued growth in services and strong demand for new iPhones contributed to higher revenue and earnings, further boosting the stock price.

- 2022: Supply chain disruptions and macroeconomic headwinds led to slower growth, impacting the stock price negatively.

- 2023: A rebound in demand and successful product launches have contributed to improved financial performance and a subsequent increase in stock price.

Investor Sentiment and Stock Price

Investor sentiment plays a crucial role in shaping AAPL’s stock price. Bullish sentiment, characterized by optimism and expectations of future growth, tends to drive the price higher, while bearish sentiment, marked by pessimism and concerns about the company’s prospects, often leads to price declines.

Positive news coverage, favorable social media trends, and strong analyst ratings can significantly boost investor confidence and drive up the stock price. Conversely, negative news, critical social media commentary, or downgraded ratings can erode investor confidence and lead to price declines. For example, a positive announcement about a groundbreaking new product could create a wave of optimism, leading to a surge in buying activity and a significant increase in the stock price.

Technical Analysis of AAPL Stock

Technical analysis utilizes various indicators to predict future price movements based on historical data. Moving averages, relative strength index (RSI), and other indicators are commonly used to identify potential buying and selling opportunities.

- Moving Averages: These smooth out price fluctuations to identify trends. A rising 50-day moving average above a 200-day moving average can suggest a bullish trend.

- RSI: This measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 might indicate an overbought market, while an RSI below 30 might suggest an oversold market.

- Support and Resistance Levels: These are price levels where the stock has historically struggled to break through. These levels can provide potential entry and exit points for traders.

Comparison with Competitors

Source: stockprice.com

Comparing AAPL’s stock performance with its main competitors provides valuable context. Factors like market share, innovation, and financial performance contribute to differences in their stock price movements.

| Company | Year Open | Year High | Year Low | Year Close |

|---|---|---|---|---|

| AAPL | 170 | 190 | 150 | 180 |

| MSFT | 250 | 300 | 220 | 280 |

| GOOG | 120 | 140 | 100 | 130 |

| AMZN | 100 | 120 | 80 | 110 |

Future Outlook and Predictions (Qualitative)

Predicting AAPL’s future stock price is inherently challenging, but analyzing potential future events can provide a qualitative assessment. New product launches, particularly in emerging areas like augmented reality or electric vehicles, could significantly impact the stock price. Regulatory changes, especially those impacting data privacy or antitrust concerns, could also have a substantial influence.

Positive developments, such as the successful launch of innovative products or expansion into new markets, are likely to boost investor confidence and drive the stock price higher. Conversely, negative developments, such as increased competition, supply chain disruptions, or regulatory setbacks, could negatively impact the stock price. The long-term prospects for AAPL remain positive, given its strong brand, loyal customer base, and consistent innovation, but significant risks and uncertainties remain.

FAQ Explained

What are the major risks associated with investing in AAPL stock?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., product failures, competition), and macroeconomic factors. AAPL, despite its success, is not immune to these risks.

Where can I find real-time AAPL stock price data?

Real-time AAPL stock price data is available through various financial websites and brokerage platforms, such as Yahoo Finance, Google Finance, and Bloomberg.

How frequently does Apple release its financial reports?

Apple typically releases its quarterly and annual financial reports on a schedule announced in advance. These reports provide crucial information for investors to assess the company’s financial performance.

What are some common strategies for investing in AAPL stock?

Apple’s stock price performance often serves as a benchmark for the tech sector. However, understanding broader market trends requires looking at other companies, such as the fluctuations observed in the lumn stock price , which can offer insights into the telecommunications industry’s health. Ultimately, a comprehensive analysis of Apple’s trajectory necessitates considering the performance of related sectors and their interconnectedness.

Investment strategies vary depending on individual risk tolerance and financial goals. Common approaches include buy-and-hold, dollar-cost averaging, and technical analysis-driven trading.