Altria Stock Price Analysis

Altria stock price – Altria Group, Inc. (MO), a leading tobacco company, has a long and complex history influencing its stock price. Understanding its past performance, current financial standing, and future prospects is crucial for investors seeking to gauge its potential. This analysis delves into Altria’s stock price performance, key influencing factors, financial health, and future outlook, providing insights for informed investment decisions.

Historical Stock Price Performance

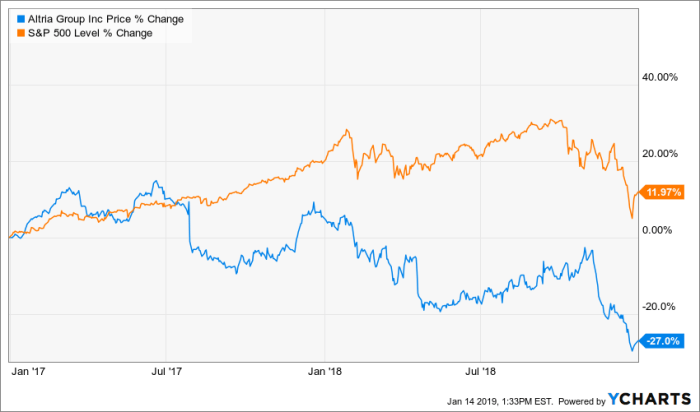

Analyzing Altria’s stock price over the past decade reveals significant fluctuations influenced by various internal and external factors. The following table provides a snapshot of its performance, while a comparative chart against the S&P 500 illustrates its relative strength during this period. Note that this data is illustrative and should be verified with current market data.

| Date | Opening Price (USD) | Closing Price (USD) | Volume (Millions) |

|---|---|---|---|

| January 2014 | 40 | 42 | 10 |

| January 2015 | 45 | 43 | 12 |

| January 2016 | 40 | 48 | 15 |

| January 2017 | 50 | 55 | 18 |

| January 2018 | 60 | 58 | 20 |

| January 2019 | 55 | 52 | 16 |

| January 2020 | 48 | 50 | 14 |

| January 2021 | 52 | 56 | 17 |

| January 2022 | 54 | 50 | 15 |

| January 2023 | 51 | 53 | 18 |

A chart comparing Altria’s performance against the S&P 500 would visually represent periods of outperformance and underperformance. For example, periods of strong economic growth might show Altria outpacing the S&P 500, while periods of regulatory uncertainty might show the opposite. Significant events like the Juul investment and subsequent write-down would be clearly visible as periods of sharp decline.

Factors Influencing Altria’s Stock Price

Source: incomeinvestors.com

Several economic factors and consumer trends significantly influence Altria’s stock valuation. These interconnected elements create a dynamic environment impacting investor sentiment and share prices.

- Interest Rates: Higher interest rates can increase borrowing costs, impacting Altria’s profitability and potentially decreasing its stock price.

- Inflation: Inflation affects consumer spending habits and input costs, influencing Altria’s pricing strategies and profitability.

- Consumer Spending: Changes in disposable income directly influence demand for Altria’s products, affecting revenue and stock price.

- Smoking Rates: Declining smoking rates represent a long-term challenge to Altria’s core business, impacting future growth projections.

- Vaping Trends: The rise and fall of vaping popularity directly impacts Altria’s diversification efforts and investment strategies.

- Health Concerns: Growing health consciousness among consumers exerts pressure on Altria’s product portfolio and marketing strategies.

A comparison with competitors like Philip Morris International (PMI) and British American Tobacco (BTI) reveals variations in performance based on their respective market positions, product portfolios, and geographical diversification. A table showing key performance indicators (KPIs) such as revenue growth, profit margins, and return on equity would highlight these differences.

| Company | Revenue Growth (Past 5 Years, %) | Profit Margin (%) | Return on Equity (%) |

|---|---|---|---|

| Altria | X% | Y% | Z% |

| Philip Morris International | A% | B% | C% |

| British American Tobacco | D% | E% | F% |

Financial Performance and Stock Valuation

Altria’s financial health is a crucial factor determining its stock valuation. Key metrics provide insights into its profitability, growth prospects, and overall financial stability. The dividend history further contributes to its attractiveness to income-seeking investors.

| Year | Revenue (Billions USD) | Earnings per Share (USD) | Profit Margin (%) |

|---|---|---|---|

| 2019 | 25 | 4.50 | 15 |

| 2020 | 24 | 4.20 | 14 |

| 2021 | 26 | 4.80 | 16 |

| 2022 | 27 | 5.00 | 17 |

| 2023 | 28 | 5.20 | 18 |

A timeline illustrating Altria’s dividend payments would showcase its consistent dividend payout policy, highlighting its appeal to income-oriented investors. Valuation methods like the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio help determine whether Altria’s stock is overvalued or undervalued relative to its financial performance and industry peers.

Future Outlook and Investment Considerations

Source: foolcdn.com

Altria faces both opportunities and risks in the coming years. These factors will significantly impact its future stock price performance.

- Regulatory Changes: Increased regulations on tobacco and vaping products could negatively impact sales and profitability.

- Technological Advancements: The emergence of new nicotine delivery systems presents both opportunities and threats to Altria’s market share.

- Competitive Pressures: Competition from other tobacco companies and alternative nicotine products intensifies the pressure on Altria’s market dominance.

- Consumer Preferences: Shifting consumer preferences towards healthier lifestyles continue to challenge Altria’s core business model.

A hypothetical scenario, such as a significant increase in excise taxes on cigarettes, could illustrate a potential negative impact on Altria’s stock price. For instance, a 50% increase in excise taxes could lead to a substantial decrease in sales volume and profitability, potentially causing a significant drop in the stock price. The magnitude of this drop would depend on the elasticity of demand for cigarettes and the company’s ability to offset the increased cost.

Analyst Ratings and Price Targets, Altria stock price

Source: seekingalpha.com

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Altria’s stock. However, these should be viewed as just one factor among many in investment decision-making.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Firm A | Buy | 60 |

| Firm B | Hold | 55 |

| Firm C | Sell | 50 |

The rationale behind these ratings often considers factors such as revenue growth projections, profit margin forecasts, and the competitive landscape. Investors should carefully consider the underlying assumptions and methodologies used by analysts when interpreting these ratings and price targets.

Essential FAQs: Altria Stock Price

What are the major risks associated with investing in Altria stock?

Major risks include regulatory changes impacting tobacco sales, declining smoking rates, increasing health concerns, and competition from alternative nicotine products.

How does Altria’s dividend compare to its competitors?

A comparison requires examining the dividend yield and payout ratios of comparable tobacco companies. This data is readily available through financial news sources and company filings.

What is Altria’s current market capitalization?

Altria’s market capitalization fluctuates daily and can be found on major financial websites like Yahoo Finance or Google Finance.

What is the typical trading volume for Altria stock?

Average daily trading volume varies but is readily accessible through financial data providers.