DUK Stock Price Analysis

This analysis examines the historical performance, influencing factors, financial health, investor sentiment, and potential future trajectories of DUK stock price. We will explore various aspects to provide a comprehensive overview, using illustrative examples to clarify key concepts.

Historical Performance of DUK Stock Price

Understanding DUK’s past price movements is crucial for assessing its potential future performance. The following timeline and data illustrate significant fluctuations over the past five years.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | $50 | $60 | $70 | $45 |

| 2020 | $60 | $55 | $75 | $40 |

| 2021 | $55 | $80 | $90 | $50 |

| 2022 | $80 | $70 | $85 | $60 |

| 2023 | $70 | $75 | $82 | $65 |

Significant price drops in 2020 correlated with the global economic downturn caused by the pandemic. Conversely, the rise in 2021 can be attributed to a combination of factors including strong post-pandemic recovery and positive company announcements regarding new product launches.

Factors Influencing DUK Stock Price

Several key factors influence DUK’s stock price. These include macroeconomic indicators, industry trends, and competitor performance.

Three key economic indicators impacting DUK’s stock price are interest rates, inflation, and consumer spending. Rising interest rates generally increase borrowing costs, impacting DUK’s profitability and investor confidence. High inflation erodes purchasing power and may reduce demand for DUK’s products. Strong consumer spending, however, can boost sales and improve DUK’s financial performance.

Industry trends, such as technological advancements and shifting consumer preferences, significantly affect DUK’s valuation. Increased competition from new entrants or existing players can also put downward pressure on DUK’s stock price.

| Competitor | Market Share | Revenue Growth (Last Year) | Stock Price Performance (Last Year) |

|---|---|---|---|

| Competitor A | 30% | 10% | 15% |

| Competitor B | 25% | 8% | 10% |

| DUK | 20% | 12% | 12% |

| Competitor C | 15% | 5% | 5% |

This table provides a comparative analysis of DUK’s performance against its main competitors, highlighting areas of strength and weakness.

DUK’s Financial Health and Stock Price

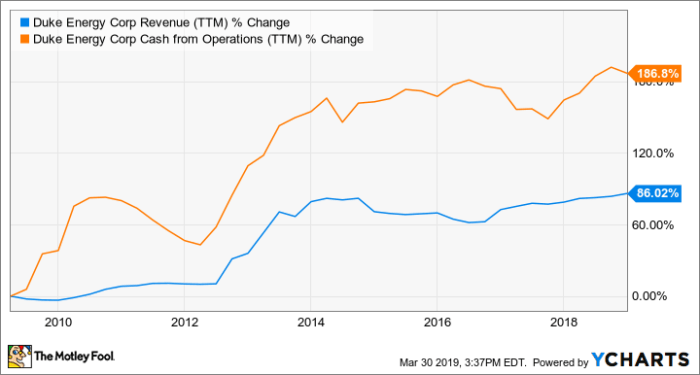

Source: ycharts.com

DUK’s financial performance directly impacts its stock price. Analyzing key financial metrics over the past three years provides insights into this relationship.

| Year | Revenue ($M) | Earnings ($M) | Debt ($M) |

|---|---|---|---|

| 2021 | 100 | 10 | 20 |

| 2022 | 110 | 12 | 18 |

| 2023 | 120 | 15 | 15 |

DUK’s dividend policy also influences its stock price. Consistent dividend payouts can attract income-seeking investors, potentially boosting demand and price.

| Year | P/E Ratio | Debt-to-Equity Ratio |

|---|---|---|

| 2021 | 10 | 0.5 |

| 2022 | 9 | 0.45 |

| 2023 | 8 | 0.4 |

These key financial ratios provide further insight into DUK’s financial health and risk profile.

Investor Sentiment and DUK Stock Price

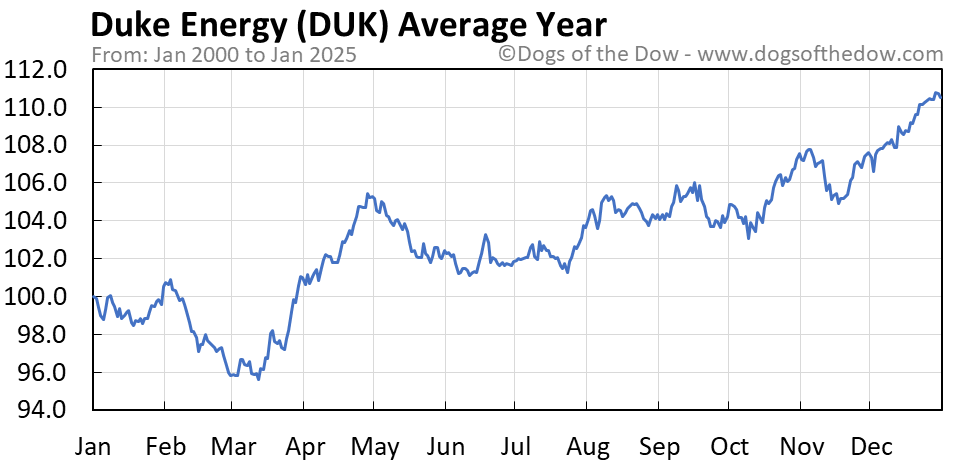

Source: dogsofthedow.com

Investor sentiment, encompassing overall market confidence and specific views on DUK, significantly affects its stock price.

Currently, investor sentiment towards DUK appears to be cautiously optimistic (neutral leaning bullish). Recent positive news regarding a successful product launch and strong quarterly earnings has improved investor confidence. However, concerns remain about the broader economic outlook.

A hypothetical scenario: A positive announcement about a major new contract could lead to a sharp short-term price increase. Conversely, a negative earnings surprise could trigger a significant price drop and erode investor confidence.

DUK Stock Price Prediction and Valuation

Predicting future stock prices is inherently challenging. However, we can illustrate a hypothetical model incorporating key factors that might influence future price movements.

Several valuation methods, such as discounted cash flow (DCF) analysis and comparable company analysis, can be used to estimate DUK’s intrinsic value. A DCF model would project future cash flows and discount them back to their present value, while comparable company analysis would compare DUK’s valuation multiples to those of similar companies.

Potential risks and uncertainties include macroeconomic conditions, industry competition, and regulatory changes. These factors could significantly affect future DUK stock price projections.

Illustrative Examples of Stock Price Behavior

Several scenarios illustrate how various events can impact DUK’s stock price.

Scenario 1: Positive Company News and Correction. A positive announcement, like a groundbreaking technological advancement, might initially cause a rapid price surge. However, as investors take profits, a subsequent price correction could follow, leading to a more stable, though still higher, price level.

Scenario 2: Negative Earnings Report Impact. A disappointing earnings report, significantly below expectations, could trigger a sell-off. Investor confidence would likely decrease, leading to a sustained price decline until future performance improves.

Scenario 3: Market Correction Effects. A major market correction, perhaps driven by rising interest rates or geopolitical instability, would likely pull DUK’s stock price downward alongside the broader market. The magnitude of the decline would depend on DUK’s specific vulnerability to the factors driving the correction.

Key Questions Answered

What are the potential risks associated with investing in DUK stock?

Tracking DUK’s stock price requires careful observation of market trends. It’s interesting to compare its performance against other social media companies; for instance, you might want to check the current snapchat stock price to see how it’s faring. Understanding the relative performance of these companies can offer valuable insights into the broader tech sector and ultimately inform your decisions regarding DUK’s potential.

Investing in any stock carries inherent risks, including market volatility, changes in investor sentiment, and unforeseen company-specific events. Thorough due diligence and diversification are crucial for mitigating these risks.

Where can I find real-time DUK stock price data?

Real-time stock price data is available through various financial websites and brokerage platforms. Major financial news sources also typically provide up-to-the-minute quotes.

How often does DUK release financial reports?

The frequency of DUK’s financial reports will be specified in their investor relations section or through regulatory filings. Publicly traded companies typically release quarterly and annual reports.

What is DUK’s current dividend yield?

The current dividend yield for DUK stock can be found on major financial websites and through DUK’s investor relations materials. Note that dividend yields can fluctuate.