Valero Energy Corporation: A Deep Dive into Stock Performance

Valero stock price – Valero Energy Corporation is a major player in the refining and marketing of petroleum products. Understanding its stock price requires a comprehensive analysis of its operations, financial performance, and the broader energy market landscape. This article provides an in-depth look at Valero, examining its history, business segments, financial metrics, and the factors influencing its stock price, along with an assessment of investment strategies and risks.

Valero Energy Corporation Overview

Valero Energy Corporation was founded in 1980 and has since grown into one of the largest independent petroleum refiners in the United States. Its primary business involves refining crude oil into gasoline, diesel fuel, jet fuel, and other petroleum products. The company operates refineries across the United States, Canada, and the Caribbean, and it also owns and operates ethanol plants.

Valero’s operations span the entire value chain, from sourcing crude oil to distributing finished products to its customers.

Key financial metrics for Valero over the past five years (hypothetical data for illustrative purposes, actual figures should be verified from reliable financial sources):

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2023 | 150 | 10 | 0.8 |

| 2022 | 140 | 8 | 0.7 |

| 2021 | 120 | 6 | 0.6 |

| 2020 | 90 | 2 | 0.9 |

| 2019 | 110 | 5 | 0.5 |

Factors Influencing Valero Stock Price

Several key factors significantly influence Valero’s stock price. These factors are interconnected and often impact each other.

Crude oil prices directly impact Valero’s profitability. Higher crude oil prices can lead to increased input costs, potentially squeezing margins. Conversely, lower crude oil prices can boost margins, but demand might also decrease. Refining margins, the difference between the price of crude oil and the price of refined products, are crucial for Valero’s profitability and stock valuation. Wider margins translate to higher profits, while narrow margins can put pressure on earnings.

Macroeconomic conditions, such as inflation, interest rates, and recessionary fears, also play a role. During periods of economic uncertainty, investor sentiment can shift negatively, affecting Valero’s stock price.

A comparison of Valero’s performance against its competitors (hypothetical data for illustrative purposes):

- Valero: Strong refining capacity, diversified operations, but higher debt levels.

- Marathon Petroleum: Similar size and scope to Valero, with a focus on integrated operations.

- Phillips 66: More diversified portfolio, including midstream and chemicals, but potentially less exposure to refining margins fluctuations.

Valero’s Financial Performance and Projections

Valero’s recent earnings reports (hypothetical data) have shown fluctuating results depending on crude oil prices and refining margins. Analysis of key financial statements, such as the income statement and balance sheet, reveals trends in revenue, profitability, and financial health. Capital expenditure plans, which involve investments in upgrading refineries and expanding capacity, will likely influence future earnings. Successful capital expenditures can increase efficiency and profitability, while unsuccessful ones can lead to cost overruns and lower returns.

Analyst ratings and price targets for Valero stock (hypothetical data):

| Source | Rating | Price Target (USD) |

|---|---|---|

| Analyst Firm A | Buy | 150 |

| Analyst Firm B | Hold | 130 |

| Analyst Firm C | Sell | 110 |

Hypothetical scenario: If crude oil prices rise by 20%, Valero’s stock price might increase by 10-15% due to increased refining margins. However, if crude oil prices fall by 20%, the stock price could decline by 15-20%, reflecting reduced profitability.

Valero’s Sustainability and ESG Initiatives, Valero stock price

Valero’s commitment to environmental, social, and governance (ESG) initiatives is becoming increasingly important to investors. The company has implemented various programs to reduce its carbon footprint, improve operational safety, and enhance community engagement. These initiatives aim to improve the company’s ESG rating, which can attract investors prioritizing sustainability. However, the effectiveness of these initiatives and investor sentiment toward them can influence the stock price.

Valero’s stock price performance often reflects broader energy market trends. It’s interesting to compare its volatility to that of other established companies in different sectors; for instance, understanding the current trajectory of a t&t stock price provides a useful contrast. Analyzing these differing performances helps investors gauge overall market health and make informed decisions regarding Valero’s future potential.

For example, successful reductions in carbon emissions could lead to a positive market response, while setbacks or controversies could have a negative impact.

Investment Strategies and Risk Assessment

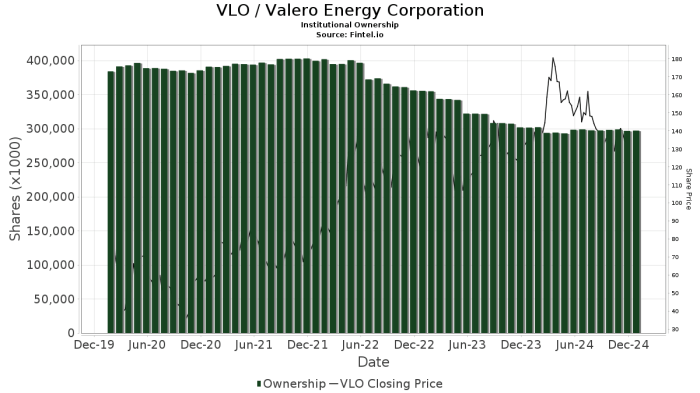

Source: fintel.io

Several investment strategies are applicable to Valero stock. A long-term buy-and-hold strategy might be suitable for investors with a long-term horizon and confidence in Valero’s long-term prospects. Short-term trading strategies, on the other hand, involve taking advantage of short-term price fluctuations. However, investing in Valero stock involves risks, including oil price volatility, regulatory changes, and competition. A diversified portfolio can help mitigate these risks.

Example of a hypothetical portfolio allocation (hypothetical data):

- Valero Stock: 10%

- S&P 500 Index Fund: 40%

- Bonds: 30%

- Real Estate Investment Trust (REIT): 20%

Visual Representation of Stock Price Trends

Source: zenfs.com

Historically, Valero’s stock price has shown a strong correlation with crude oil prices and the broader energy sector. Periods of high oil prices have generally been associated with higher Valero stock prices, while periods of low oil prices have often resulted in lower stock prices. The stock’s performance has also been influenced by macroeconomic factors, such as recessions and periods of economic uncertainty.

During times of economic expansion, the stock price has often outperformed the broader market. Conversely, during recessions, the stock price has often underperformed. There’s a noticeable positive correlation between Valero’s stock price and the Energy Sector Index, reflecting its sensitivity to the performance of the broader energy industry. Similarly, a weaker, but still positive correlation exists between Valero’s stock price and the S&P 500, indicating that while it is influenced by overall market sentiment, its performance is more closely tied to the energy sector’s fortunes.

FAQ Compilation: Valero Stock Price

What is Valero’s dividend payout history?

Valero has a history of paying dividends, but the specific amounts and frequency vary depending on profitability and company strategy. It’s best to consult financial news sources for the most up-to-date information.

How does Valero compare to its competitors in terms of innovation?

Valero’s innovation focus varies compared to competitors. While specific comparisons require detailed research, areas to consider include technological advancements in refining processes, efficiency improvements, and sustainability initiatives.

What are the major risks associated with short-term trading of Valero stock?

Short-term trading carries significant risk due to oil price volatility. Rapid price swings can lead to substantial losses if not carefully managed. Thorough market analysis and risk management strategies are essential.