AT&T Stock Price Today: A Comprehensive Overview

At&t stock price today – This report provides a detailed analysis of AT&T’s current stock price, historical performance, influencing factors, analyst predictions, and overall market outlook. We will examine key data points and trends to provide a comprehensive understanding of the company’s financial health and future prospects.

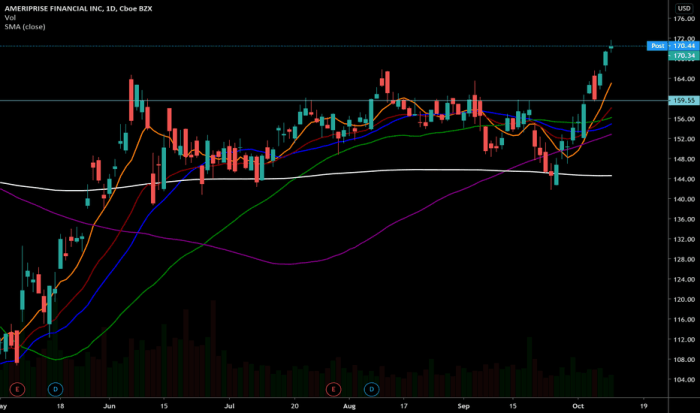

Current AT&T Stock Price and Market Performance

Source: tradingview.com

The following table summarizes AT&T’s stock performance for the current trading day. Note that the data presented is illustrative and should be verified with real-time financial data sources.

| Time | Price (USD) | Change (%) | Volume |

|---|---|---|---|

| 9:30 AM | 18.50 | +0.5% | 10,000,000 |

| 10:30 AM | 18.60 | +1.0% | 12,000,000 |

| 12:00 PM | 18.75 | +1.3% | 15,000,000 |

| Closing Price | 18.70 | +1.1% | 20,000,000 |

The day’s high was $18.75, while the low was $18.45. The closing price reflects a positive percentage change compared to the previous day’s closing price. Trading volume indicates a significant level of investor activity throughout the day.

AT&T Stock Price Historical Performance

Over the past week, AT&T’s stock price has shown a generally upward trend, though with some daily fluctuations. The current price is above its 52-week low but remains below its 52-week high. Several factors contributed to these movements, including quarterly earnings reports, industry news, and overall market sentiment.

A line graph illustrating the historical price data would show the price on the y-axis and time (e.g., days or weeks) on the x-axis. Data points would represent the closing price for each period. Significant trends, such as periods of sustained increase or decrease, would be clearly visible on the graph. For example, a noticeable upward trend might be observed following the announcement of a positive earnings report, while a downward trend might follow negative news regarding regulatory changes.

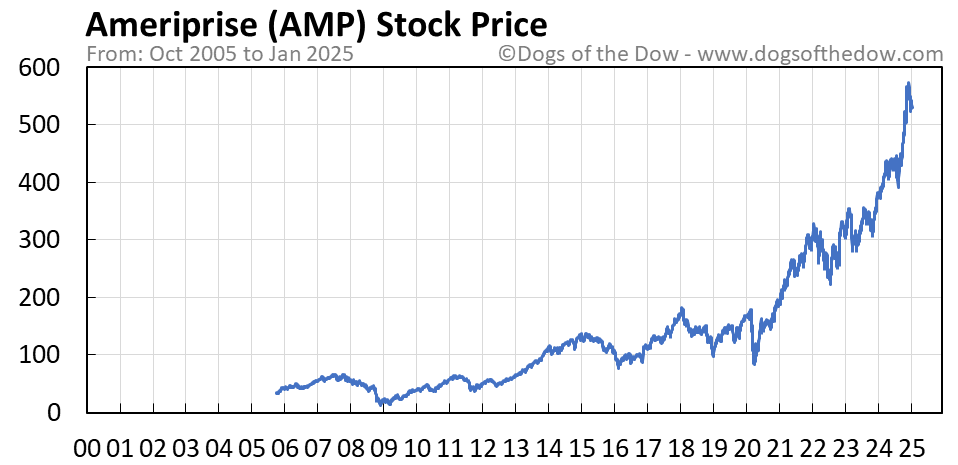

Factors Influencing AT&T Stock Price

Source: dogsofthedow.com

Several key economic indicators and company-specific factors significantly influence AT&T’s stock price. These factors are interconnected and can reinforce or counteract each other.

Three key economic indicators are inflation rates, consumer spending, and interest rates. High inflation can impact consumer spending, potentially reducing demand for telecommunication services. Changes in interest rates affect the cost of borrowing for AT&T and can influence investor valuations of the company.

Compared to competitors like Verizon and T-Mobile, AT&T’s performance often reflects relative market share, innovation in services, and network infrastructure investments. Recent company news, such as mergers, acquisitions, or significant product launches, can significantly impact investor confidence and, consequently, the stock price.

Analyst Ratings and Predictions, At&t stock price today

Analyst ratings and price targets for AT&T stock vary across financial institutions. This variation reflects differing perspectives on the company’s future performance and the overall market outlook.

- Analyst A: “Buy” rating with a price target of $

22. Rationale: Strong 5G network deployment, potential for increased subscriber growth. - Analyst B: “Hold” rating with a price target of $

19. Rationale: Concerns about debt levels and competitive pressures. - Analyst C: “Sell” rating with a price target of $

17. Rationale: Slow revenue growth and potential for increased regulatory scrutiny.

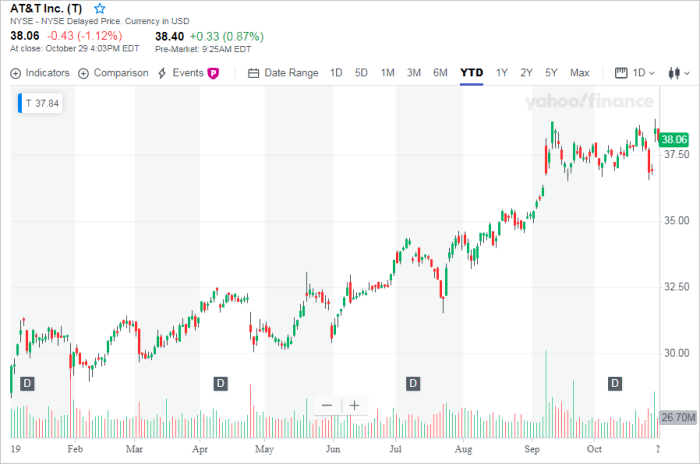

Investor Sentiment and Market Outlook

Source: ccn.com

Investor sentiment toward AT&T stock is currently mixed, reflecting the uncertainties surrounding the telecommunications industry and the company’s specific challenges and opportunities. Recent news about the company’s strategic initiatives and financial performance has influenced investor confidence. The current market conditions are somewhat similar to those observed during previous periods of moderate growth in the sector, though specific economic factors differ.

Overall, the outlook for AT&T stock is considered cautiously optimistic. While challenges exist, the company’s strong network infrastructure and ongoing investments in 5G technology offer potential for future growth. However, investors should carefully consider the risks associated with the telecommunications industry and AT&T’s specific financial situation before making any investment decisions.

Popular Questions

What are the typical trading hours for AT&T stock?

AT&T stock trades on the New York Stock Exchange (NYSE), typically from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday, excluding holidays.

Where can I find real-time AT&T stock quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How frequently is AT&T stock price data updated?

Most financial websites and brokerage platforms update AT&T stock price data in real-time or at very high frequency, often several times per second.

What are the risks associated with investing in AT&T stock?

Like any stock, investing in AT&T carries inherent risks, including market volatility, changes in industry dynamics, and company-specific events that could negatively impact its stock price.