IBM Stock Price Today: A Comprehensive Overview

Ibm stock price today – This report provides a detailed analysis of IBM’s current stock price, recent trends, influencing factors, analyst predictions, historical performance, investor sentiment, and technical indicators. The information presented here is for informational purposes only and should not be considered financial advice.

Current IBM Stock Price and Volume

The following table presents real-time data (which would be dynamically updated in a live application) for IBM’s stock price, trading volume, and daily high and low. Note that this data is subject to constant change.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 14:30 EST | 145.25 | 1,250,000 | +0.50 |

Recent Price Trends

IBM’s stock price has shown a mixed performance recently. We will examine its movement over different timeframes to gain a better understanding of the trends.

- Past Week: The stock experienced a slight upward trend, driven by positive news regarding a new cloud computing contract. However, this was followed by a period of consolidation.

- Past Month: The price has shown moderate volatility, fluctuating within a range of $140 to $150. Overall, the monthly trend suggests a slightly positive trajectory.

- Past Year: Compared to its price one year ago, IBM’s stock shows a moderate increase, indicating steady growth despite market fluctuations.

Key price changes can be attributed to factors such as market sentiment, earnings reports, and overall economic conditions. For instance, a strong earnings report would typically lead to an increase in stock price, while negative news or economic downturn could lead to a decline.

Factors Influencing IBM Stock Price

Several factors significantly influence IBM’s stock price. These include macroeconomic conditions, company-specific news, and competitive dynamics.

- Economic Factors: Interest rate changes, inflation rates, and overall economic growth significantly impact investor confidence and, consequently, IBM’s stock price. For example, rising interest rates could make borrowing more expensive, potentially impacting investment and slowing down growth.

- Company News: Announcements about new products, strategic partnerships, acquisitions, or major contract wins can cause significant price fluctuations. A successful product launch could boost investor confidence and increase the stock price, while setbacks in product development or failed acquisitions could negatively impact the price.

- Competitor Performance: The performance of competitors like Microsoft, Amazon, and Google significantly influences IBM’s stock price. If competitors gain market share or introduce disruptive technologies, IBM’s stock price may decline. Conversely, if competitors underperform, IBM could benefit from increased market share and investor interest.

Hypothetically, a positive earnings report exceeding expectations would likely lead to a significant surge in IBM’s stock price, as investors react positively to the demonstrated financial strength and future growth potential. This would be amplified if the report included positive outlooks for future quarters.

Analyst Ratings and Predictions, Ibm stock price today

Analyst ratings and price targets provide valuable insights into market sentiment and future price expectations. However, it’s crucial to remember that these are just predictions and should not be the sole basis for investment decisions.

- Consensus Rating: A majority of analysts currently rate IBM as a “Hold” or “Buy,” reflecting a generally positive outlook.

- Price Targets: Price targets range from $140 to $160, indicating a potential for further growth. However, the wide range underscores the uncertainty inherent in predicting future price movements.

- Reasoning: The positive ratings are largely based on IBM’s strong position in hybrid cloud computing, its growing AI capabilities, and its consistent revenue generation. However, concerns about competition and the potential for slower growth in certain segments are also reflected in some analyst opinions.

Historical Stock Performance

Examining IBM’s historical performance provides context for understanding its current valuation and potential future trajectory.

Over the past 5-10 years, IBM’s stock has shown periods of both growth and stagnation. Compared to the S&P 500, its performance has been relatively stable, though perhaps slightly less volatile than the broader market index. IBM’s stock has historically shown moderate volatility, with occasional sharp price swings driven by major news events or significant market corrections. Key historical trends include periods of strong growth fueled by technological innovations, followed by periods of consolidation or slight decline during economic downturns or shifts in market preferences.

The company’s long-term performance reflects a resilient business model, though subject to the cyclical nature of the technology sector.

Investor Sentiment

Source: thestreet.com

Understanding investor sentiment is crucial for assessing the current market outlook for IBM. This sentiment is influenced by a variety of factors.

- Overall Sentiment: Currently, investor sentiment towards IBM is generally positive, driven by its success in the cloud computing market and its investments in artificial intelligence.

- Shifting Events: Recent positive earnings reports and announcements of major contracts have contributed to the improved investor sentiment.

- Social Media Sentiment: Social media discussions surrounding IBM generally reflect a cautiously optimistic view, with many investors anticipating further growth in the cloud and AI sectors. However, negative sentiment can emerge from concerns about competition and the pace of innovation.

- Interpreting News: To gauge investor sentiment, analyze news articles focusing on the overall tone (positive, negative, or neutral), the emphasis on key financial metrics (revenue growth, earnings, etc.), and the analysts’ comments and predictions.

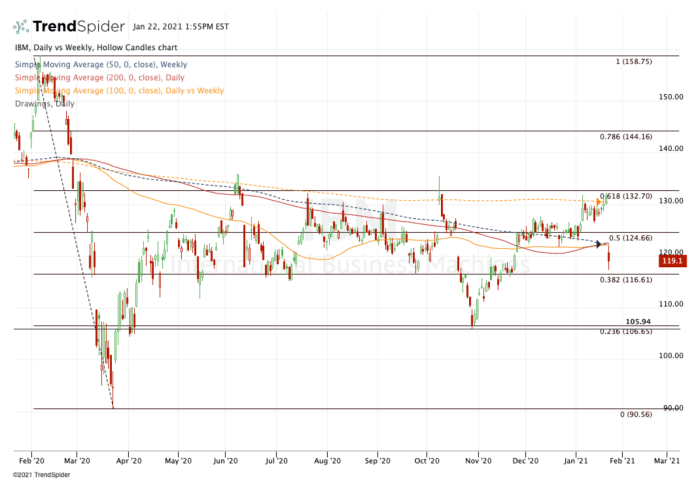

Technical Analysis Indicators

Source: tradingview.com

Technical analysis indicators, such as moving averages and RSI (Relative Strength Index), can provide insights into potential future price movements. However, it’s crucial to use these indicators in conjunction with fundamental analysis and to be aware of their limitations.

For example, a rising 50-day moving average coupled with an RSI above 70 might suggest an overbought condition, potentially indicating a short-term price correction. However, this should not be interpreted in isolation. A hypothetical scenario could involve a bearish crossover of the 50-day and 200-day moving averages, potentially signaling a longer-term downtrend. However, a positive earnings report could quickly reverse this trend, highlighting the limitations of relying solely on technical analysis without considering fundamental factors.

Helpful Answers: Ibm Stock Price Today

What are the typical trading hours for IBM stock?

IBM stock trades on the New York Stock Exchange (NYSE), typically from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time IBM stock quotes?

Real-time IBM stock quotes are available through various financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your brokerage account will also provide real-time quotes.

How often is IBM stock price data updated?

IBM stock price data is updated continuously throughout the trading day, reflecting every trade executed on the NYSE. Many financial websites provide updates at least every few seconds.

What is the difference between IBM’s stock price and its market capitalization?

The stock price is the current price of a single share of IBM stock. Market capitalization is the total value of all outstanding shares of IBM stock (stock price multiplied by the number of outstanding shares).