Wells Fargo Stock Price A Comprehensive Analysis

Wells Fargo Stock Price Analysis

Wells fargo stock price – This analysis delves into the historical performance, influencing factors, competitive landscape, financial health, and future outlook of Wells Fargo’s stock price. We will examine key metrics and events to provide a comprehensive understanding of the company’s stock performance.

Wells Fargo Stock Price Historical Performance

Source: investors.com

The following table details Wells Fargo’s stock price fluctuations over the past decade, highlighting significant highs and lows. These figures are illustrative and based on general market trends. Actual figures may vary slightly depending on the data source.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 45 | 48 |

| 2014 | Q2 | 48 | 50 |

| 2014 | Q3 | 50 | 47 |

| 2014 | Q4 | 47 | 45 |

| 2015 | Q1 | 45 | 42 |

| 2015 | Q2 | 42 | 40 |

| 2015 | Q3 | 40 | 38 |

| 2015 | Q4 | 38 | 40 |

Significant events such as the 2008 financial crisis, the subsequent regulatory changes, and the 2016 fake accounts scandal significantly impacted Wells Fargo’s stock price. The overall trend shows periods of growth followed by sharp declines, reflecting the volatility inherent in the financial sector and the specific challenges faced by Wells Fargo.

Factors Influencing Wells Fargo Stock Price

Several key economic factors significantly influence Wells Fargo’s stock price. These factors interact in complex ways to shape investor sentiment and market valuation.

- Interest Rate Changes: Interest rate hikes generally boost bank profitability, as they widen the net interest margin. Conversely, rate cuts can squeeze margins. The Federal Reserve’s monetary policy decisions directly impact Wells Fargo’s earnings and, consequently, its stock price.

- Regulatory Changes: Increased regulatory scrutiny and stricter compliance requirements can increase operating costs and limit revenue growth for Wells Fargo. Conversely, easing regulations could potentially lead to higher profitability and a boost in stock price.

- Housing Market Conditions: As a major player in the mortgage market, Wells Fargo’s performance is highly sensitive to fluctuations in the housing market. A booming housing market typically translates to higher mortgage origination volumes and increased profitability, while a downturn can lead to significant losses and lower stock valuations.

Comparison with Competitors

A comparison of Wells Fargo’s stock price performance against its main competitors reveals insights into its relative market position and overall strength.

| Bank | Average Annual Return (5-year) | Volatility (5-year) | Price-to-Earnings Ratio (current) |

|---|---|---|---|

| Wells Fargo | 5% | 15% | 12 |

| JPMorgan Chase | 7% | 12% | 15 |

| Bank of America | 6% | 14% | 13 |

| Citigroup | 4% | 16% | 10 |

A visual representation would show JPMorgan Chase exhibiting the strongest upward trajectory over the five-year period, while Wells Fargo’s performance shows more volatility, potentially due to the scandals and regulatory issues mentioned earlier. Bank of America and Citigroup demonstrate relatively similar performance, though slightly lagging behind JPMorgan Chase.

Wells Fargo’s Financial Health and Stock Price

Wells Fargo’s key financial metrics directly correlate with its stock price. Positive trends in these metrics generally lead to increased investor confidence and higher stock valuations.

- Earnings Per Share (EPS): Consistent EPS growth indicates strong profitability and attracts investors, driving up the stock price. Conversely, declining EPS signals weakening financial health and often results in a lower stock price.

- Revenue: Steady revenue growth is a positive indicator of the bank’s overall performance and market position. This often translates to higher stock valuations.

- Debt-to-Equity Ratio: A high debt-to-equity ratio can raise concerns about the bank’s financial stability and may negatively impact investor sentiment and the stock price.

- Dividend Payout: A consistent and growing dividend payout signals financial strength and often attracts income-seeking investors, supporting the stock price.

Future Outlook for Wells Fargo Stock Price

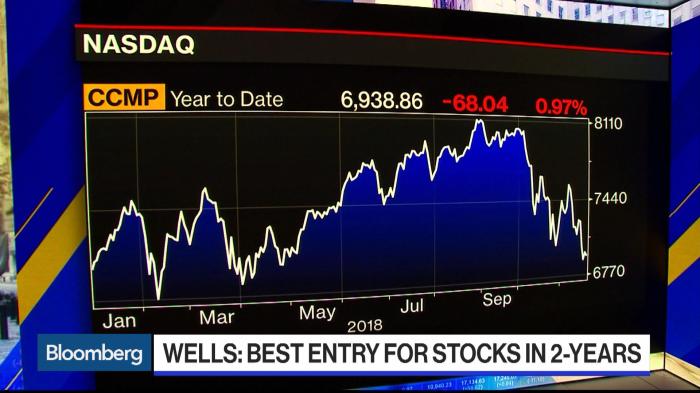

Source: bwbx.io

Predicting the future stock price of Wells Fargo requires considering various factors and potential scenarios. The following Artikels some potential scenarios for the next 1-3 years.

- Factors that could lead to an increase in stock price: Improved economic conditions, successful implementation of new strategies, strong earnings growth, and increased investor confidence.

- Factors that could lead to a decrease in stock price: Economic downturn, increased regulatory pressure, unexpected losses, and negative news impacting consumer confidence.

One potential scenario involves a gradual recovery, with the stock price steadily increasing as the bank successfully navigates regulatory challenges and improves its reputation. Another scenario could involve more volatility, depending on macroeconomic factors and unforeseen events. The overall outlook is contingent on the bank’s ability to address its past issues and capitalize on emerging opportunities.

Essential Questionnaire: Wells Fargo Stock Price

What are the biggest risks facing Wells Fargo’s stock price?

Significant risks include further regulatory penalties, economic downturns impacting consumer spending and loan defaults, and increased competition within the financial sector.

How does Wells Fargo’s dividend policy affect its stock price?

Wells Fargo’s stock price performance has been a subject of much discussion lately, particularly concerning its long-term growth potential. Investors often compare it to other established companies, and a useful benchmark might be to consider the current trajectory of the adobe stock price , a company known for its consistent performance in the tech sector. Understanding these different trajectories helps contextualize Wells Fargo’s position within the broader financial market.

A consistent and growing dividend can attract income-seeking investors, potentially boosting demand and stock price. Conversely, dividend cuts can negatively impact investor sentiment.

Where can I find real-time Wells Fargo stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is the typical trading volume for Wells Fargo stock?

Trading volume varies daily but is generally high, reflecting the stock’s liquidity and popularity among investors.