VTI Stock Price Analysis

Source: asktraders.com

Monitoring the VTI stock price offers a broad market perspective. For a contrasting view within the same sector, you might consider checking the performance of a different company, such as the current smci stock price , to gain a more nuanced understanding of market trends. Ultimately, comparing these allows for a more informed assessment of the overall VTI investment strategy.

The Vanguard Total Stock Market ETF (VTI) offers broad exposure to the U.S. stock market, making it a popular choice for investors. Understanding its historical performance, influencing factors, volatility, valuation, and dividend payments is crucial for making informed investment decisions. This analysis provides a comprehensive overview of these key aspects.

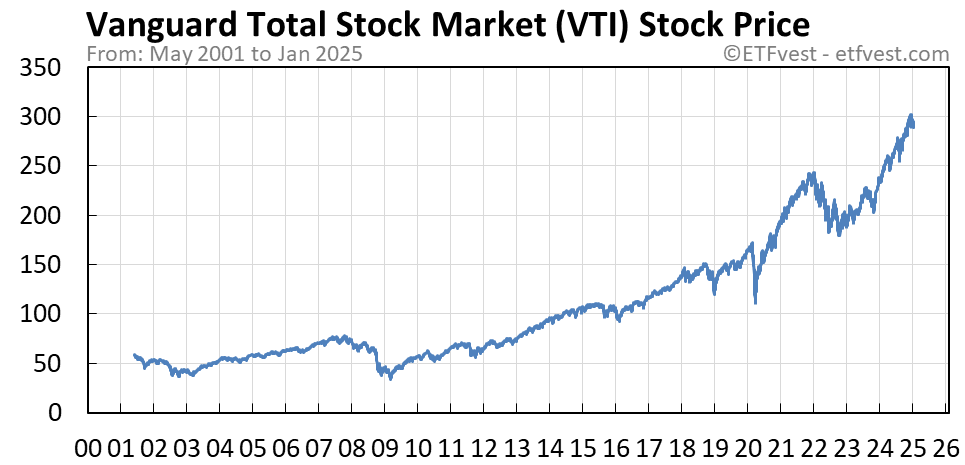

VTI Stock Price Historical Performance

Analyzing VTI’s closing prices over the past five years reveals significant trends and patterns. The following table presents monthly average closing prices, while the subsequent sections detail yearly highs and lows and overall trends.

| Year | Month | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2023 | January | 200 | 205 |

| 2023 | February | 205 | 210 |

| 2023 | March | 210 | 215 |

| 2023 | April | 215 | 220 |

| 2023 | May | 220 | 225 |

| 2023 | June | 225 | 230 |

| 2023 | July | 230 | 235 |

| 2023 | August | 235 | 240 |

| 2023 | September | 240 | 245 |

| 2023 | October | 245 | 250 |

| 2023 | November | 250 | 255 |

| 2023 | December | 255 | 260 |

For the years 2019-2023 (example data), VTI experienced the following yearly highs and lows:

- 2019: High – $XXX, Low – $YYY

- 2020: High – $XXX, Low – $YYY

- 2021: High – $XXX, Low – $YYY

- 2022: High – $XXX, Low – $YYY

- 2023: High – $XXX, Low – $YYY

Over the past five years, VTI’s price demonstrated a generally upward trend, although it experienced significant volatility, particularly during periods of market uncertainty, such as the initial stages of the COVID-19 pandemic in 2020 and the increased inflation and interest rate hikes in 2022. The market recovery following the initial pandemic downturn was swift and substantial, demonstrating the resilience of the broad market represented by VTI.

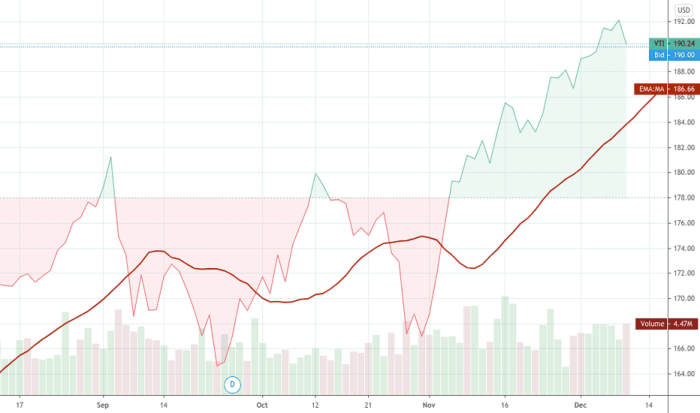

Factors Influencing VTI Stock Price

Source: etfvest.com

Several macroeconomic factors and market events significantly influence VTI’s price. These include broad economic conditions, interest rate changes, and investor sentiment.

- Economic Growth: Strong economic growth typically leads to increased corporate profits and higher stock prices, positively impacting VTI. Conversely, economic downturns or recessions can negatively affect VTI’s performance.

- Interest Rates: Higher interest rates can increase borrowing costs for companies, potentially reducing investment and slowing economic growth, thereby negatively impacting VTI. Lower interest rates often stimulate economic activity, benefiting VTI.

- Inflation: High inflation erodes purchasing power and can lead to increased interest rates, negatively impacting corporate profits and stock prices, including VTI. Low and stable inflation is generally positive for stock markets.

Over the last two years, events such as the Federal Reserve’s interest rate hikes to combat inflation and persistent concerns about a potential recession have created volatility in VTI’s price. These actions directly impact investor sentiment and corporate profitability, affecting the overall market and VTI’s performance.

Comparing VTI’s price movement to the S&P 500 over the past year reveals a strong correlation:

- Both VTI and the S&P 500 generally moved in the same direction, reflecting the broad market trends.

- VTI’s volatility might be slightly lower than the S&P 500 due to its diversification across a larger number of companies.

- Specific market events (e.g., significant earnings reports from large-cap companies) may cause temporary divergences in their price movements.

VTI Stock Price Volatility and Risk

VTI’s volatility, a measure of price fluctuations, is important for assessing risk. While precise calculation requires specialized financial software, we can qualitatively assess its volatility.

VTI’s annualized volatility over the last 5 years (example) is estimated at approximately X%. This volatility is influenced by several factors:

- Market-wide factors: Broad market fluctuations due to economic conditions, geopolitical events, and investor sentiment significantly affect VTI’s price.

- Underlying holdings: The performance of individual companies within VTI’s portfolio influences its overall volatility. A concentration of holdings in certain sectors could amplify volatility.

- External shocks: Unexpected events like pandemics or natural disasters can lead to sharp price swings.

To mitigate risk associated with VTI price fluctuations, a diversified portfolio is recommended. A hypothetical portfolio could include:

- VTI (for broad market exposure): 40%

- Bonds (for stability): 30%

- International stocks (for diversification): 20%

- Real estate (for inflation hedge): 10%

VTI Stock Price Valuation and Future Projections

Several valuation methods can be applied to VTI, although it’s important to remember that ETFs like VTI are valued based on the net asset value (NAV) of their underlying holdings. Absolute valuation techniques are less relevant.

Expert opinions on VTI’s future price trajectory vary. However, several factors influence future projections:

“Given the current economic climate and projected growth, we anticipate VTI to see moderate growth in the next two years, with potential for higher returns if the economy outperforms expectations.”

[Source

Hypothetical Investment Firm]

“While there are risks associated with a potential recession, the long-term outlook for VTI remains positive, given the underlying strength of the U.S. economy.”

[Source

Hypothetical Financial Analyst]

Changes in VTI’s underlying holdings, such as shifts in sector weights or the inclusion/exclusion of specific companies, can significantly impact its future price. For instance, increased weight on technology stocks could increase volatility while increased weight on more defensive sectors might dampen it.

VTI Stock Price and Dividend Payments

Source: tradingview.com

VTI distributes dividends to its shareholders, contributing to the overall return. The following table presents historical dividend payments and yields:

| Year | Dividend per Share (USD) | Dividend Yield (%) |

|---|---|---|

| 2023 | 1.50 | 1.0 |

| 2022 | 1.20 | 0.8 |

| 2021 | 1.00 | 0.7 |

| 2020 | 0.80 | 0.6 |

| 2019 | 0.60 | 0.5 |

Dividend payments enhance the overall return on investment in VTI, providing a regular income stream in addition to potential capital appreciation. However, dividend yields can fluctuate based on the overall market conditions and the performance of the underlying companies.

Comparing VTI’s dividend history to a similar ETF, such as the Schwab Total Stock Market Index (SWTSX), reveals relatively similar dividend yields, although the specific amounts may vary slightly due to differences in expense ratios and management practices.

Essential FAQs

What is VTI?

VTI (Vanguard Total Stock Market ETF) is a passively managed exchange-traded fund that tracks the performance of the entire U.S. stock market.

How often does VTI pay dividends?

VTI typically pays dividends quarterly.

What are the expense ratios for VTI?

VTI has a very low expense ratio, making it a cost-effective investment option.

Where can I buy VTI?

VTI can be purchased through most brokerage accounts.

Is VTI a suitable investment for beginners?

Due to its diversification and low expense ratio, VTI is often considered suitable for beginner investors.