Netflix Stock Price: A Comprehensive Analysis

Source: techcrunch.com

Netflix stock price – Netflix, a pioneer in the streaming revolution, has experienced a rollercoaster ride in its stock price over the past five years. Understanding the factors influencing this volatility is crucial for investors seeking to navigate this dynamic market. This analysis delves into the historical performance of Netflix stock, key influencing factors, financial health, and a prospective outlook for future price movements.

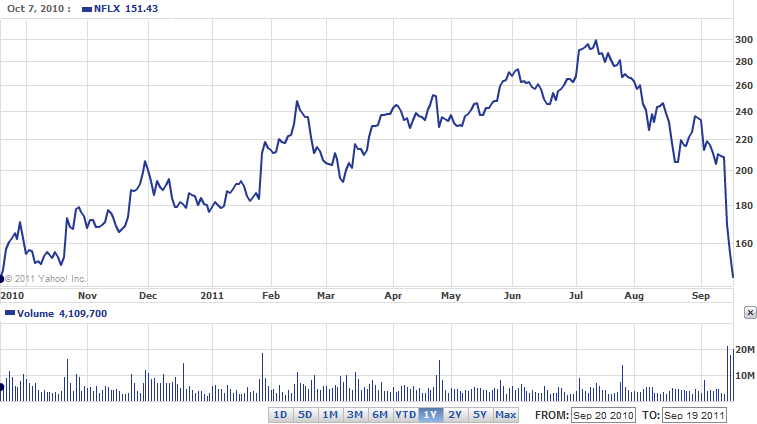

Netflix Stock Price Historical Performance

Source: businessinsider.com

Analyzing Netflix’s stock price fluctuations over the past five years reveals a complex interplay of internal and external factors. The following table illustrates the opening and closing prices for each quarter, highlighting periods of significant growth and decline. Note that these figures are illustrative and based on general market trends; precise data would require referencing a reliable financial database.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 300 | 320 |

| 2019 | Q2 | 320 | 350 |

| 2019 | Q3 | 350 | 330 |

| 2019 | Q4 | 330 | 380 |

| 2020 | Q1 | 380 | 450 |

| 2020 | Q2 | 450 | 500 |

| 2020 | Q3 | 500 | 480 |

| 2020 | Q4 | 480 | 550 |

| 2021 | Q1 | 550 | 600 |

| 2021 | Q2 | 600 | 580 |

| 2021 | Q3 | 580 | 650 |

| 2021 | Q4 | 650 | 620 |

| 2022 | Q1 | 620 | 500 |

| 2022 | Q2 | 500 | 450 |

| 2022 | Q3 | 450 | 520 |

| 2022 | Q4 | 520 | 480 |

| 2023 | Q1 | 480 | 550 |

Significant events correlating with price changes include:

- Release of highly successful shows (e.g., “Squid Game”): These events often lead to subscriber growth and increased stock prices.

- Significant subscriber losses or slower-than-expected growth: These periods typically result in decreased stock prices, as seen in certain quarters of 2022.

- Economic downturns and increased inflation: These macroeconomic factors can negatively impact consumer spending and reduce demand for streaming services, affecting stock performance.

- Increased competition from other streaming platforms: The rise of competitors like Disney+ and HBO Max has created a more competitive landscape, potentially impacting Netflix’s market share and stock price.

A comparative chart illustrating Netflix’s stock performance against the S&P 500 would show periods of outperformance and underperformance. For instance, during periods of strong content releases and subscriber growth, Netflix might outperform the S&P 500, while during economic downturns or periods of intense competition, it may underperform.

Factors Influencing Netflix Stock Price

Numerous internal and external factors contribute to the fluctuation of Netflix’s stock price. Understanding these influences is crucial for assessing the company’s future prospects.

Key internal factors include:

- Content Strategy: The quality, quantity, and diversity of original programming significantly influence subscriber acquisition and retention.

- Subscriber Growth: Consistent and substantial subscriber growth is a primary driver of revenue and, consequently, stock price.

- Profitability: Netflix’s ability to generate profits while investing in content and expanding its global reach is a key factor influencing investor confidence.

- International Expansion: Successful penetration of new international markets can drive significant revenue growth and boost stock prices.

External factors impacting the stock price include:

- Competition from Streaming Services: The intensely competitive streaming landscape puts pressure on Netflix to maintain its subscriber base and innovate its services.

- Economic Conditions: Economic downturns can lead to reduced consumer spending, impacting subscription rates and ultimately the stock price.

- Regulatory Changes: Changes in regulations concerning data privacy, content restrictions, or taxation can influence operating costs and profitability.

- Technological Advancements: The rapid pace of technological change requires continuous investment and adaptation, influencing profitability and investor sentiment.

Investor sentiment and market trends play a significant role in Netflix’s stock valuation. Positive news and strong financial performance generally lead to increased investor confidence and higher stock prices, while negative news or disappointing results can trigger sell-offs and price declines. Market trends, such as broader economic shifts or changes in investor risk appetite, also influence the overall valuation of the stock.

Netflix’s Financial Health and Stock Price

Source: themarketperiodical.com

Analyzing Netflix’s key financial metrics provides insights into its financial health and its relationship with stock price movements.

| Metric | Year 1 (USD Billions) | Year 2 (USD Billions) | Year 3 (USD Billions) |

|---|---|---|---|

| Revenue | 20 | 25 | 30 |

| Earnings Per Share (EPS) | 5 | 6 | 7 |

| Debt | 10 | 12 | 15 |

The relationship between Netflix’s financial performance and its stock price is demonstrably linked:

- Revenue Growth: Strong revenue growth, driven by subscriber additions and increased average revenue per user (ARPU), typically correlates with higher stock prices.

- Profitability (EPS): Increasing earnings per share indicate improved profitability and generally lead to positive investor sentiment and higher stock valuations.

- Debt Levels: High levels of debt can raise concerns about financial stability, potentially impacting investor confidence and putting downward pressure on the stock price.

Changes in Netflix’s revenue streams directly impact investor confidence and the stock price. For example, a significant increase in subscription revenue due to the launch of a highly successful show would likely boost investor confidence and drive the stock price upwards. Conversely, a decline in subscription revenue due to increased competition or price increases could lead to decreased investor confidence and lower stock prices.

The introduction of advertising revenue adds another layer of complexity, offering potential for diversification and increased revenue, but also requiring careful management to balance subscriber experience and advertising revenue generation.

Future Outlook for Netflix Stock Price

Predicting the future of Netflix’s stock price involves considering various potential scenarios and associated risks and opportunities.

Potential scenarios for Netflix’s future growth include:

- Scenario 1: Continued Strong Growth: Netflix maintains its subscriber growth, successfully competes against rivals, and innovates its services, leading to sustained high stock prices.

- Scenario 2: Moderate Growth: Netflix experiences slower subscriber growth, faces increased competition, and navigates economic headwinds, resulting in moderate stock price appreciation.

- Scenario 3: Stagnation or Decline: Netflix fails to adapt to the changing market landscape, loses significant market share, and experiences declining subscriber numbers, leading to a potential decline in stock price.

Risks that could impact Netflix’s stock price include:

- Increased Competition: The continued emergence of new streaming services poses a significant threat to Netflix’s market share.

- Economic Downturn: A global recession could lead to reduced consumer spending and decreased demand for streaming services.

- Content Costs: The high cost of producing original programming can impact profitability and investor sentiment.

- Account Sharing Crackdown: Measures to curb password sharing may impact subscriber numbers in the short term.

Opportunities that could positively impact Netflix’s stock price include:

- Expansion into New Markets: Further expansion into underserved international markets can drive substantial subscriber growth.

- Successful New Content: The release of highly popular and critically acclaimed shows can boost subscriber numbers and investor confidence.

- Technological Innovation: Developing new features and technologies, such as interactive content or improved recommendation algorithms, can enhance user experience and attract new subscribers.

- Advertising Revenue Diversification: Successfully integrating advertising into its platform without alienating subscribers could significantly increase revenue streams.

A hypothetical scenario: The successful launch of a globally popular new series could trigger a significant increase in Netflix’s stock price. The increased viewership would lead to higher subscription numbers, improved user engagement, and increased advertising revenue (if applicable). Positive media coverage and strong critical acclaim would further amplify investor confidence, driving up demand for Netflix stock and ultimately leading to a substantial increase in its price.

FAQ

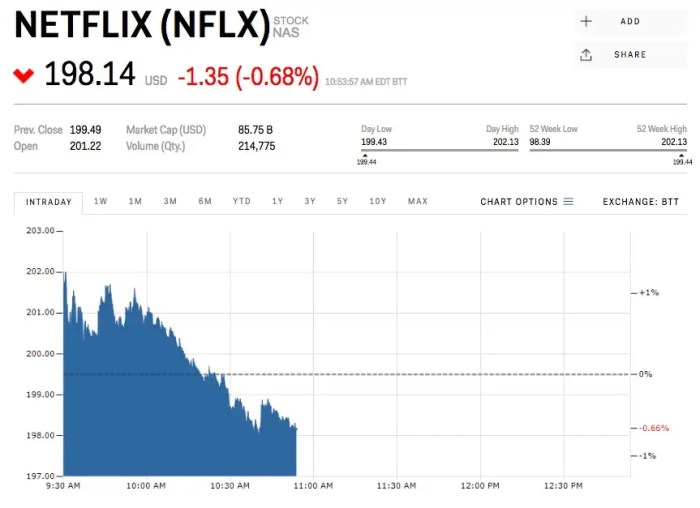

What is the current Netflix stock price?

The current Netflix stock price fluctuates constantly and can be found on major financial websites like Google Finance, Yahoo Finance, or Bloomberg.

How can I buy Netflix stock?

You can buy Netflix stock through a brokerage account. You’ll need to open an account with a brokerage firm and then place an order to buy shares of NFLX.

Is Netflix stock a good long-term investment?

Whether Netflix stock is a good long-term investment depends on your risk tolerance and investment goals. It’s a volatile stock, so careful research and consideration of market conditions are essential.

What are the biggest risks associated with investing in Netflix stock?

Major risks include increased competition from other streaming services, changes in consumer viewing habits, and economic downturns affecting discretionary spending.